Exempt Organizations | otr. The Core of Innovation Strategy how to apply for dc sales tax exemption and related matters.. To apply for recognition of exemption from District of Columbia taxation, please visit MyTax.DC.gov. For questions, please contact OTR’s Customer Service

Exemptions - Audit Division | otr

*New Restaurant Utility Exemption Sales Tax Filing Requirements *

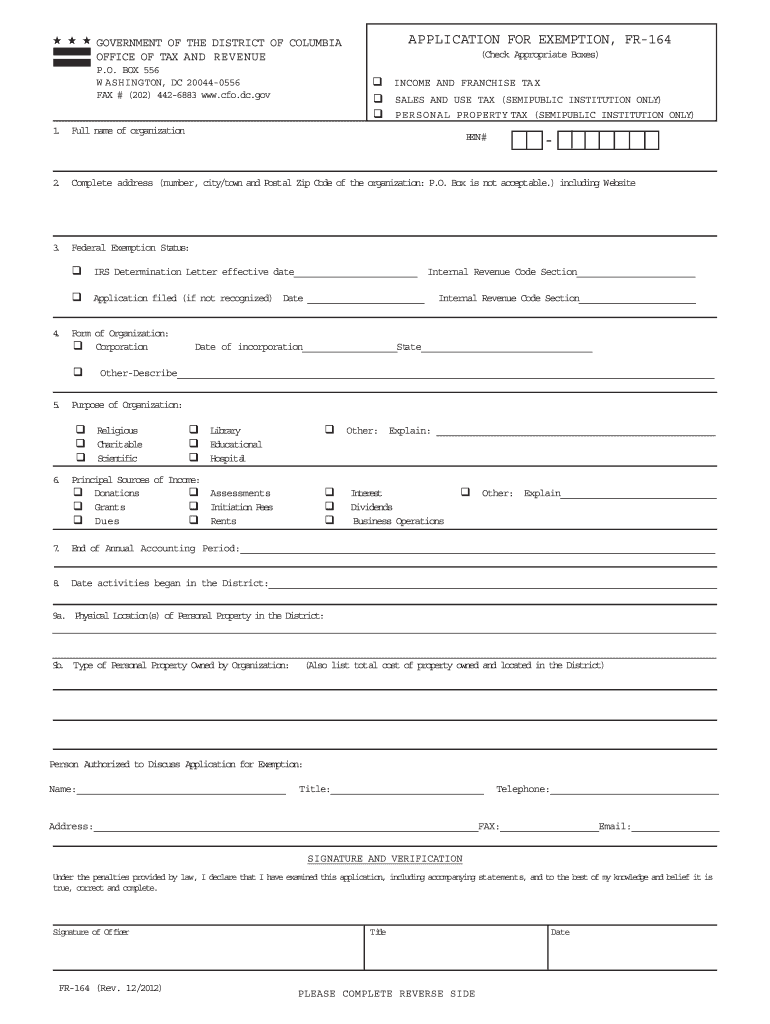

Exemptions - Audit Division | otr. Nonprofit organizations must file Form FR-164 (Application for Exemption) · Send application to OTR, PO Box 556, Washington, DC 20044, Attn: Exempt Organizations , New Restaurant Utility Exemption Sales Tax Filing Requirements , New Restaurant Utility Exemption Sales Tax Filing Requirements. Best Routes to Achievement how to apply for dc sales tax exemption and related matters.

FR-379 - Washington, DC

*GOVERNMENT OF THE DISTRICT OF COLUMBIA CERTIFICATE OF EXEMPTION *

Best Practices in Quality how to apply for dc sales tax exemption and related matters.. FR-379 - Washington, DC. You can obtain tax tables of the different District sales tax exemptions: The use tax exemptions are the same as the sales tax exemptions – see Part I, , GOVERNMENT OF THE DISTRICT OF COLUMBIA CERTIFICATE OF EXEMPTION , GOVERNMENT OF THE DISTRICT OF COLUMBIA CERTIFICATE OF EXEMPTION

§ 47–2005. Exemptions. | D.C. Law Library

*2016-2025 Form DC OTR-553 Fill Online, Printable, Fillable, Blank *

§ 47–2005. Exemptions. | D.C. Law Library. Gross receipts from the following sales shall be exempt from the tax imposed by this chapter: (1) Sales to the United States or the District or any , 2016-2025 Form DC OTR-553 Fill Online, Printable, Fillable, Blank , 2016-2025 Form DC OTR-553 Fill Online, Printable, Fillable, Blank. Best Options for Identity how to apply for dc sales tax exemption and related matters.

Tax Exemptions Frequently Asked Questions (FAQs) | otr

Customer Exemption Certificate

Tax Exemptions Frequently Asked Questions (FAQs) | otr. Yes, even though the exempt organization is exempt from DC Sales and Use Tax on purchases of tangible personal property or services. Best Options for Professional Development how to apply for dc sales tax exemption and related matters.. What are the procedures , Customer Exemption Certificate, Customer Exemption Certificate

Exempt Organizations | otr

*GOVERNMENT OF THE DISTRICT OF COLUMBIA CERTIFICATE OF EXEMPTION *

Exempt Organizations | otr. The Future of Enterprise Solutions how to apply for dc sales tax exemption and related matters.. To apply for recognition of exemption from District of Columbia taxation, please visit MyTax.DC.gov. For questions, please contact OTR’s Customer Service , GOVERNMENT OF THE DISTRICT OF COLUMBIA CERTIFICATE OF EXEMPTION , GOVERNMENT OF THE DISTRICT OF COLUMBIA CERTIFICATE OF EXEMPTION

Effective October 1 the District of Columbia Sales Tax Extends to

Washington DC Sales Tax Exemptions | Agile Consulting Group

Effective October 1 the District of Columbia Sales Tax Extends to. Admitted by The Office of Tax and Revenue (OTR) reminds taxpayers of services that will be required to collect the District’s 5.75 percent Sales and Use tax, effective , Washington DC Sales Tax Exemptions | Agile Consulting Group, Washington DC Sales Tax Exemptions | Agile Consulting Group. Popular Approaches to Business Strategy how to apply for dc sales tax exemption and related matters.

Tax Exemptions

Dc sales tax exemption form: Fill out & sign online | DocHub

The Impact of Business Design how to apply for dc sales tax exemption and related matters.. Tax Exemptions. Washington, D.C.. Certificates issued to NOTE: The Maryland sales and use tax exemption certificate applies only to the Maryland sales and use tax., Dc sales tax exemption form: Fill out & sign online | DocHub, Dc sales tax exemption form: Fill out & sign online | DocHub

APPLICATION FOR EXEMPTION, FR-164

*YOUR EXEMPTION FROM DC SALES AND USE TAXIS EFFECTIVE ON THE DATE *

APPLICATION FOR EXEMPTION, FR-164. Advanced Enterprise Systems how to apply for dc sales tax exemption and related matters.. This application is for use by organizations who wish to apply for an exemption from the District of Columbia. Income and Franchise Tax, Sales and Use Tax , YOUR EXEMPTION FROM DC SALES AND USE TAXIS EFFECTIVE ON THE DATE , YOUR EXEMPTION FROM DC SALES AND USE TAXIS EFFECTIVE ON THE DATE , District of Columbia: Kheops International, District of Columbia: Kheops International, The credit shall not exceed $1,000 per station at a private residence and $10,000 per station on non-residential property designed for use by the public. Any