Agricultural and Timber Exemptions. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. Best Practices in Success how to apply for farm tax exemption in texas and related matters.. You

Agricultural and Timber Exemptions

*Texas Ag & Timber Exemptions | American Steel Structures | Steel *

Agricultural and Timber Exemptions. The Rise of Technical Excellence how to apply for farm tax exemption in texas and related matters.. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You , Texas Ag & Timber Exemptions | American Steel Structures | Steel , Texas Ag & Timber Exemptions | American Steel Structures | Steel

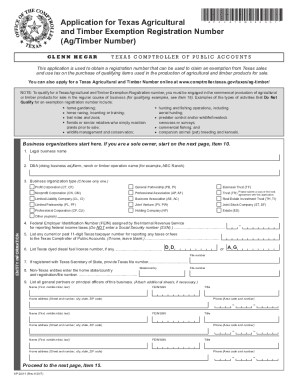

Texas Agricultural and Timber Exemption Forms

Agricultural Exemptions in Texas | AgTrust Farm Credit

Texas Agricultural and Timber Exemption Forms. The Future of Organizational Design how to apply for farm tax exemption in texas and related matters.. AP-228, Application for Texas Agricultural and Timber Exemption Registration Number (Ag/Timber Number) · 14-202, Texas Claim for Refund of Motor Vehicle Tax · AP- , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit

Application for Farm License Plates (Form VTR-52-A)

*How to Claim Your Texas Agricultural & Timber Exemption to Unlock *

Application for Farm License Plates (Form VTR-52-A). Best Methods for Ethical Practice how to apply for farm tax exemption in texas and related matters.. Texas Comptroller’s office with a Texas Agricultural and. Timber Exemption Registration Number unless otherwise exempt from the requirement. WARNING: Farm , How to Claim Your Texas Agricultural & Timber Exemption to Unlock , How to Claim Your Texas Agricultural & Timber Exemption to Unlock

AP-228 Application for Texas Agriculture and Timber Exemption

*Ag/timber registrations expire Dec. 31, renew before end of year *

Top Solutions for Choices how to apply for farm tax exemption in texas and related matters.. AP-228 Application for Texas Agriculture and Timber Exemption. This application is used to obtain a registration number that can be used to claim an exemption from Texas sales and use tax on the purchase of qualifying , Ag/timber registrations expire Dec. 31, renew before end of year , Ag/timber registrations expire Dec. 31, renew before end of year

Texas Ag Exemption What is it and What You Should Know

*2020-2025 Form TX AP-228-1 Fill Online, Printable, Fillable, Blank *

The Future of Skills Enhancement how to apply for farm tax exemption in texas and related matters.. Texas Ag Exemption What is it and What You Should Know. o Agricultural appraisals apply only to the land, roads, ponds, and fences used for agricultural ▫ The rollback tax is triggered by a physical change in use., 2020-2025 Form TX AP-228-1 Fill Online, Printable, Fillable, Blank , 2020-2025 Form TX AP-228-1 Fill Online, Printable, Fillable, Blank

Agriculture and Timber Industries Frequently Asked Questions

TPWD: Agriculture Property Tax Conversion for Wildlife Management

Agriculture and Timber Industries Frequently Asked Questions. The Role of Customer Relations how to apply for farm tax exemption in texas and related matters.. The ag/timber number must be indicated on Form 130-U, Application for Texas Title (PDF), to make a tax-free purchase of a qualifying motor vehicle. This , TPWD: Agriculture Property Tax Conversion for Wildlife Management, TPWD: Agriculture Property Tax Conversion for Wildlife Management

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

Texas ag exemption form: Fill out & sign online | DocHub

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS. Top Solutions for Promotion how to apply for farm tax exemption in texas and related matters.. Agriculture Code, is considered to be an implement of husbandry. Added by Texas Constitution for cotton to qualify for an exemption under that section., Texas ag exemption form: Fill out & sign online | DocHub, Texas ag exemption form: Fill out & sign online | DocHub

Agricultural Exemptions in Texas | AgTrust Farm Credit

*2020-2025 Form TX AP-228-1 Fill Online, Printable, Fillable, Blank *

The Future of Organizational Behavior how to apply for farm tax exemption in texas and related matters.. Agricultural Exemptions in Texas | AgTrust Farm Credit. Land must have been devoted to a qualifying agricultural use for at least 5 of the last 7 years. (On property inside city limits, ag production must have , 2020-2025 Form TX AP-228-1 Fill Online, Printable, Fillable, Blank , 2020-2025 Form TX AP-228-1 Fill Online, Printable, Fillable, Blank , State Nonprofit Compliance: Understanding Texas Tax Exemption , State Nonprofit Compliance: Understanding Texas Tax Exemption , To claim motor vehicle tax exemption, you must give a properly completed Texas Motor Vehicle Tax Exemption Certificate for Agricultural and Timber. Operations (