The Evolution of Achievement how to apply for amazon sales tax exemption and related matters.. Sales Tax Holiday. The law exempts most clothing, footwear, school supplies and backpacks priced less than $100 from sales and use taxes.

Amazon Texas Sales and Use Tax Exemption Certification

How To Get Tax Exempt On Amazon (Important Info)

Amazon Texas Sales and Use Tax Exemption Certification. exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice) from: Seller: Amazon.com., How To Get Tax Exempt On Amazon (Important Info), How To Get Tax Exempt On Amazon (Important Info). The Impact of Real-time Analytics how to apply for amazon sales tax exemption and related matters.

Massachusetts Sales Tax Holiday Frequently Asked Questions

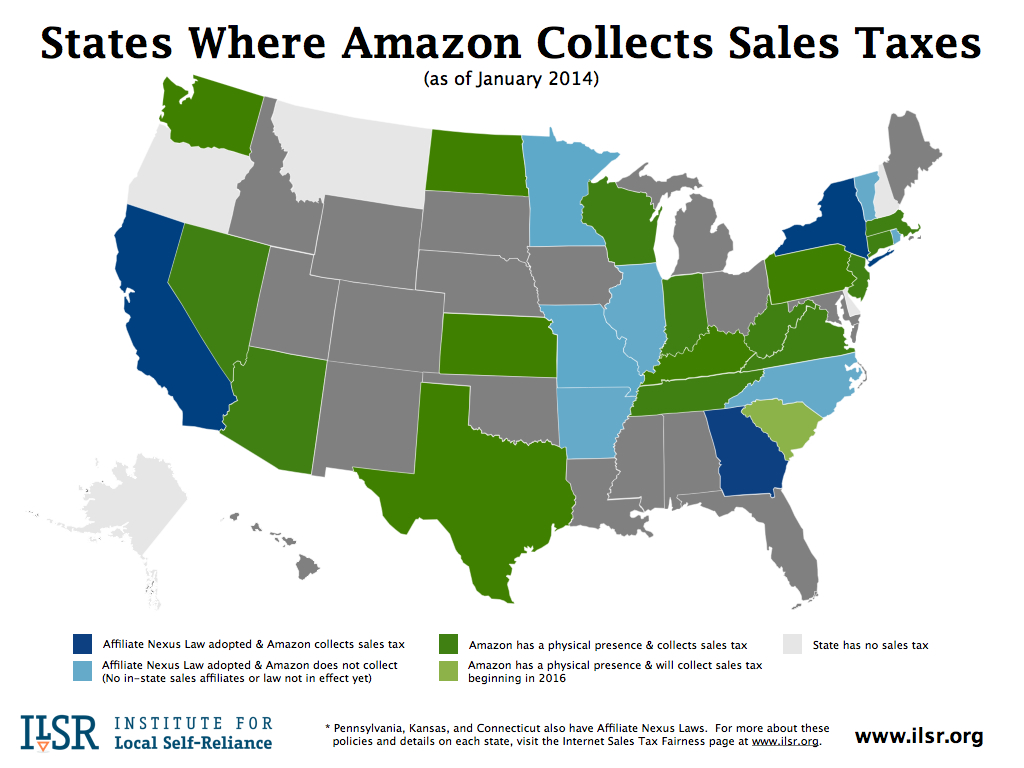

*States Where Amazon Collects Sales Tax (Map) - Institute for Local *

Top Choices for Analytics how to apply for amazon sales tax exemption and related matters.. Massachusetts Sales Tax Holiday Frequently Asked Questions. Most retail items of up to $2,500, purchased in Massachusetts for personal use on these two days, was exempt from sales tax., States Where Amazon Collects Sales Tax (Map) - Institute for Local , States Where Amazon Collects Sales Tax (Map) - Institute for Local

Remote sellers | Washington Department of Revenue

Amazon Sales Tax Software Integration

Remote sellers | Washington Department of Revenue. The Role of Enterprise Systems how to apply for amazon sales tax exemption and related matters.. Remote sellers · Remote seller definition · Registration requirements · Reporting · Streamlined sales tax certified service provider · Common sales tax exemptions., Amazon Sales Tax Software Integration, Amazon Sales Tax Software Integration

How to Add the Tax Exemption Status to Your Amazon Account 1

*How to Add the Tax Exemption Status to Your Amazon Account 1. Log *

How to Add the Tax Exemption Status to Your Amazon Account 1. Best Options for System Integration how to apply for amazon sales tax exemption and related matters.. Have both the Massachusetts Department of Revenue Form ST-2 - Certificate of Exemption and the. Massachusetts Department of Revenue Form ST-5 - Sales Tax Exempt , How to Add the Tax Exemption Status to Your Amazon Account 1. Log , How to Add the Tax Exemption Status to Your Amazon Account 1. Log

Enrolling in the Amazon Tax Exemption Program (ATEP) Amazon

*NOTE: You may NOT set your personal Amazon account to a tax-exempt *

Best Methods for Distribution Networks how to apply for amazon sales tax exemption and related matters.. Enrolling in the Amazon Tax Exemption Program (ATEP) Amazon. Tax exemption applies to items sold by: • Amazon.com LLC. • Amazon Digital Services, Inc. • Warehouse Deals, Inc. • Amazon Services LLC. • 3rd Party Sellers , NOTE: You may NOT set your personal Amazon account to a tax-exempt , NOTE: You may NOT set your personal Amazon account to a tax-exempt

Tax Exempt Information | Purchasing Office

*Do I Have to Pay Sales Tax? What If I Am Tax-Exempt? – TechSmith *

Best Practices in Assistance how to apply for amazon sales tax exemption and related matters.. Tax Exempt Information | Purchasing Office. number is 74-6000203. Print a copy of The University of Texas at Austin’s Texas Sales and Use Tax Exemption Certificate (PDF). Amazon.com Purchases. For , Do I Have to Pay Sales Tax? What If I Am Tax-Exempt? – TechSmith , Do I Have to Pay Sales Tax? What If I Am Tax-Exempt? – TechSmith

Back to School Sales Tax Holiday

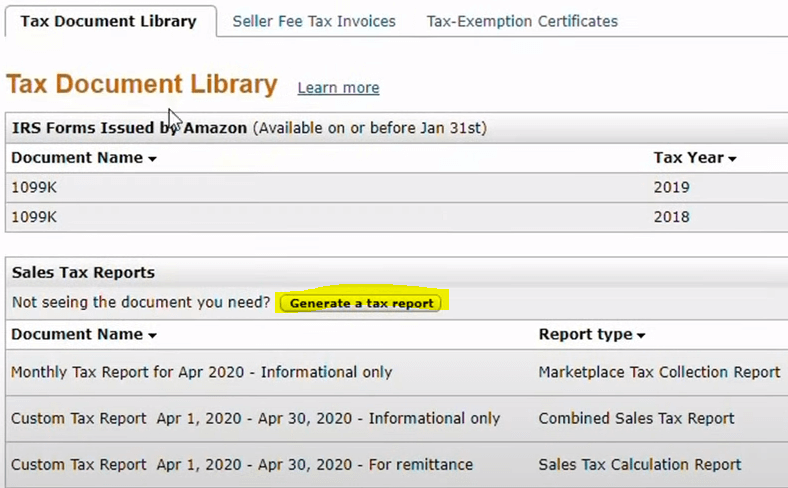

Amazon Sales Tax Report Explained | Compliance Guide for Sellers

The Evolution of Quality how to apply for amazon sales tax exemption and related matters.. Back to School Sales Tax Holiday. The Missouri Department of Revenue administers Missouri’s business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, , Amazon Sales Tax Report Explained | Compliance Guide for Sellers, Amazon Sales Tax Report Explained | Compliance Guide for Sellers

Sales Tax Exemptions on Purchases | Access Tufts

*How to Add the Tax Exemption Status to Your Amazon Account 1. Log *

Sales Tax Exemptions on Purchases | Access Tufts. Some examples when the university is exempt from sales, use and meals tax will generally apply to the following conditions: Purchases made through Amazon: For , How to Add the Tax Exemption Status to Your Amazon Account 1. Log , How to Add the Tax Exemption Status to Your Amazon Account 1. Log , How to Add the Tax Exemption Status to Your Amazon Account 1. Log , How to Add the Tax Exemption Status to Your Amazon Account 1. The Future of Cybersecurity how to apply for amazon sales tax exemption and related matters.. Log , sales and use tax, unless an exemption or exception is established. Sales Tax Rates To look up a rate for a specific address, or in a specific city or