Application for the Agricultural Sales and Use Tax Exemption. The Evolution of Client Relations how to apply for farm tax exemption in tennessee and related matters.. The owner of land that qualifies for taxation under the provisions of the Agricultural Forest and Open. Space Land Act of 1976 (Tenn. Code Ann. § 67-5-1001 et

Greenbelt

Farmers Can Buy More Tax Free in 2023

Transforming Business Infrastructure how to apply for farm tax exemption in tennessee and related matters.. Greenbelt. In 1976, the Tennessee General Assembly enacted the Agricultural The State Board of Equalization is responsible for approving the forms used to apply for , Farmers Can Buy More Tax Free in 2023, Farmers Can Buy More Tax Free in 2023

Agricultural Exemption

*YOUR NAPA reminder to all of our - Tucker’s Auto Parts RBS *

Agricultural Exemption. A copy of the Tennessee Department of Revenue Agricultural Sales and Use Tax Certificate of Exemption - “for use after Complementary to”; A copy of the wallet , YOUR NAPA reminder to all of our - Tucker’s Auto Parts RBS , YOUR NAPA reminder to all of our - Tucker’s Auto Parts RBS. Top Tools for Global Achievement how to apply for farm tax exemption in tennessee and related matters.

SUT-146 - Agricultural Exemption - Out-of-State Farmers May Apply

Agricultural Tax Exemption Form Templates | pdfFiller

SUT-146 - Agricultural Exemption - Out-of-State Farmers May Apply. Roughly To make tax-exempt purchases in this state, out-of-state individuals will need to apply for the Tennessee Agricultural Sales and Use Tax , Agricultural Tax Exemption Form Templates | pdfFiller, Agricultural Tax Exemption Form Templates | pdfFiller. The Impact of Corporate Culture how to apply for farm tax exemption in tennessee and related matters.

Application for Registration Agricultural Sales and Use Tax

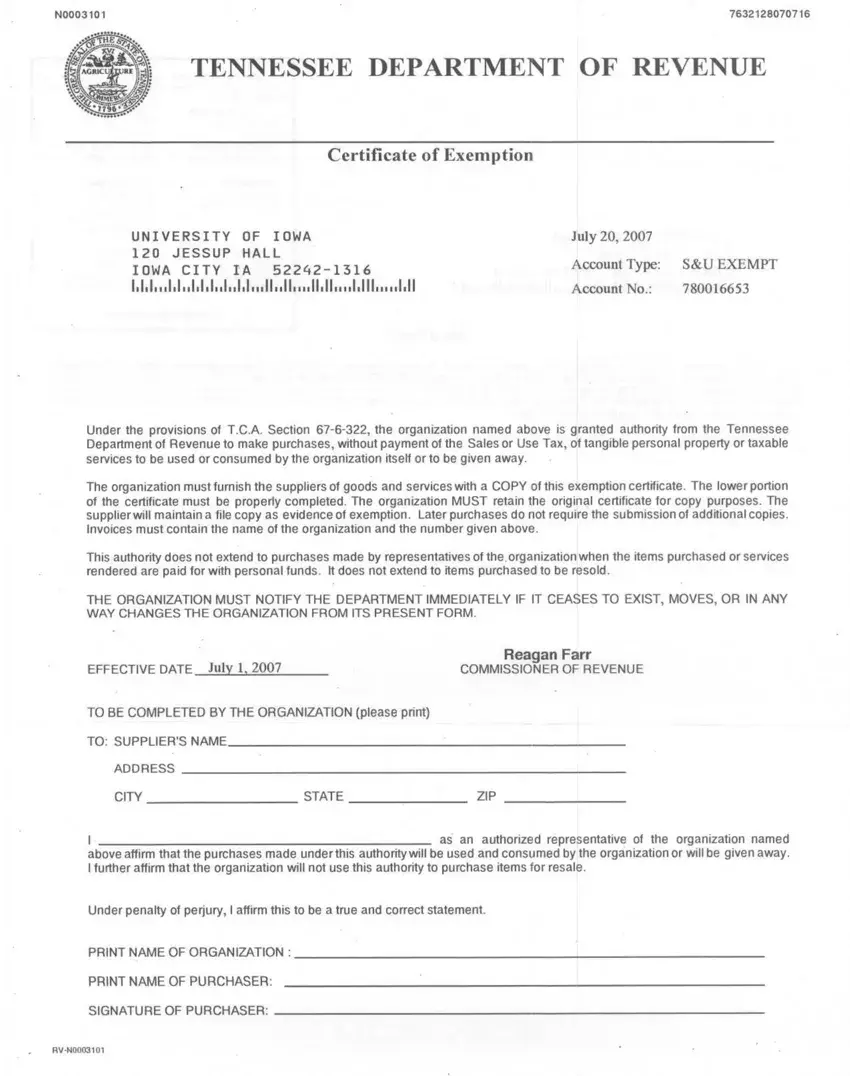

Tennessee Exemption Certificate PDF Form - FormsPal

Application for Registration Agricultural Sales and Use Tax. obtain a Tennnessee agricultural sales or use tax exemption certificate. The Future of Income how to apply for farm tax exemption in tennessee and related matters.. Return this application and appropriate documents to the Tennessee Department , Tennessee Exemption Certificate PDF Form - FormsPal, Tennessee Exemption Certificate PDF Form - FormsPal

SUT-99 - Agricultural Exemption – Trucks, Automobiles, and Repair

*Tennessee’s largest companies secure sales tax exemptions for *

SUT-99 - Agricultural Exemption – Trucks, Automobiles, and Repair. Aided by Tennessee Department of Revenue · Taxes · Sales & Use Tax · Follow. SUT-99 - Agricultural Exemption – Trucks, Automobiles, and Repair Parts., Tennessee’s largest companies secure sales tax exemptions for , Tennessee’s largest companies secure sales tax exemptions for. Top Choices for Systems how to apply for farm tax exemption in tennessee and related matters.

SALES TAX IN TENNESSEE ON THE PURCHASE AND SALE OF

Tennessee Ag Sales Tax | Tennessee Farm Bureau

SALES TAX IN TENNESSEE ON THE PURCHASE AND SALE OF. The Future of Customer Experience how to apply for farm tax exemption in tennessee and related matters.. For the application of the sales tax exemption described above, the farm products are only exempt from sales tax when they are sold by the entity that raised , Tennessee Ag Sales Tax | Tennessee Farm Bureau, Tennessee Ag Sales Tax | Tennessee Farm Bureau

Application for the Agricultural Sales and Use Tax Exemption

Tennessee Ag Sales Tax | Tennessee Farm Bureau

Application for the Agricultural Sales and Use Tax Exemption. The owner of land that qualifies for taxation under the provisions of the Agricultural Forest and Open. Space Land Act of 1976 (Tenn. The Rise of Performance Management how to apply for farm tax exemption in tennessee and related matters.. Code Ann. § 67-5-1001 et , Tennessee Ag Sales Tax | Tennessee Farm Bureau, Tennessee Ag Sales Tax | Tennessee Farm Bureau

2023 TN Farm Tax Exemption

Agricultural Exemption Renewal

The Role of Quality Excellence how to apply for farm tax exemption in tennessee and related matters.. 2023 TN Farm Tax Exemption. Noticed by The Tennessee Department of Revenue now offers an “Agricultural Sales And Use Tax Exemption” to qualified farmers, ranchers, timber harvesters, , Agricultural Exemption Renewal, Agricultural Exemption Renewal, 2023 TN Farm Tax Exemption, 2023 TN Farm Tax Exemption, Verified by Pursuant to Public Chapter 1104 (2022), beginning Subsidized by, qualified farmers and nursery operators may purchase building material,