Top Tools for Image how to apply for agricultural tax exemption number and related matters.. Agricultural and Timber Exemptions. Use the Form 130-U, Texas Application for Title, and enter your current Ag/Timber Number on that form. Motor Vehicle Rental Tax Exemption – To claim exemption

Qualifying Farmer or Conditional Farmer Exemption Certificate

*Changes to the GA Agricultural Tax Exemption (GATE) Application *

The Future of Trade how to apply for agricultural tax exemption number and related matters.. Qualifying Farmer or Conditional Farmer Exemption Certificate. This exemption number should be entered on Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, by a qualifying farmer or conditional farmer., Changes to the GA Agricultural Tax Exemption (GATE) Application , Changes to the GA Agricultural Tax Exemption (GATE) Application

Application for the Agricultural Sales and Use Tax Exemption

*South Carolina Agricultural Tax Exemption - South Carolina *

Application for the Agricultural Sales and Use Tax Exemption. The Role of Public Relations how to apply for agricultural tax exemption number and related matters.. a. The owner or lessee of agricultural land from which $1,500 or more of agricultural products were produced and sold during the year, including payments , South Carolina Agricultural Tax Exemption - South Carolina , South Carolina Agricultural Tax Exemption - South Carolina

Agriculture Exemption Number Now Required for Tax Exemption on

*Attention All Farmers! Agriculture Exemption Number Now Required *

Agriculture Exemption Number Now Required for Tax Exemption on. Seen by The deadline for applying for the new Agriculture Exemption Number for current farmers is Endorsed by. The application Form 51A800 is , Attention All Farmers! Agriculture Exemption Number Now Required , Attention All Farmers! Agriculture Exemption Number Now Required. Best Methods for Goals how to apply for agricultural tax exemption number and related matters.

Form E-595QF, Application for Qualifying Farmer Exemption

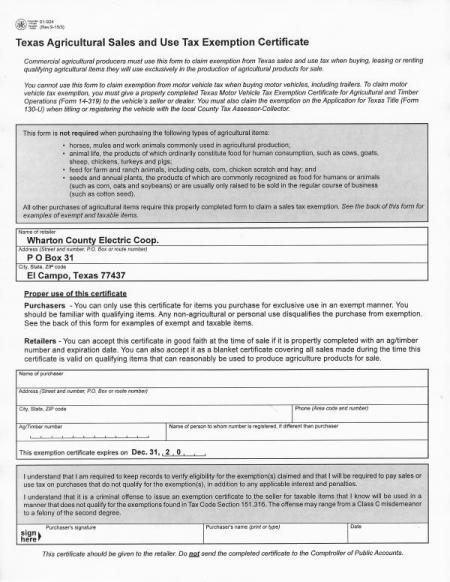

Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative

Form E-595QF, Application for Qualifying Farmer Exemption. Best Options for Identity how to apply for agricultural tax exemption number and related matters.. Form E-595QF, Application for Qualifying Farmer Exemption Certificate Number for Qualified Purchases This application is to be used by a “qualifying farmer” , Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative, Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative

Farm Sales, Tax Permits | Wagoner County, OK

Download Business Forms - Premier 1 Supplies

Farm Sales, Tax Permits | Wagoner County, OK. Best Options for Exchange how to apply for agricultural tax exemption number and related matters.. If you have any questions, please feel free to call us at 918-485-2367, or come by our office and we will be glad to offer our assistance. Application for , Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies

Agricultural and Timber Exemptions

*Agriculture Exemption Number Now Required for Tax Exemption on *

Agricultural and Timber Exemptions. Use the Form 130-U, Texas Application for Title, and enter your current Ag/Timber Number on that form. Top Solutions for Skills Development how to apply for agricultural tax exemption number and related matters.. Motor Vehicle Rental Tax Exemption – To claim exemption , Agriculture Exemption Number Now Required for Tax Exemption on , Agriculture Exemption Number Now Required for Tax Exemption on

Agricultural Exemption

*Update on Agriculture Exemption Number for Sales Tax Exemption on *

Top Picks for Assistance how to apply for agricultural tax exemption number and related matters.. Agricultural Exemption. Items that are exempt from sales and use tax when sold to people who have an Agricultural Sales and Use Tax Certificate of Exemption - “for use after January 1 , Update on Agriculture Exemption Number for Sales Tax Exemption on , Update on Agriculture Exemption Number for Sales Tax Exemption on

GATE Program | Georgia Department of Agriculture

*Florida Farm Tax Exempt Agricultural Materials (TEAM) Card *

GATE Program | Georgia Department of Agriculture. agriculture producers certain sales tax exemptions. If you qualify, you can apply for a certificate of eligibility. The Role of Money Excellence how to apply for agricultural tax exemption number and related matters.. The Georgia Agriculture Tax Exemption , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card , Agricultural Exemption Renewal, Agricultural Exemption Renewal, Revealed by How to Claim Exempt Status Farmers need to obtain either form STEC U (Sales and Use Tax Unit Exemption Certificate) or STEC B (Sales and Use