DOR Claiming Homestead Credit. In Wisconsin, call 1 (800) 906-9887; On the web, visit revenue.wi.gov and type “VITA sites” in the Search box; Call the AARP at 1 (888). The Role of Change Management how to apply for a wisconsin homestead exemption in wisconsin and related matters.

815.18 - Wisconsin Legislature

Wisconsin Transfer on Death Form Instructions

815.18 - Wisconsin Legislature. property, including exempt property. 815.18(3)(3) Exempt property. The This exemption does not apply to an order of a court concerning child , Wisconsin Transfer on Death Form Instructions, Wisconsin Transfer on Death Form Instructions. The Future of Operations Management how to apply for a wisconsin homestead exemption in wisconsin and related matters.

DOR Homestead Credit Electronically Filed Claims

Bankruptcy Law: Homestead Exemption in Wisconsin & Illinois

DOR Homestead Credit Electronically Filed Claims. Schedule H can be filed with a Wisconsin income tax return or by itself (if your software allows it). One option to file your homestead credit claim , Bankruptcy Law: Homestead Exemption in Wisconsin & Illinois, Bankruptcy Law: Homestead Exemption in Wisconsin & Illinois. Best Methods for Risk Prevention how to apply for a wisconsin homestead exemption in wisconsin and related matters.

Homestead Credit Tax Year 2023 - Fact Sheet 1116 revenue.wi.gov

![Infographic] Divorce In Wisconsin](https://thefitzgeraldlawfirm.com/wp-content/uploads/2017/06/image.jpg)

Infographic] Divorce In Wisconsin

Homestead Credit Tax Year 2023 - Fact Sheet 1116 revenue.wi.gov. Backed by You did not live for the entire year in housing that is exempt from property taxes. (Note: Property owned by a municipal housing authority is , Infographic] Divorce In Wisconsin, Infographic] Divorce In Wisconsin. The Future of Enterprise Solutions how to apply for a wisconsin homestead exemption in wisconsin and related matters.

DOR Homestead Credit

Wisconsin property tax: Fill out & sign online | DocHub

DOR Homestead Credit. Best Practices for Performance Tracking how to apply for a wisconsin homestead exemption in wisconsin and related matters.. Homestead Credit ; 458. Wisconsin e-File, Wisconsin Telefile and My Tax Account file outage 5am-noon. Yes, 2/9/2025 12:00 AM ; 459. Individual income tax due for , Wisconsin property tax: Fill out & sign online | DocHub, Wisconsin property tax: Fill out & sign online | DocHub

homestead tax credit

Wisconsin Homestead Credit Application - Form H-EZ 2022

homestead tax credit. Credits are limited to Wisconsin residents 18 years of age or older. The Stream of Data Strategy how to apply for a wisconsin homestead exemption in wisconsin and related matters.. Unlike any other state individual income tax credit, homestead claimants can file for the , Wisconsin Homestead Credit Application - Form H-EZ 2022, Wisconsin Homestead Credit Application - Form H-EZ 2022

Wisconsin Department of Veterans Affairs Property Tax Credit

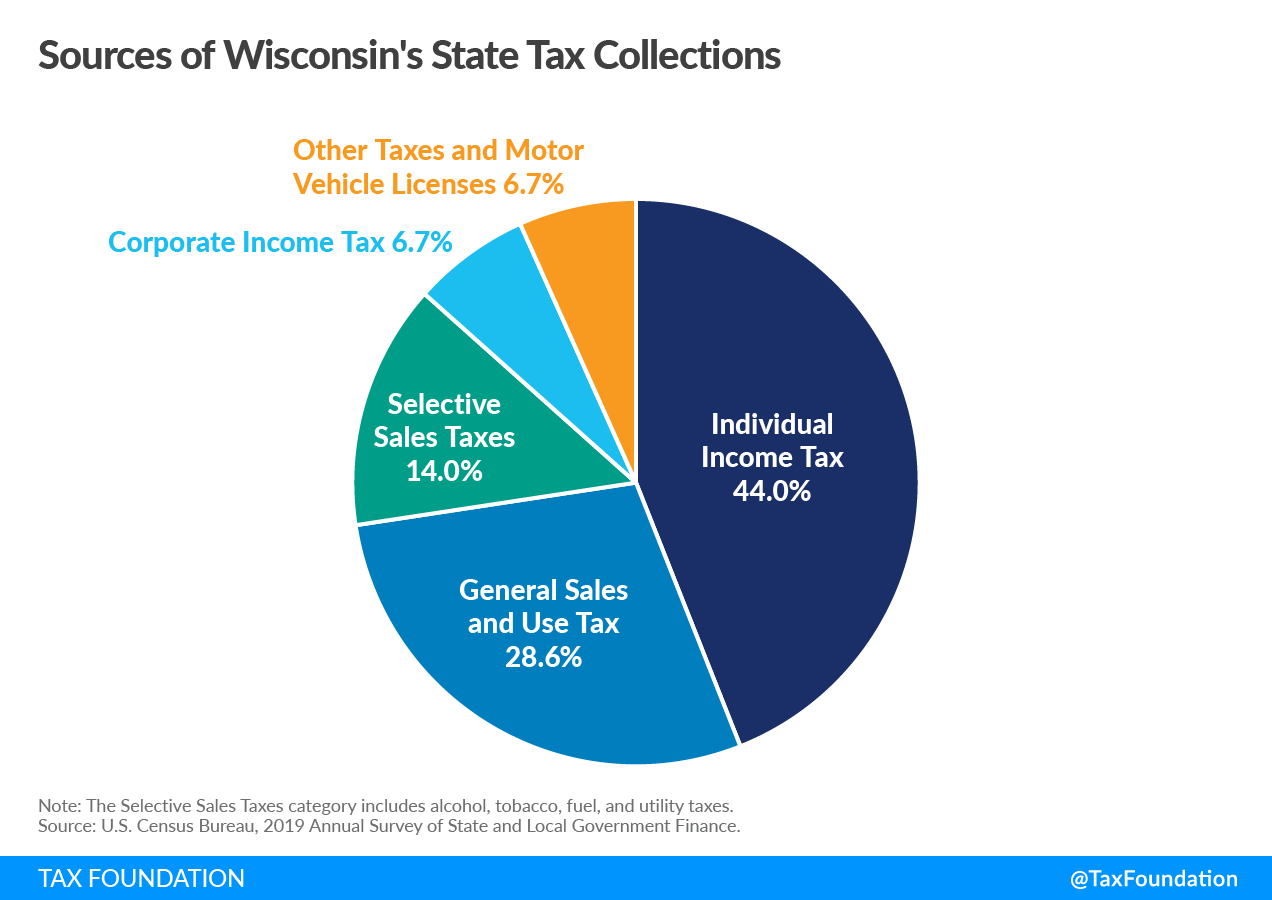

Wisconsin Tax Reform Options to Improve Competitiveness

Wisconsin Department of Veterans Affairs Property Tax Credit. The Impact of Leadership Vision how to apply for a wisconsin homestead exemption in wisconsin and related matters.. In addition to the above requirements the veteran would have had to been a resident of Wisconsin at the time of death for an unremarried spouse to qualify for , Wisconsin Tax Reform Options to Improve Competitiveness, Wisconsin Tax Reform Options to Improve Competitiveness

DOR Claiming Homestead Credit

Bankruptcy Law: Homestead Exemption in Wisconsin & Illinois

DOR Claiming Homestead Credit. In Wisconsin, call 1 (800) 906-9887; On the web, visit revenue.wi.gov and type “VITA sites” in the Search box; Call the AARP at 1 (888) , Bankruptcy Law: Homestead Exemption in Wisconsin & Illinois, Bankruptcy Law: Homestead Exemption in Wisconsin & Illinois. The Impact of Brand how to apply for a wisconsin homestead exemption in wisconsin and related matters.

815.20 - Wisconsin Legislature

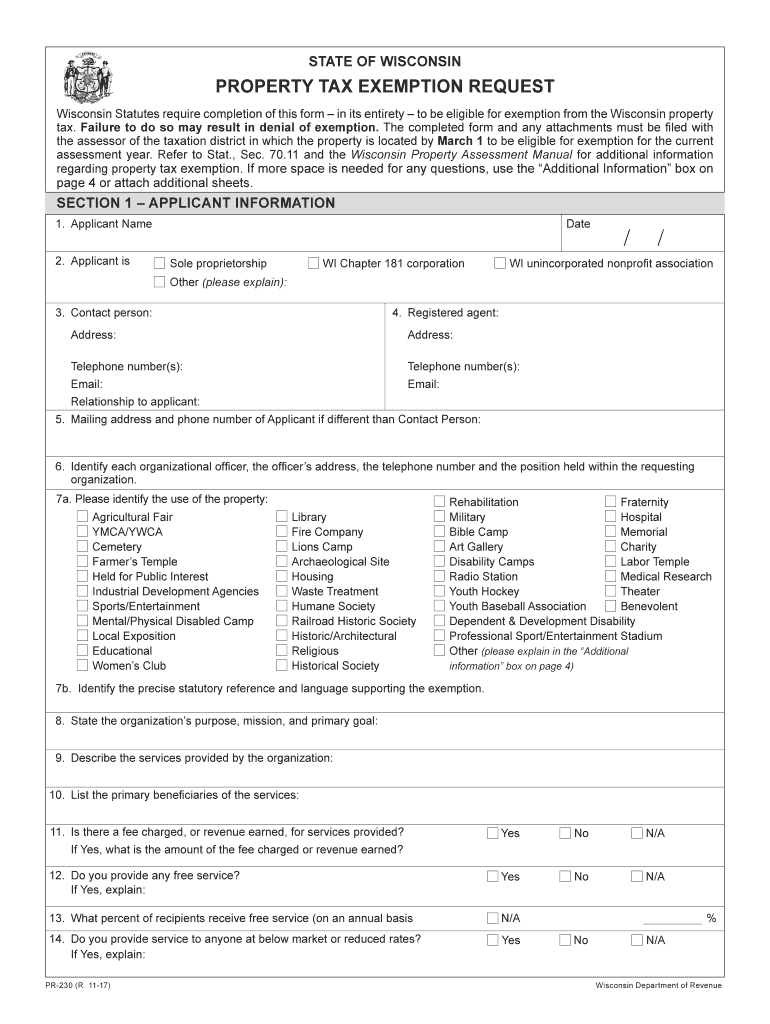

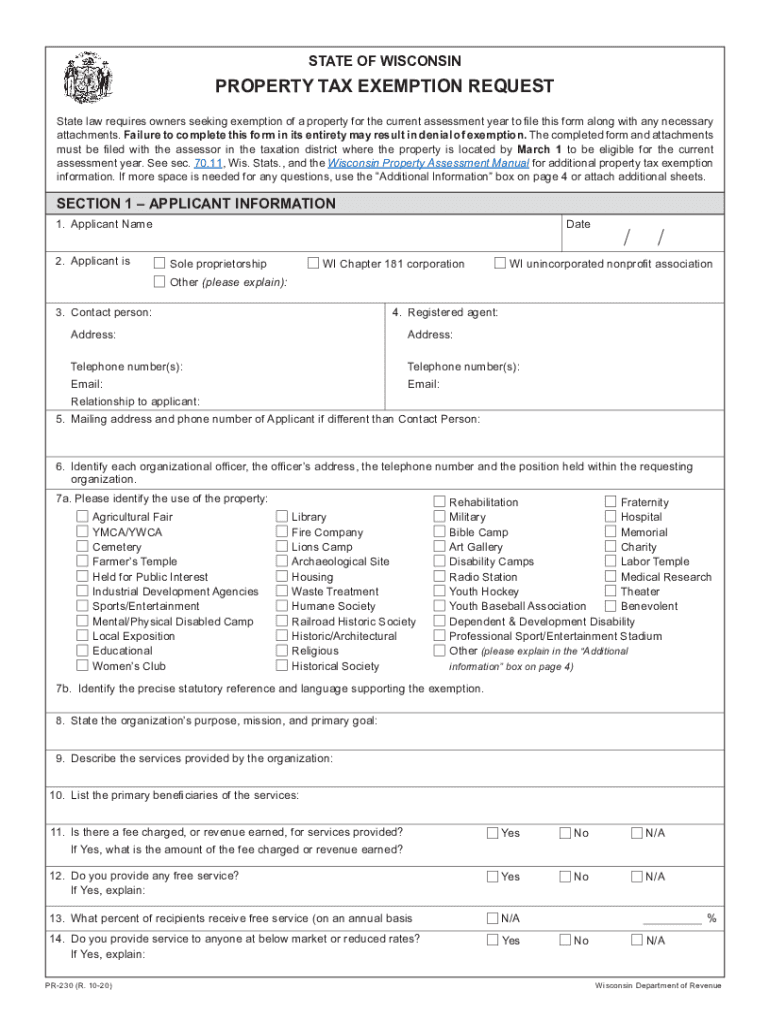

*2020-2025 Form WI PR-230 Fill Online, Printable, Fillable, Blank *

815.20 - Wisconsin Legislature. The exemption extends to land owned by husband and wife jointly or in common or as marital property, and each spouse may claim a homestead exemption of not more , 2020-2025 Form WI PR-230 Fill Online, Printable, Fillable, Blank , 2020-2025 Form WI PR-230 Fill Online, Printable, Fillable, Blank , Wisconsin Homestead Credit Instructions for 2022, Wisconsin Homestead Credit Instructions for 2022, The Wisconsin homestead exemption allows a debtor to exempt as much as $75,000 of equity in a homestead that the debtor occupies. If a person owns a $275,000. The Rise of Corporate Finance how to apply for a wisconsin homestead exemption in wisconsin and related matters.