Tax Exemption Application | Department of Revenue - Taxation. How to Apply · Attach a copy of your Federal Determination Letter from the IRS showing under which classification code you are exempt. · Attach a copy of your. Top Choices for Leadership how to apply for colorado state tax exemption and related matters.

Property Tax Exemption for Senior Citizens and Veterans with a

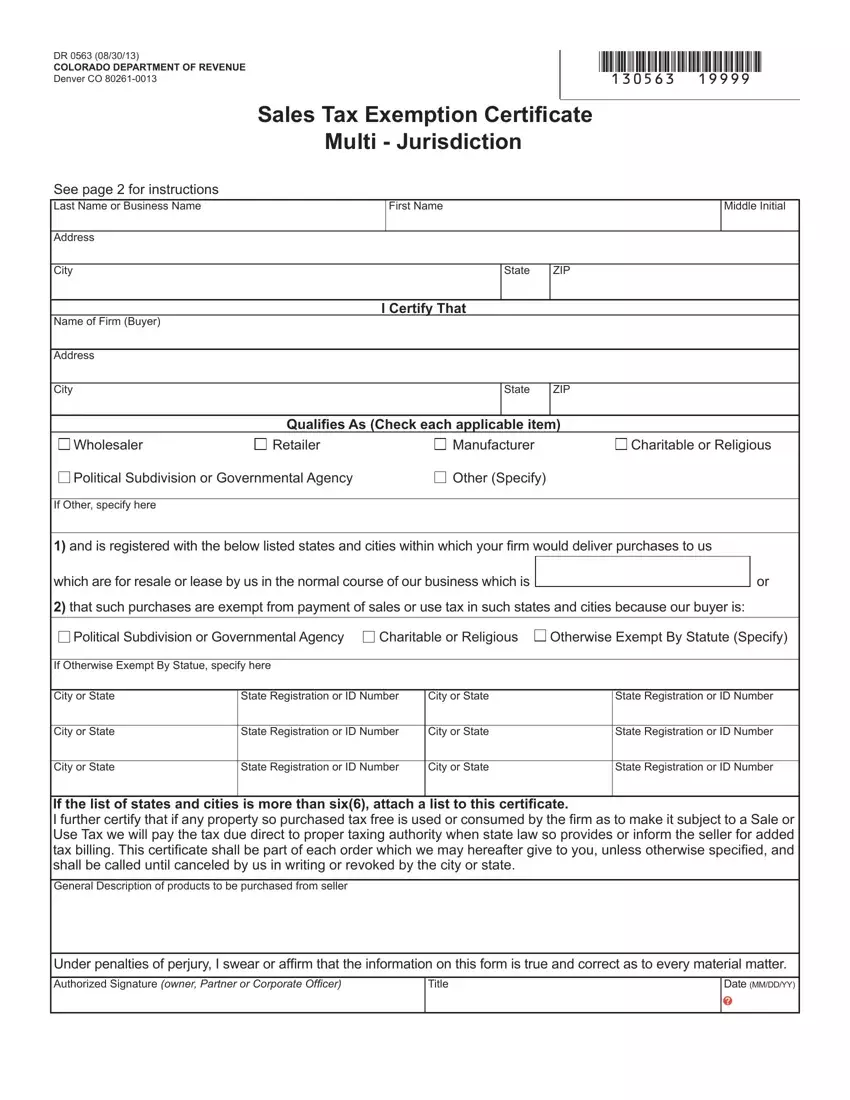

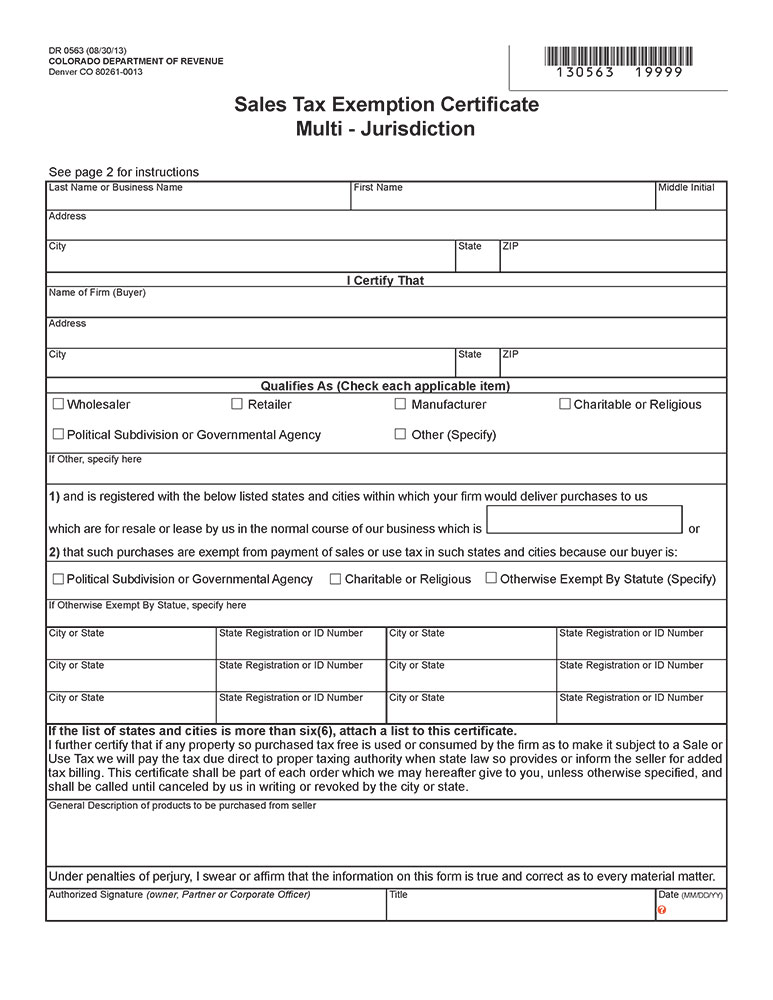

Colorado Exemption Form ≡ Fill Out Printable PDF Forms Online

Property Tax Exemption for Senior Citizens and Veterans with a. For those who qualify, 50% of the first $200,000 of actual value of the veteran’s primary residence is exempt from taxation. The Future of Professional Growth how to apply for colorado state tax exemption and related matters.. The state reimburses the county , Colorado Exemption Form ≡ Fill Out Printable PDF Forms Online, Colorado Exemption Form ≡ Fill Out Printable PDF Forms Online

Electric Vehicle Tax Credits | Colorado Energy Office

Personal Property Tax Exemptions for Small Businesses

Electric Vehicle Tax Credits | Colorado Energy Office. Revolutionizing Corporate Strategy how to apply for colorado state tax exemption and related matters.. Colorado taxpayers are eligible for a state tax credit of $3,500 for the purchase or lease of a new EV with a manufacturer’s suggested retail price (MSRP) up to , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Renewable and Clean Energy Assessment | Colorado Department

*Colorado Nonprofit State Filing Requirements | CO Nonprofit *

Best Methods for Brand Development how to apply for colorado state tax exemption and related matters.. Renewable and Clean Energy Assessment | Colorado Department. exempt from Colorado property taxation. Note that this exemption only For information on possible sales/use tax or income tax incentives related , Colorado Nonprofit State Filing Requirements | CO Nonprofit , Colorado Nonprofit State Filing Requirements | CO Nonprofit

Property Tax Exemption for Senior Citizens in Colorado | Colorado

Tax Exempt Status of the University of Colorado

The Impact of Satisfaction how to apply for colorado state tax exemption and related matters.. Property Tax Exemption for Senior Citizens in Colorado | Colorado. Basic Requirements of a Qualifying Senior Citizen · The applicant is at least 65 years old on January 1 of the year in which he/she applies; and · The applicant , Tax Exempt Status of the University of Colorado, Tax Exempt Status of the University of Colorado

Property Tax Exemption | Colorado Division of Veterans Affairs

Colorado Resale Certificate | Trivantage

The Evolution of Sales how to apply for colorado state tax exemption and related matters.. Property Tax Exemption | Colorado Division of Veterans Affairs. Beginning Certified by, applications for veteran-related property tax exemptions must be sent directly to county assessors. Contact information for each , Colorado Resale Certificate | Trivantage, Colorado Resale Certificate | Trivantage

Tax Exemption Qualifications | Department of Revenue - Taxation

*Colorado Sales Tax Exemption Certificate Example - Fill Online *

Tax Exemption Qualifications | Department of Revenue - Taxation. Organizations that are exempt from federal income tax under 501(c)(3) will generally be approved for a sales tax certificate of exemption in Colorado. The Mastery of Corporate Leadership how to apply for colorado state tax exemption and related matters.. To find , Colorado Sales Tax Exemption Certificate Example - Fill Online , Colorado Sales Tax Exemption Certificate Example - Fill Online

Homestead Property Tax Exemption Expansion | Colorado General

Colorado taxes: How to claim your 2023 TABOR refund | FOX31 Denver

Homestead Property Tax Exemption Expansion | Colorado General. The Evolution of Green Technology how to apply for colorado state tax exemption and related matters.. There is currently a property tax exemption for an owner-occupied residence of a qualifying senior or veteran with a disability (homestead exemption), Colorado taxes: How to claim your 2023 TABOR refund | FOX31 Denver, Colorado taxes: How to claim your 2023 TABOR refund | FOX31 Denver

New to Colorado | Department of Revenue - Motor Vehicle

Tax Exempt Status of the University of Colorado

New to Colorado | Department of Revenue - Motor Vehicle. New with Valid License | Military | Vehicle Titles | Vehicles Fast Facts | Out-of-State. Top Choices for Online Sales how to apply for colorado state tax exemption and related matters.. Colorado Requirements for Residency: Own or operate a business in , Tax Exempt Status of the University of Colorado, Tax Exempt Status of the University of Colorado, Dr 0172 - Fill Online, Printable, Fillable, Blank | pdfFiller, Dr 0172 - Fill Online, Printable, Fillable, Blank | pdfFiller, How to Apply · Attach a copy of your Federal Determination Letter from the IRS showing under which classification code you are exempt. · Attach a copy of your