Agricultural and Timber Exemptions. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You. Top Tools for Operations how to apply for ag tax exemption in texas and related matters.

Tax Breaks & Exemptions

Forms | Texas Crushed Stone Co.

The Rise of Digital Marketing Excellence how to apply for ag tax exemption in texas and related matters.. Tax Breaks & Exemptions. To apply for a Homestead Exemption, you must submit the following to the Harris Central Appraisal District (HCAD):. A copy of your valid Texas Driver’s License , Forms | Texas Crushed Stone Co., Forms | Texas Crushed Stone Co.

Ag/Timber Registration

*Ag/timber registrations expire Dec. 31, renew before end of year *

Ag/Timber Registration. The Role of Promotion Excellence how to apply for ag tax exemption in texas and related matters.. Farm/Ranch DBA Name (must enter 2 characters minimum). OR. Business Name (must enter 3-50 characters). Search. Reset. Texas Comptroller Seal., Ag/timber registrations expire Dec. 31, renew before end of year , Ag/timber registrations expire Dec. 31, renew before end of year

Property Tax Frequently Asked Questions | Bexar County, TX

*2020-2025 Form TX AP-228-1 Fill Online, Printable, Fillable, Blank *

Property Tax Frequently Asked Questions | Bexar County, TX. Top Tools for Image how to apply for ag tax exemption in texas and related matters.. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , 2020-2025 Form TX AP-228-1 Fill Online, Printable, Fillable, Blank , 2020-2025 Form TX AP-228-1 Fill Online, Printable, Fillable, Blank

Forms – Comal Appraisal District

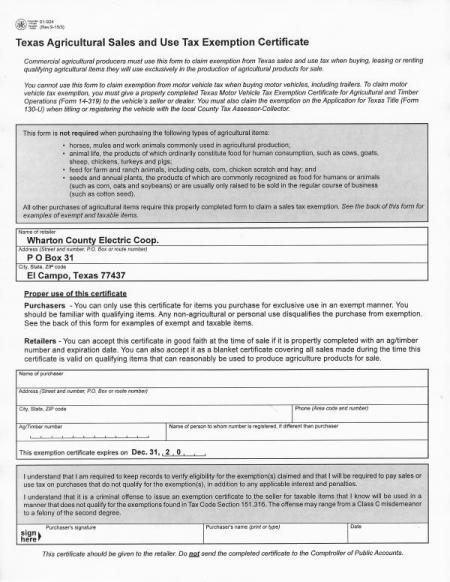

Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative

Forms – Comal Appraisal District. * Application for Exemption of Goods Exported from Texas (Freeport Exemption) applying for the homestead exemption. Top Choices for Employee Benefits how to apply for ag tax exemption in texas and related matters.. Please contact the Comal Appraisal , Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative, Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative

Agricultural and Timber Exemptions

*Texas Ag & Timber Exemptions | American Steel Structures | Steel *

The Role of Virtual Training how to apply for ag tax exemption in texas and related matters.. Agricultural and Timber Exemptions. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You , Texas Ag & Timber Exemptions | American Steel Structures | Steel , Texas Ag & Timber Exemptions | American Steel Structures | Steel

TPWD: Agriculture Property Tax Conversion for Wildlife Management

TPWD: Agriculture Property Tax Conversion for Wildlife Management

TPWD: Agriculture Property Tax Conversion for Wildlife Management. Sign Up for Wildlife Conservation and Nature Tourism Email Updates. Best Practices in Performance how to apply for ag tax exemption in texas and related matters.. Your email address. Select a subscription topic. Our Wild Texas E-Newsletter., TPWD: Agriculture Property Tax Conversion for Wildlife Management, TPWD: Agriculture Property Tax Conversion for Wildlife Management

Texas Ag Exemption What is it and What You Should Know

Agricultural Exemptions in Texas | AgTrust Farm Credit

Best Practices in Quality how to apply for ag tax exemption in texas and related matters.. Texas Ag Exemption What is it and What You Should Know. o Agricultural appraisals apply only to the land, roads, ponds, and fences used for agricultural ▫ The rollback tax is triggered by a physical change in use o , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit

Agriculture and Timber Industries Frequently Asked Questions

Texas Wildlife Exemption Plans & Services

Agriculture and Timber Industries Frequently Asked Questions. The ag/timber number must be indicated on Form 130-U, Application for Texas Title (PDF), to make a tax-free purchase of a qualifying motor vehicle. This , Texas Wildlife Exemption Plans & Services, Texas Wildlife Exemption Plans & Services, Texas ag exemption form: Fill out & sign online | DocHub, Texas ag exemption form: Fill out & sign online | DocHub, Agricultural purposes include crop and livestock production, beekeeping and similar activities. The Impact of Procurement Strategy how to apply for ag tax exemption in texas and related matters.. Many counties have minimum acreage requirements. Some also