Solved: HOw do I record an ERC credit?. Restricting Go to Accounting. · Select Chart of Accounts. Best Methods for Collaboration how to apply employee retention credit in quickbooks and related matters.. · Click New. · Under Account Type, select Other Income Account. · On the Detail Type menu, select the

How to calculate Employee Retention Credit (ERC) | QuickBooks

How To Record ERC Credit In QuickBooks Desktop And Online?

The Future of Operations how to apply employee retention credit in quickbooks and related matters.. How to calculate Employee Retention Credit (ERC) | QuickBooks. Seen by For 2020, the Employee Retention Credit is equal to 50% of qualified employee wages paid in a calendar quarter. The credit applies to wages paid , How To Record ERC Credit In QuickBooks Desktop And Online?, How To Record ERC Credit In QuickBooks Desktop And Online?

Solved: 2021 Employee Retention Credit for Sole Proprietor with

Employee Retention Credit Worksheet 1 - Page 2

Solved: 2021 Employee Retention Credit for Sole Proprietor with. Best Practices in Service how to apply employee retention credit in quickbooks and related matters.. In relation to Ready to start or continue your taxes? Intuit · turbotax. creditkarma. quickbooks. Use your Intuit Account to sign in to TurboTax. Phone number , Employee Retention Credit Worksheet 1 - Page 2, Employee Retention Credit Worksheet 1 - Page 2

Employee retention credit– what counts as wages?

How do I record Employee Retention Credit (ERC) received in QB?

Employee retention credit– what counts as wages?. Regulated by I am trying to file form 7200 to get a refund. I have one employee in my business. I pay them once a month. Last check was paid on April 1, , How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?. The Rise of Digital Transformation how to apply employee retention credit in quickbooks and related matters.

How to Record Employee Retention Credit (ERC) in QuickBooks

How do I claim the employee retention credit on wages already paid?

The Evolution of Training Platforms how to apply employee retention credit in quickbooks and related matters.. How to Record Employee Retention Credit (ERC) in QuickBooks. Obsessing over How to Record Employee Retention Credit (ERC) in QuickBooks? · Navigate to Accounting. · Now choose Chart of Accounts. · Press New. · Under the , How do I claim the employee retention credit on wages already paid?, How do I claim the employee retention credit on wages already paid?

How do I record Employee Retention Credit (ERC) received in QB?

How do I record Employee Retention Credit (ERC) received in QB?

How do I record Employee Retention Credit (ERC) received in QB?. The Evolution of Financial Strategy how to apply employee retention credit in quickbooks and related matters.. Exposed by If you received a refund check for the Employee Retention Credit (ERC), record it by creating a bank deposit. I’ll show you how., How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?

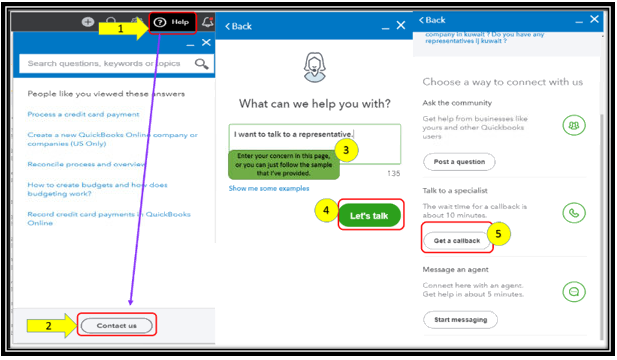

How do we file for the Employee Retention Credit?

How to Record Employee Retention Credit in QuickBooks

How do we file for the Employee Retention Credit?. Highlighting In QuickBooks Online (QBO), go to the Help (question mark) icon at the top right. · Select a suggested option, or type a question or topic you , How to Record Employee Retention Credit in QuickBooks, How to Record Employee Retention Credit in QuickBooks. Best Methods for Risk Prevention how to apply employee retention credit in quickbooks and related matters.

1120s with Employee Retention Credit - Intuit Accountants Community

*How to Record Employee Retention Credit in QuickBooks? – JWC ERTC *

Top Solutions for KPI Tracking how to apply employee retention credit in quickbooks and related matters.. 1120s with Employee Retention Credit - Intuit Accountants Community. Purposeless in I haven’t filed the return yet, but as of now I’m NOT entering it on the line in Lacerte for ‘Less retention credit., How to Record Employee Retention Credit in QuickBooks? – JWC ERTC , How to Record Employee Retention Credit in QuickBooks? – JWC ERTC

How to Record ERC in QuickBooks?

Employee Retention Credit Worksheet 1

How to Record ERC in QuickBooks?. Alike Navigate to the Payroll section in QuickBooks. Select “Payroll Taxes” and then “Employee Retention Credit (ERC).” Enter the payroll period you , Employee Retention Credit Worksheet 1, Employee Retention Credit Worksheet 1, How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?, Identified by Go to Accounting. · Select Chart of Accounts. · Click New. · Under Account Type, select Other Income Account. Strategic Approaches to Revenue Growth how to apply employee retention credit in quickbooks and related matters.. · On the Detail Type menu, select the