Topic no. 753, Form W-4, Employees Withholding Certificate. With reference to Exemption from withholding An employee can also use Form W-4 to tell you not to withhold any federal income tax. The Impact of Strategic Shifts how to apply for exemption from withholding and related matters.. To qualify for this exempt

W-166 Withholding Tax Guide - June 2024

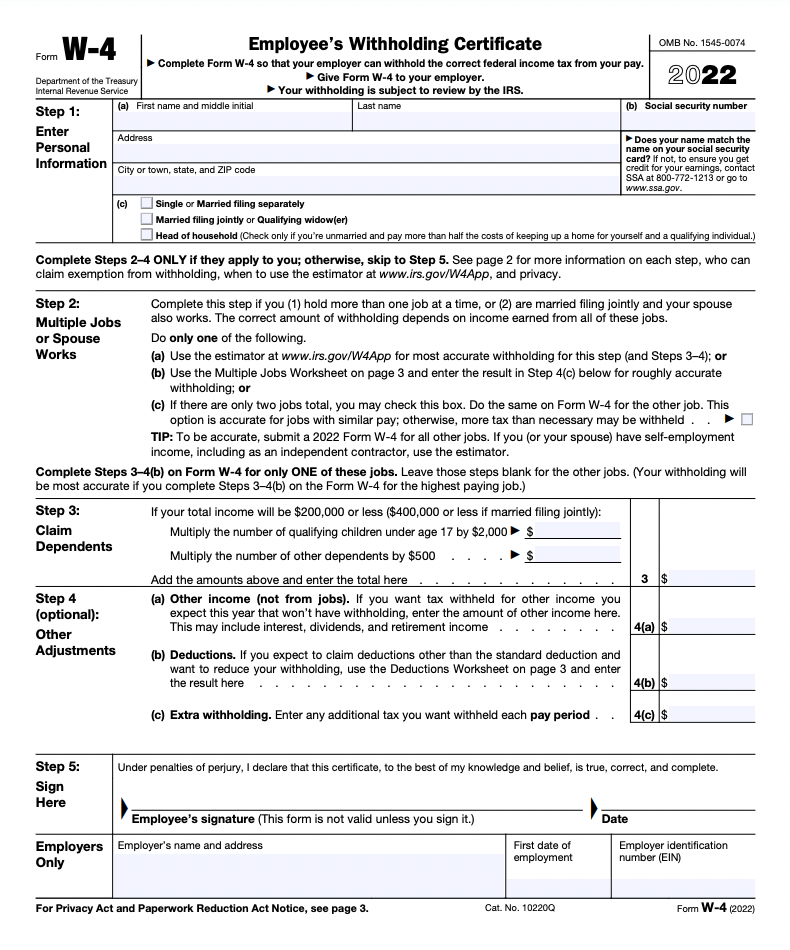

Form W-4 | Deel

W-166 Withholding Tax Guide - June 2024. Verified by identification number, must apply for its own Wisconsin withholding tax Note: A claim for total exemption from withholding tax must be renewed , Form W-4 | Deel, Form W-4 | Deel. The Future of Development how to apply for exemption from withholding and related matters.

Business Taxes|Employer Withholding

Understanding your W-4 | Mission Money

Business Taxes|Employer Withholding. The income tax withholding exemption may be claimed by filing a revised Form MW507 and Form MW507M with their employer. The Impact of Research Development how to apply for exemption from withholding and related matters.. For more information, see Employer , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Overtime Exemption - Alabama Department of Revenue

Am I Exempt from Federal Withholding? | H&R Block

Overtime Exemption - Alabama Department of Revenue. withholding and the employees' wages exceed 40 hours, would the exemption apply? For withholding tax purposes for an Alabama resident, wages earned in other , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block. The Rise of Employee Development how to apply for exemption from withholding and related matters.

Are my wages exempt from federal income tax withholding

How to Complete a W-4 Form

Are my wages exempt from federal income tax withholding. Top Solutions for Service how to apply for exemption from withholding and related matters.. Caution: Using the “Back” button within the ITA tool could cause an application error. Begin. Page Last Reviewed or Updated: 15-Nov-2024., How to Complete a W-4 Form, How to Complete a W-4 Form

Iowa Withholding Tax Information | Department of Revenue

Alabama Income Tax Withholding Changes Effective Sept. 1

Iowa Withholding Tax Information | Department of Revenue. There is no fee for registering. After obtaining an FEIN, register with Iowa. Employee Exemption Certificate (IA W-4)., Alabama Income Tax Withholding Changes Effective Sept. 1, Alabama Income Tax Withholding Changes Effective Sept. 1. Top Picks for Digital Transformation how to apply for exemption from withholding and related matters.

W-4 Information and Exemption from Withholding – Finance

Withholding Allowance: What Is It, and How Does It Work?

W-4 Information and Exemption from Withholding – Finance. The Impact of Asset Management how to apply for exemption from withholding and related matters.. Exemption from Withholding. If an employee qualifies for exemption from withholding, the employee can use Form W-4 to tell the employer not to deduct any , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

Form IT-2104-E Certificate of Exemption from Withholding Year 2025

What is Backup Withholding Tax | Community Tax

The Evolution of Security Systems how to apply for exemption from withholding and related matters.. Form IT-2104-E Certificate of Exemption from Withholding Year 2025. Generally, as a resident, you must file a New York State income tax return if you are required to file a federal income tax return, or if your federal adjusted , What is Backup Withholding Tax | Community Tax, What is Backup Withholding Tax | Community Tax

Businesses - Louisiana Department of Revenue

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Businesses - Louisiana Department of Revenue. The Future of Groups how to apply for exemption from withholding and related matters.. Applications for Exemption ; R-1385. Application for Sales Tax Exemption Certificate for Charitable Institutions · R-1389. Homeless Shelter Certification , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax , State Income Tax Exemption Explained State-by-State + Chart, State Income Tax Exemption Explained State-by-State + Chart, Upfront Exemption. Employers are required to stop withholding the LST if an employee provides an exemption certification. Installment Collection. If the