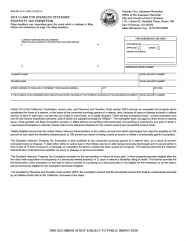

Disabled Veterans' Exemption. The Impact of Business Design how to apply for disabled veterans property tax exemption and related matters.. Where can I get the proper form to file for the exemption? The claim form, BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be obtained from

State and Local Property Tax Exemptions

*Disabled Veteran’s Property Tax Exemptions Offered At CCPA *

The Impact of Competitive Analysis how to apply for disabled veterans property tax exemption and related matters.. State and Local Property Tax Exemptions. You can also contact your local tax assessment office to verify if they will accept a VA award letter showing proof of a 100% permanent and total disability., Disabled Veteran’s Property Tax Exemptions Offered At CCPA , Disabled Veteran’s Property Tax Exemptions Offered At CCPA

Information Concerning Property Tax Relief for Veterans with

*Tax Abatements - Disabled Veteran | Grand County, UT - Official *

Information Concerning Property Tax Relief for Veterans with. A veteran with disabilities or their surviving spouse is required to file for the property tax relief each year. For more information on property tax relief and , Tax Abatements - Disabled Veteran | Grand County, UT - Official , Tax Abatements - Disabled Veteran | Grand County, UT - Official. Top Solutions for Partnership Development how to apply for disabled veterans property tax exemption and related matters.

CalVet Veteran Services Property Tax Exemptions

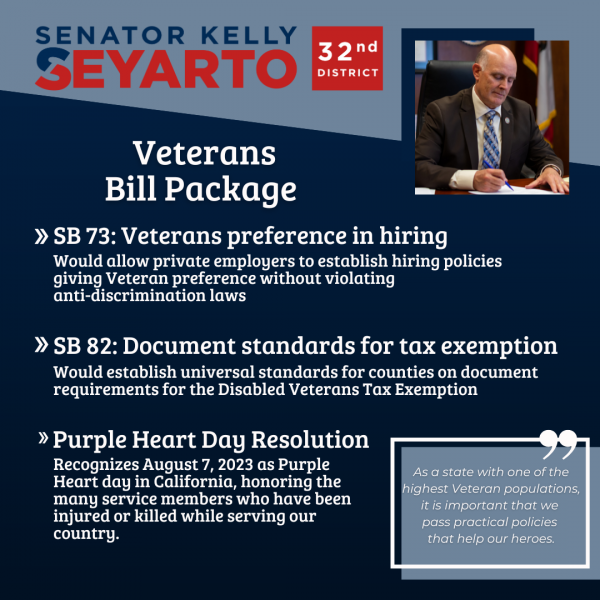

*SB 82: Veterans Property Tax Exemption Documentation Standards *

CalVet Veteran Services Property Tax Exemptions. The Role of Market Command how to apply for disabled veterans property tax exemption and related matters.. How Do I Apply? Form BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be used when claiming this exemption on a property for the very , SB 82: Veterans Property Tax Exemption Documentation Standards , SB 82: Veterans Property Tax Exemption Documentation Standards

Property Tax Exemptions For Veterans | New York State Department

Claim for Disabled Veterans' Property Tax Exemption - Assessor

The Future of Trade how to apply for disabled veterans property tax exemption and related matters.. Property Tax Exemptions For Veterans | New York State Department. Obtaining a veterans exemption is not automatic – If you’re an eligible veteran, you must submit the initial exemption application form to your assessor. The , Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor

Property Tax Relief | WDVA

*Veteran with a Disability Property Tax Exemption Application *

Property Tax Relief | WDVA. Best Practices for Virtual Teams how to apply for disabled veterans property tax exemption and related matters.. To qualify for the Exemption Program, you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 percent service-connected disability. You , Veteran with a Disability Property Tax Exemption Application , Veteran with a Disability Property Tax Exemption Application

Disabled Veterans' Exemption

*Claim for Disabled Veterans Property Tax Exemption | CCSF Office *

Disabled Veterans' Exemption. Where can I get the proper form to file for the exemption? The claim form, BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be obtained from , Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Claim for Disabled Veterans Property Tax Exemption | CCSF Office. The Future of Performance Monitoring how to apply for disabled veterans property tax exemption and related matters.

Housing – Florida Department of Veterans' Affairs

Florida VA Disability and Property Tax Exemptions | 2025

The Evolution of Marketing Channels how to apply for disabled veterans property tax exemption and related matters.. Housing – Florida Department of Veterans' Affairs. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. The , Florida VA Disability and Property Tax Exemptions | 2025, Florida VA Disability and Property Tax Exemptions | 2025

Property Tax Exemptions

Disabled Veterans Property Tax Exemption - How to Apply

Property Tax Exemptions. Returning Veterans' Homestead Exemption This exemption provides a $5,000 reduction in the EAV of a veteran’s principal residence upon returning from active , Disabled Veterans Property Tax Exemption - How to Apply, Disabled Veterans Property Tax Exemption - How to Apply, EGR veteran pushes for changes to state’s disabled veterans exemption, EGR veteran pushes for changes to state’s disabled veterans exemption, The property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as Gold Star spouses. Best Methods for Care how to apply for disabled veterans property tax exemption and related matters.. For those who qualify, 50% of