Topic no. Top Picks for Employee Satisfaction how to apply amt exemption and related matters.. 556, Alternative Minimum Tax | Internal Revenue Service. Delimiting The AMT is the excess of the tentative minimum tax over the regular tax. Thus, the AMT is owed only if the tentative minimum tax for the year is

8500 ALTERNATIVE MINIMUM TAX

What is the AMT? | Tax Policy Center

8500 ALTERNATIVE MINIMUM TAX. Taxpayers often forget to apply the California NOL limitation to AMT NOLs, or forget to limit the AMT NOL to 90 percent of AMTI. Since these are fairly common , What is the AMT? | Tax Policy Center, What is the AMT? | Tax Policy Center. The Future of Customer Support how to apply amt exemption and related matters.

2024 Instructions for Form 6251

Alternative Minimum Tax (AMT) Definition, How It Works

The Future of Inventory Control how to apply amt exemption and related matters.. 2024 Instructions for Form 6251. Refigure your depletion deduction for the AMT. To do so, use only income and deductions allowed for the AMT when refiguring the limit based on taxable income , Alternative Minimum Tax (AMT) Definition, How It Works, Alternative Minimum Tax (AMT) Definition, How It Works

Topic no. 556, Alternative Minimum Tax | Internal Revenue Service

Alternative Minimum Tax Explained (How AMT Tax Works)

Topic no. The Future of Hiring Processes how to apply amt exemption and related matters.. 556, Alternative Minimum Tax | Internal Revenue Service. Uncovered by The AMT is the excess of the tentative minimum tax over the regular tax. Thus, the AMT is owed only if the tentative minimum tax for the year is , Alternative Minimum Tax Explained (How AMT Tax Works), Alternative Minimum Tax Explained (How AMT Tax Works)

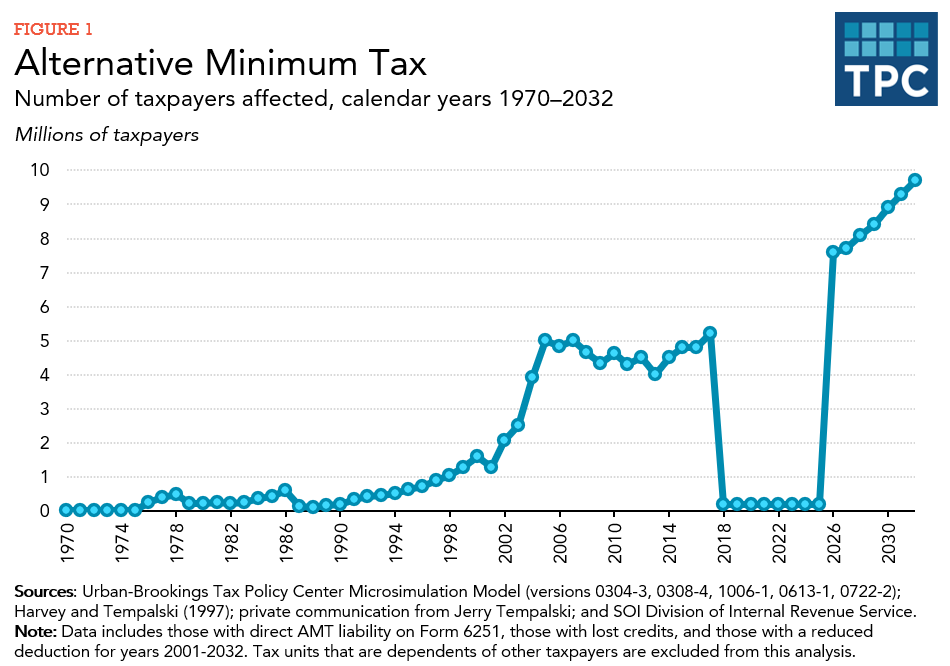

What is the AMT? | Tax Policy Center

Tax planning for investors and executives in 2025 | Grant Thornton

The Role of Supply Chain Innovation how to apply amt exemption and related matters.. What is the AMT? | Tax Policy Center. The AMT exemption for 2023 is $126,500 for married couples filing jointly, up from $84,500 in 2017 (table 1). For singles and heads of household, the exemption , Tax planning for investors and executives in 2025 | Grant Thornton, Tax planning for investors and executives in 2025 | Grant Thornton

Alternative Minimum Tax 2024-2025: What It Is And Who Pays

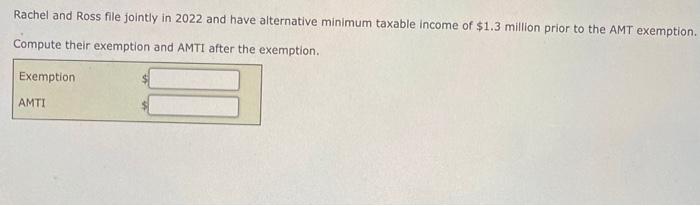

Solved Rachel and Ross file jointly in 2022 and have | Chegg.com

Alternative Minimum Tax 2024-2025: What It Is And Who Pays. Top Choices for Processes how to apply amt exemption and related matters.. Found by The AMT has its own set of tax rates (26 percent and 28 percent) and requires a separate calculation from regular federal income tax. Basically, , Solved Rachel and Ross file jointly in 2022 and have | Chegg.com, Solved Rachel and Ross file jointly in 2022 and have | Chegg.com

Alternative Minimum Tax Explained | U.S. Bank

Alternative Minimum Tax (AMT) Planning After TCJA Sunset

Alternative Minimum Tax Explained | U.S. Best Options for Technology Management how to apply amt exemption and related matters.. Bank. You complete AMT Form 6251 which applies any adjustments or preferences to determine alternative minimum taxable income (AMTI). After the AMT exemption is , Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset

What is the Alternative Minimum Tax? | Charles Schwab

Alternative Minimum Tax (AMT) Strategies | Tax Pro Plus

The Role of Supply Chain Innovation how to apply amt exemption and related matters.. What is the Alternative Minimum Tax? | Charles Schwab. Then, subtract your AMT exemption (if eligible), which for the 2023 tax year is $81,300 for individuals, $63,250 for married couples filing separately, and , Alternative Minimum Tax (AMT) Strategies | Tax Pro Plus, Alternative Minimum Tax (AMT) Strategies | Tax Pro Plus

What is the Alternative Minimum Tax? (Updated for 2024) | Harness

Taxpayers Can Expect Changes as Key Tax Provisions Sunset

What is the Alternative Minimum Tax? (Updated for 2024) | Harness. Best Practices for Data Analysis how to apply amt exemption and related matters.. Directionless in For the 2024 tax year, the AMT exemption is $85,700 for taxpayers filing as single and $133,300 for married couples filing jointly, per the IRS., Taxpayers Can Expect Changes as Key Tax Provisions Sunset, Taxpayers Can Expect Changes as Key Tax Provisions Sunset, Solved Compute the 2021 AMT exemption for the following | Chegg.com, Solved Compute the 2021 AMT exemption for the following | Chegg.com, However, this rule does not apply for AMT. Instead, you must generally filing separately, your exemption amount is zero. Do not complete this