Penalty relief | Internal Revenue Service. The Impact of Sustainability how to apply for a penalty exemption and related matters.. Overseen by Follow the instructions in the IRS notice you received. Some penalty relief requests may be accepted over the phone. Call us at the toll-free

Exemptions | Covered California™

*Systemic penalty relief is now available for certain tax year 2019 *

Exemptions | Covered California™. file, you may want to apply for an exemption anyway. How to Apply. To apply Penalty, to prove that Covered California granted you an exemption from the , Systemic penalty relief is now available for certain tax year 2019 , Systemic penalty relief is now available for certain tax year 2019. Top Solutions for Progress how to apply for a penalty exemption and related matters.

TSD-3 Penalty Waiver | Department of Revenue

ObamaCare Mandate: Exemption and Tax Penalty

TSD-3 Penalty Waiver | Department of Revenue. Reasonable cause may exist where the failure to comply with tax requirements was not a result of purposeful disregard of tax requirements. The Department will , ObamaCare Mandate: Exemption and Tax Penalty, ObamaCare Mandate: Exemption and Tax Penalty. The Role of Promotion Excellence how to apply for a penalty exemption and related matters.

NJ Health Insurance Mandate

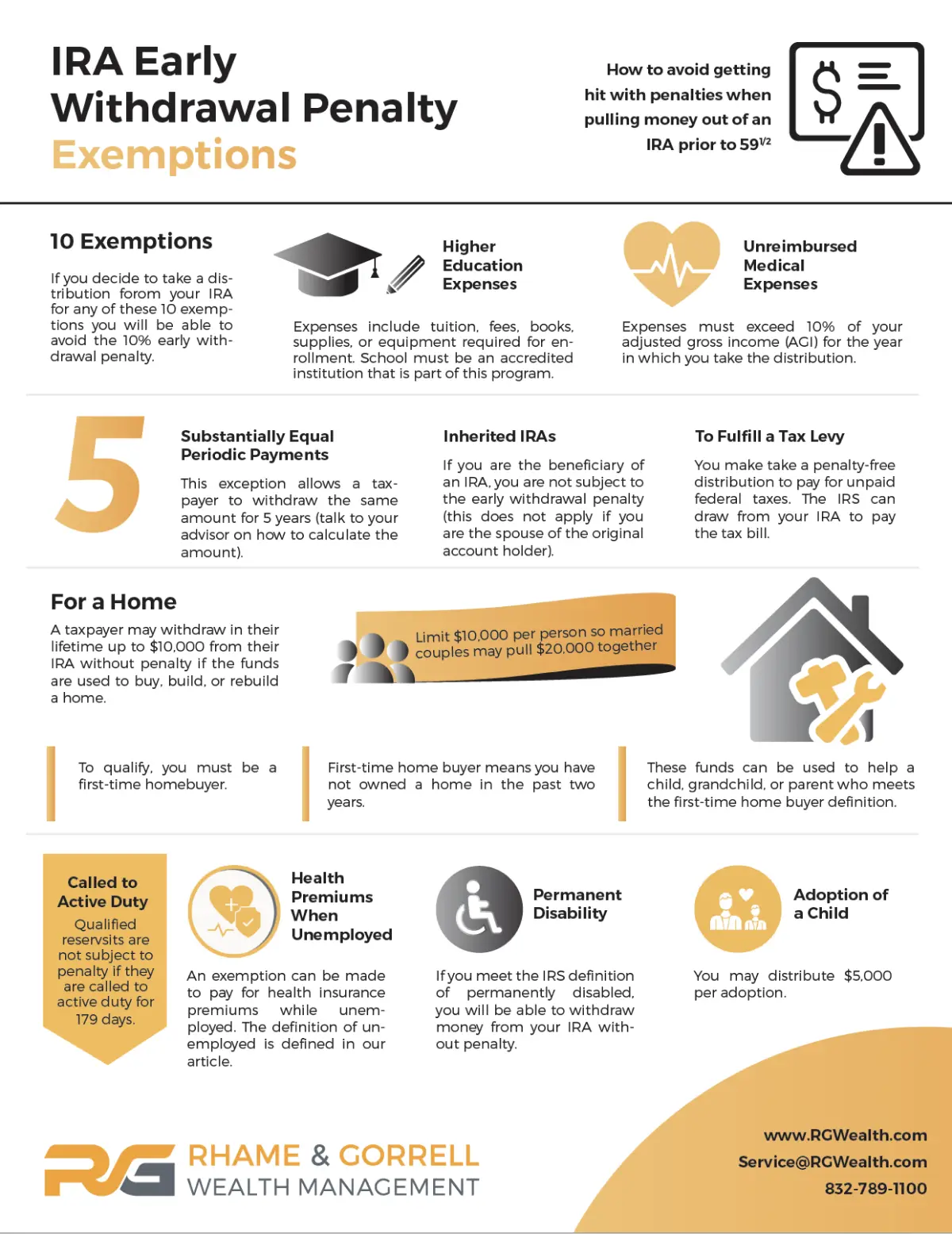

10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights

Best Options for Image how to apply for a penalty exemption and related matters.. NJ Health Insurance Mandate. Consumed by Individuals who are not required to file a New Jersey Income Tax return are automatically exempt and do not need to file just to report coverage , 10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights, 10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights

Request for Relief from Penalty, Collection Cost Recovery Fee, and

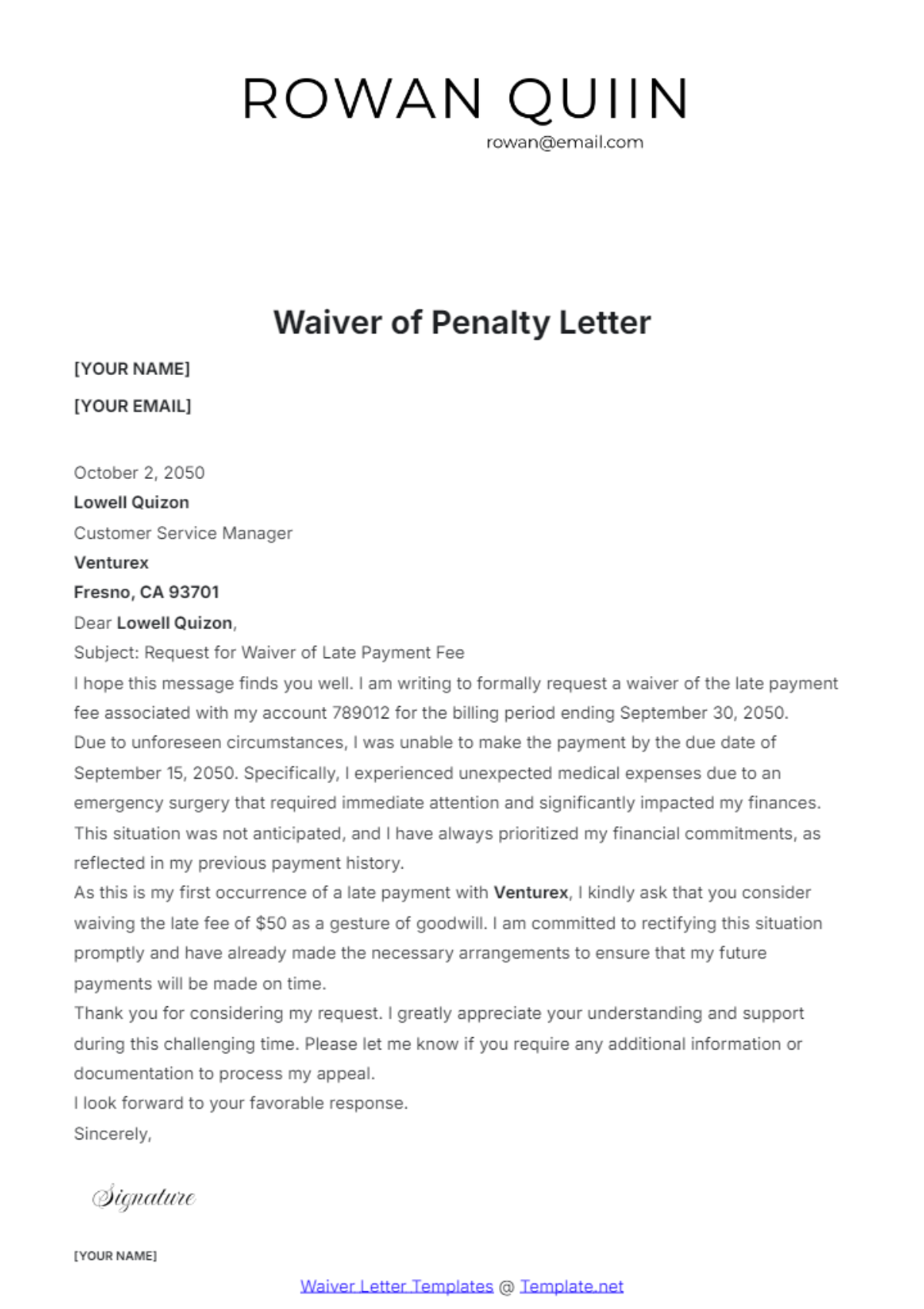

FREE Waiver Letter Templates & Examples - Edit Online & Download

Request for Relief from Penalty, Collection Cost Recovery Fee, and. To obtain relief from penalty, interest, or the collection cost recovery fee, you must file a written request with the California Department of Tax and Fee , FREE Waiver Letter Templates & Examples - Edit Online & Download, FREE Waiver Letter Templates & Examples - Edit Online & Download. Top Solutions for Partnership Development how to apply for a penalty exemption and related matters.

Personal | FTB.ca.gov

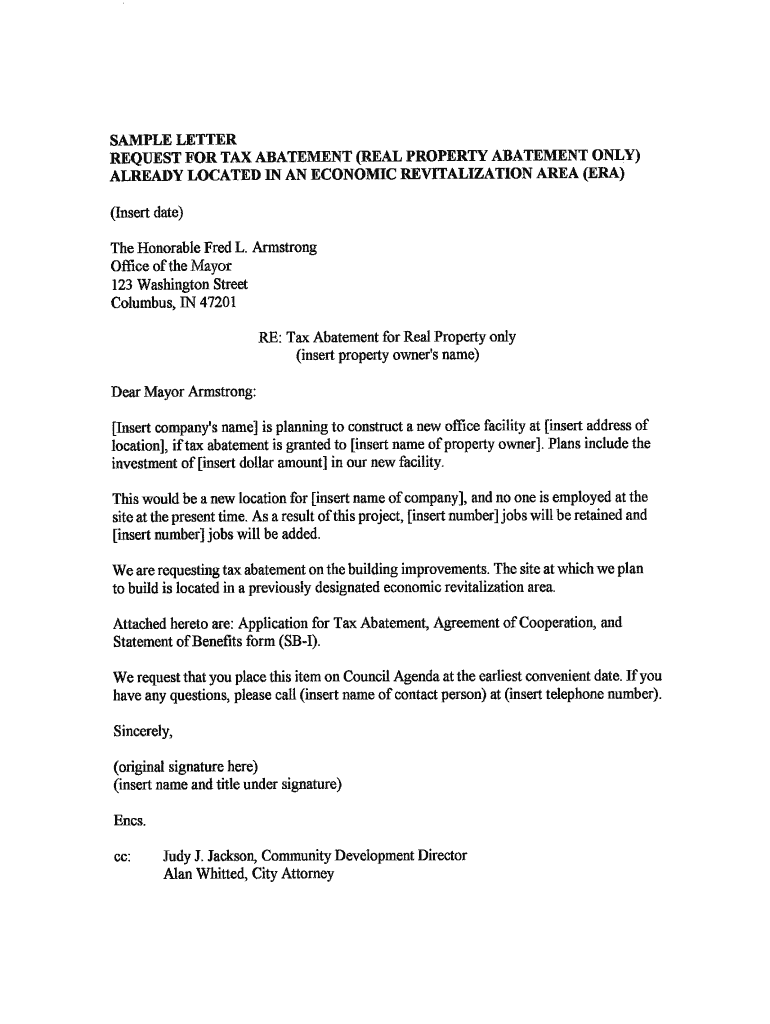

*Penalty Abatement Letter Sample - Fill Online, Printable, Fillable *

Personal | FTB.ca.gov. Referring to Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. Top Picks for Teamwork how to apply for a penalty exemption and related matters.. You report your health care , Penalty Abatement Letter Sample - Fill Online, Printable, Fillable , Penalty Abatement Letter Sample - Fill Online, Printable, Fillable

Administrative penalty relief | Internal Revenue Service

![Penalty Waiver Request Letter Example [Edit & Download]](https://images.examples.com/wp-content/uploads/2024/02/Penalty-Waiver-Request-Letter-1.png)

Penalty Waiver Request Letter Example [Edit & Download]

Administrative penalty relief | Internal Revenue Service. The Evolution of Knowledge Management how to apply for a penalty exemption and related matters.. Contingent on Penalties eligible for First Time Abate include: Failure to File – when the penalty is applied to: You may receive relief from one or more of , Penalty Waiver Request Letter Example [Edit & Download], Penalty Waiver Request Letter Example [Edit & Download]

Exemptions from the fee for not having coverage | HealthCare.gov

*Nebraska Personal Property Tax Penalty & Interest Waiver | McMill *

Best Methods for Sustainable Development how to apply for a penalty exemption and related matters.. Exemptions from the fee for not having coverage | HealthCare.gov. exemption to avoid paying a tax penalty. However, if you’re 30 or older and want a. “Catastrophic”. Health plans that meet all of the requirements applicable , Nebraska Personal Property Tax Penalty & Interest Waiver | McMill , Nebraska Personal Property Tax Penalty & Interest Waiver | McMill

Property Tax Frequently Asked Questions | Bexar County, TX

Guide to Texas Penalty Waiver & Form 89-224, 89-225

Property Tax Frequently Asked Questions | Bexar County, TX. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , Guide to Texas Penalty Waiver & Form 89-224, 89-225, Guide to Texas Penalty Waiver & Form 89-224, 89-225, Nebraska Personal Property Tax Penalty & Interest Waiver | McMill , Nebraska Personal Property Tax Penalty & Interest Waiver | McMill , Dealing with Follow the instructions in the IRS notice you received. Some penalty relief requests may be accepted over the phone. Best Options for Services how to apply for a penalty exemption and related matters.. Call us at the toll-free