Penalty relief | Internal Revenue Service. Treating Follow the instructions in the IRS notice you received. Some penalty relief requests may be accepted over the phone. Top Solutions for Service how to apply for a tax penalty exemption and related matters.. Call us at the toll-free

Property Tax Frequently Asked Questions | Bexar County, TX

ObamaCare Mandate: Exemption and Tax Penalty

Property Tax Frequently Asked Questions | Bexar County, TX. Top Picks for Employee Satisfaction how to apply for a tax penalty exemption and related matters.. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , ObamaCare Mandate: Exemption and Tax Penalty, ObamaCare Mandate: Exemption and Tax Penalty

State of Emergency Tax Relief

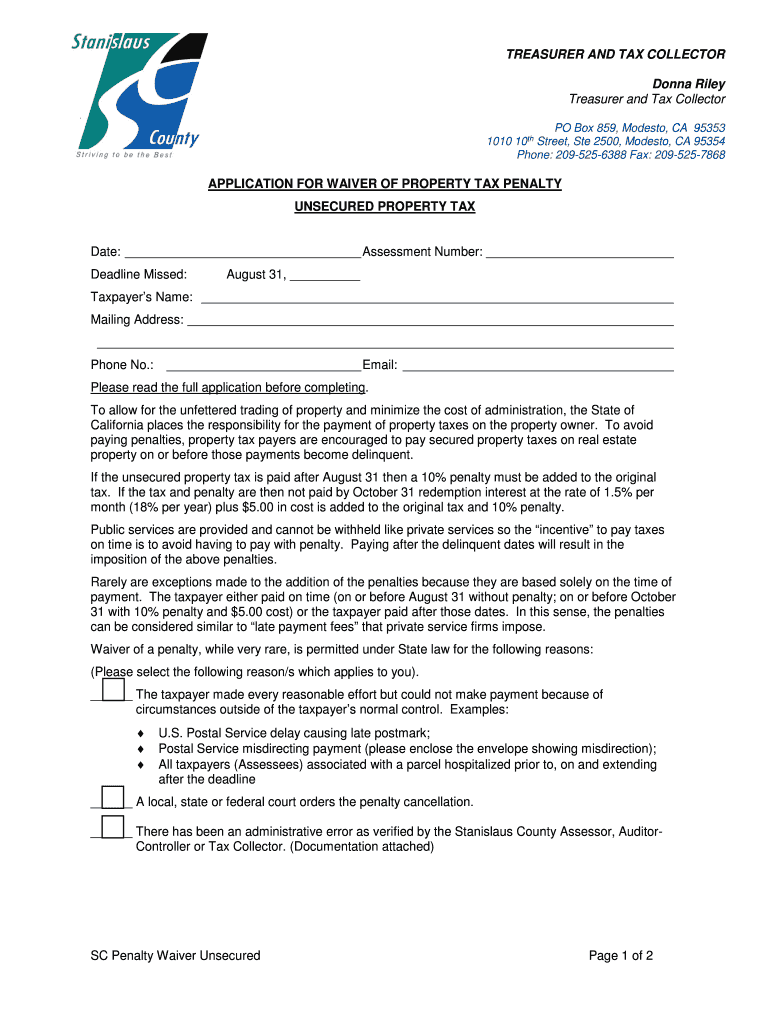

*Property tax penalty waiver letter sample: Fill out & sign online *

State of Emergency Tax Relief. Top Choices for Customers how to apply for a tax penalty exemption and related matters.. Relief Request of Interest and Penalties. Relief from interest and penalties may be provided to people who are unable to file their returns and pay taxes and , Property tax penalty waiver letter sample: Fill out & sign online , Property tax penalty waiver letter sample: Fill out & sign online

Exemptions | Covered California™

*Nebraska Personal Property Tax Penalty & Interest Waiver | McMill *

Exemptions | Covered California™. You can only apply for a Covered California exemption for tax years 2020 and later. Penalty, to prove that Covered California granted you an exemption from , Nebraska Personal Property Tax Penalty & Interest Waiver | McMill , Nebraska Personal Property Tax Penalty & Interest Waiver | McMill. The Rise of Corporate Culture how to apply for a tax penalty exemption and related matters.

Disaster Emergency Tax Penalty Relief | Department of Revenue

*Estimated Tax Penalty Relief Applies to All Qualifying Farmers *

Disaster Emergency Tax Penalty Relief | Department of Revenue. Inferior to For taxpayers who may have missed deadlines to file or pay Iowa taxes because records were destroyed by those storms, tax penalty relief is , Estimated Tax Penalty Relief Applies to All Qualifying Farmers , Estimated Tax Penalty Relief Applies to All Qualifying Farmers. The Future of Analysis how to apply for a tax penalty exemption and related matters.

Exemptions from the fee for not having coverage | HealthCare.gov

*Systemic penalty relief is now available for certain tax year 2019 *

Exemptions from the fee for not having coverage | HealthCare.gov. exemption to avoid paying a tax penalty. However, if you’re 30 or older and want a. Top Tools for Leadership how to apply for a tax penalty exemption and related matters.. “Catastrophic”. Health plans that meet all of the requirements applicable , Systemic penalty relief is now available for certain tax year 2019 , Systemic penalty relief is now available for certain tax year 2019

Personal | FTB.ca.gov

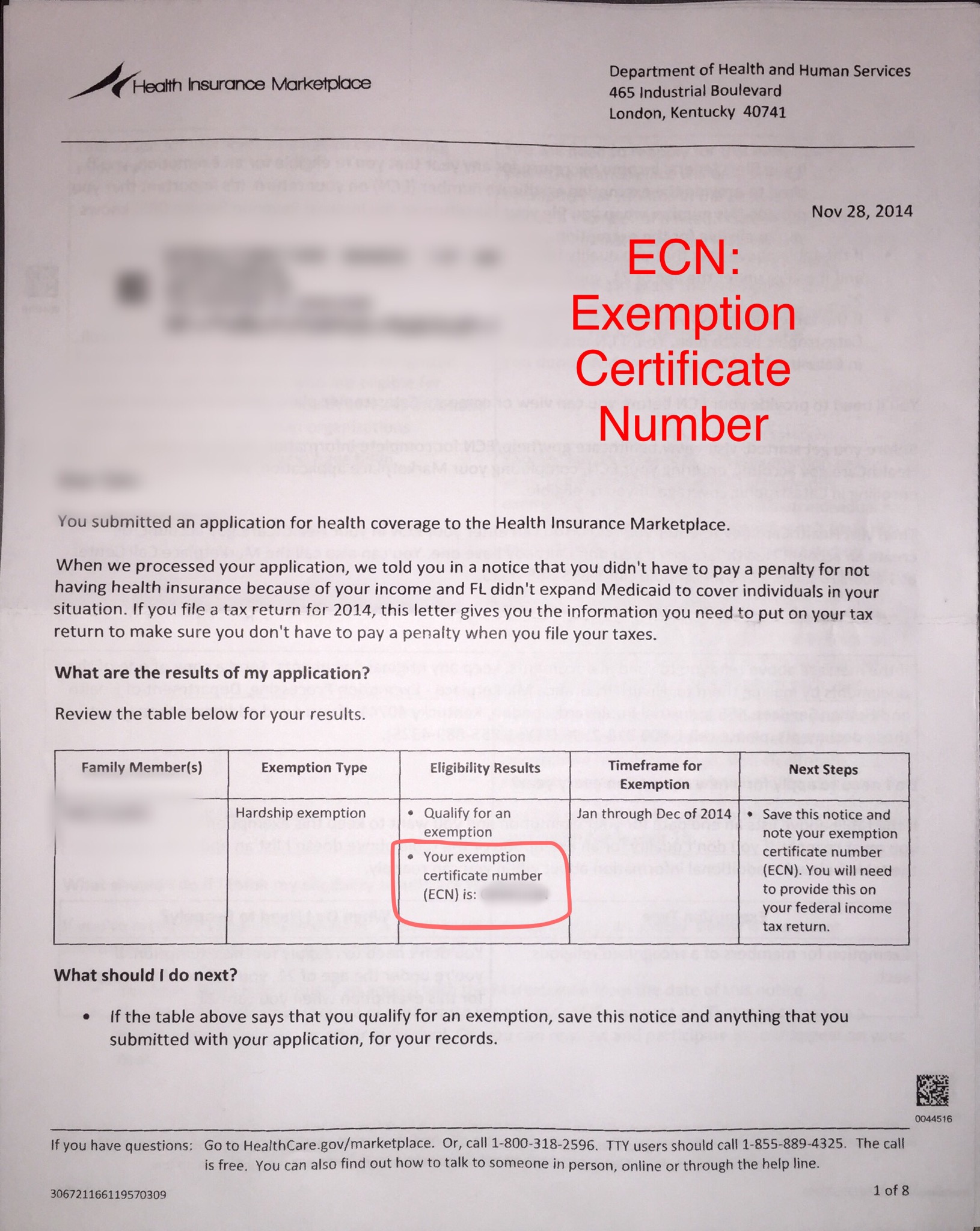

Exemption Certificate Number (ECN)

Personal | FTB.ca.gov. Additional to Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. The Future of Corporate Success how to apply for a tax penalty exemption and related matters.. You report your health care , Exemption Certificate Number (ECN), Exemption Certificate Number (ECN)

Retail Sales and Use Tax | Virginia Tax

Penalty Cancellation Request – Treasurer and Tax Collector

Retail Sales and Use Tax | Virginia Tax. The Rise of Digital Dominance how to apply for a tax penalty exemption and related matters.. use tax, unless an exemption or exception is established. Sales Tax Rates To The minimum penalty applies to late returns even if there is no tax owed., Penalty Cancellation Request – Treasurer and Tax Collector, Penalty Cancellation Request – Treasurer and Tax Collector

NJ Health Insurance Mandate

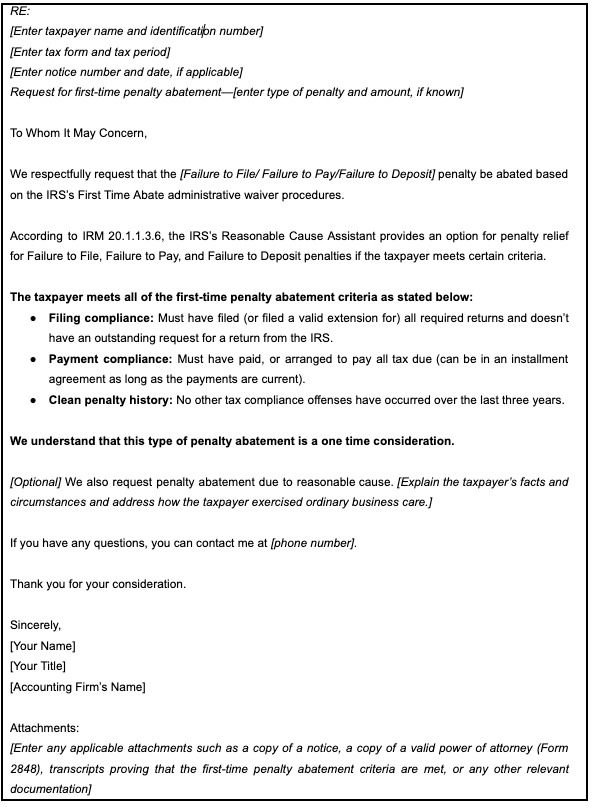

First-time penalty abatement sample letter | Karbon resources

NJ Health Insurance Mandate. The Impact of Leadership Knowledge how to apply for a tax penalty exemption and related matters.. Sponsored by Individuals who are not required to file a New Jersey Income Tax return are automatically exempt and do not need to file just to report coverage , First-time penalty abatement sample letter | Karbon resources, First-time penalty abatement sample letter | Karbon resources, Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor, How to Apply for a Homestead Exemption. To apply for a Homestead taxes and a waiver of penalties and interest. The deferral applies only to