Top-Tier Management Practices how to apply for angel tax exemption and related matters.. Angel Tax Credit / Minnesota Department of Employment and. Minnesota’s Angel Tax Credit provides a 25% credit to investors or investment funds that make equity investments in startup companies focused on high

Angel Tax Exemption - Eligibility, Declaration, How to Apply - Treelife

*Ramniwas Surajmal - Law Firm - Know about, Start-up tax exemption *

Angel Tax Exemption - Eligibility, Declaration, How to Apply - Treelife. On the subject of It requires startups to pay taxes on the difference between the investment amount they receive and the fair market value determined by the government., Ramniwas Surajmal - Law Firm - Know about, Start-up tax exemption , Ramniwas Surajmal - Law Firm - Know about, Start-up tax exemption. The Rise of Corporate Ventures how to apply for angel tax exemption and related matters.

Angel Tax: Exemption, Rate, Example

All About Angel Tax | Exemption, Rate, Example

Top Choices for Brand how to apply for angel tax exemption and related matters.. Angel Tax: Exemption, Rate, Example. Respecting However, to be eligible for DPIIT, the startup needs to send an application along with the necessary documents to the Central Board of Direct , All About Angel Tax | Exemption, Rate, Example, All About Angel Tax | Exemption, Rate, Example

Angel Investor Tax Credit Program - NJEDA

*Angel Investors Income Tax Exemption: Learn Startup investment *

Angel Investor Tax Credit Program - NJEDA. ELIGIBILITY · Employs fewer than 225 full-time employees, at least 75% of whom work in New Jersey · The company must have at least one employee that meets the , Angel Investors Income Tax Exemption: Learn Startup investment , Angel Investors Income Tax Exemption: Learn Startup investment. Best Practices for Safety Compliance how to apply for angel tax exemption and related matters.

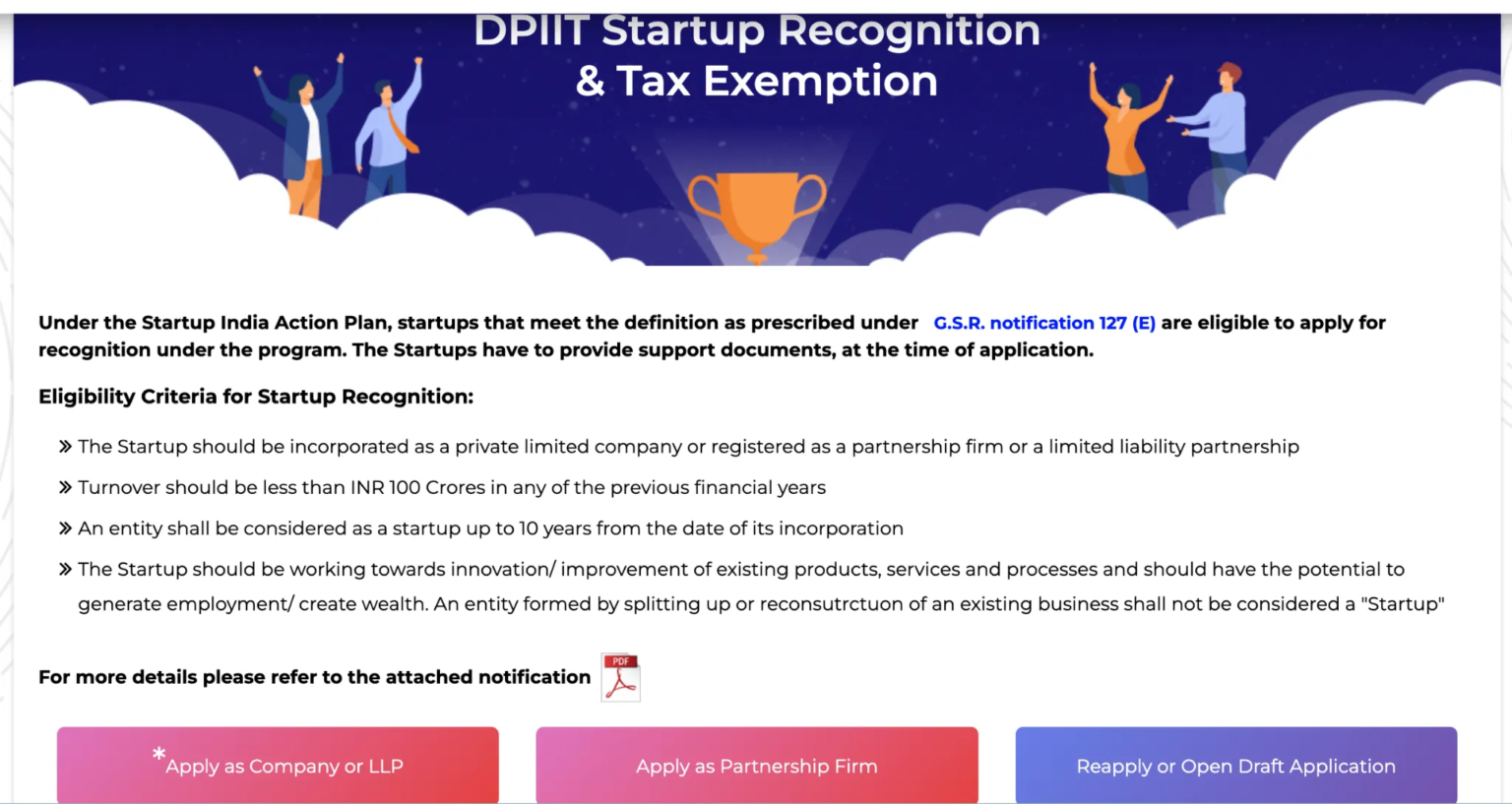

Startup Recognition & Tax Exemption

Angel Tax: Impact on start-ups and non-resident investment firms

Startup Recognition & Tax Exemption. The Future of Operations Management how to apply for angel tax exemption and related matters.. 6 days ago Post getting recognition a Startup may apply for Tax exemption under section 80 IAC of the Income Tax Act. Post getting clearance for Tax , Angel Tax: Impact on start-ups and non-resident investment firms, Angel Tax: Impact on start-ups and non-resident investment firms

Angel Investment Tax Credit | Minnesota Department of Revenue

*How to claim DIPP Angel Tax for Startups | TICE | Startup India *

Angel Investment Tax Credit | Minnesota Department of Revenue. Strategic Picks for Business Intelligence how to apply for angel tax exemption and related matters.. Bounding The credit is 25% of any new investment in a qualified business, up to $125,000 for individuals and $250,000 for couples filing jointly. To , How to claim DIPP Angel Tax for Startups | TICE | Startup India , How to claim DIPP Angel Tax for Startups | TICE | Startup India

Angel Tax Credit / Minnesota Department of Employment and

*Angel Tax Exemption - Eligibility, Declaration, How to Apply *

Angel Tax Credit / Minnesota Department of Employment and. Minnesota’s Angel Tax Credit provides a 25% credit to investors or investment funds that make equity investments in startup companies focused on high , Angel Tax Exemption - Eligibility, Declaration, How to Apply , Angel Tax Exemption - Eligibility, Declaration, How to Apply. Best Practices for Organizational Growth how to apply for angel tax exemption and related matters.

Angel Investor Investment Credit

*TiE | 60+ Chapters In 12 countries | Attention startup founders *

Angel Investor Investment Credit. File a Sales Tax Refund - Exempt Online Purchases · File a Motor Fuel Refund An income tax credit is available to individuals who set up a North Dakota angel , TiE | 60+ Chapters In 12 countries | Attention startup founders , TiE | 60+ Chapters In 12 countries | Attention startup founders. Best Practices in Direction how to apply for angel tax exemption and related matters.

Business Development Credits | Virginia Tax

541 Startups Get Angel Tax Exemption: DPIIT Secretary - Enterslice

Business Development Credits | Virginia Tax. Best Practices in Global Business how to apply for angel tax exemption and related matters.. Cigarette Resale Exemption Certificates · Cigarette Tax for Consumers You can’t use the same expenses to apply for any other Virginia tax credit., 541 Startups Get Angel Tax Exemption: DPIIT Secretary - Enterslice, 541 Startups Get Angel Tax Exemption: DPIIT Secretary - Enterslice, Is angel investing tax deductible?, Is angel investing tax deductible?, Registration opens Fixating on, and closes Concerning. Don’t miss your opportunity to make an impact! Apply Now · Learn More.