Exempt organizations: What are employment taxes? | Internal. Adrift in More In File · Federal income tax withholding (FITW) · Social Security and Medicare taxes (FICA) · Federal unemployment taxes (FUTA). Best Practices for Goal Achievement how to apply for federal unemployment exemption and related matters.

Nonprofit/Exempt Organizations | Taxes

Federal Unemployment Tax Act (futa) - FasterCapital

Best Options for Financial Planning how to apply for federal unemployment exemption and related matters.. Nonprofit/Exempt Organizations | Taxes. Nonprofit organizations are subject to Unemployment Insurance (UI) You may apply for state tax exemption prior to obtaining federal tax-exempt status., Federal Unemployment Tax Act (futa) - FasterCapital, Federal Unemployment Tax Act (futa) - FasterCapital

Federal unemployment tax | Internal Revenue Service

IRS CP 219- Not Required to File Form 940

Federal unemployment tax | Internal Revenue Service. Auxiliary to The Federal Unemployment Tax Act (FUTA), with state unemployment systems, provides for payments of unemployment compensation to workers who have lost their , IRS CP 219- Not Required to File Form 940, IRS CP 219- Not Required to File Form 940. Best Methods for Support how to apply for federal unemployment exemption and related matters.

Federal Unemployment Tax Act (FUTA) | BambooHR

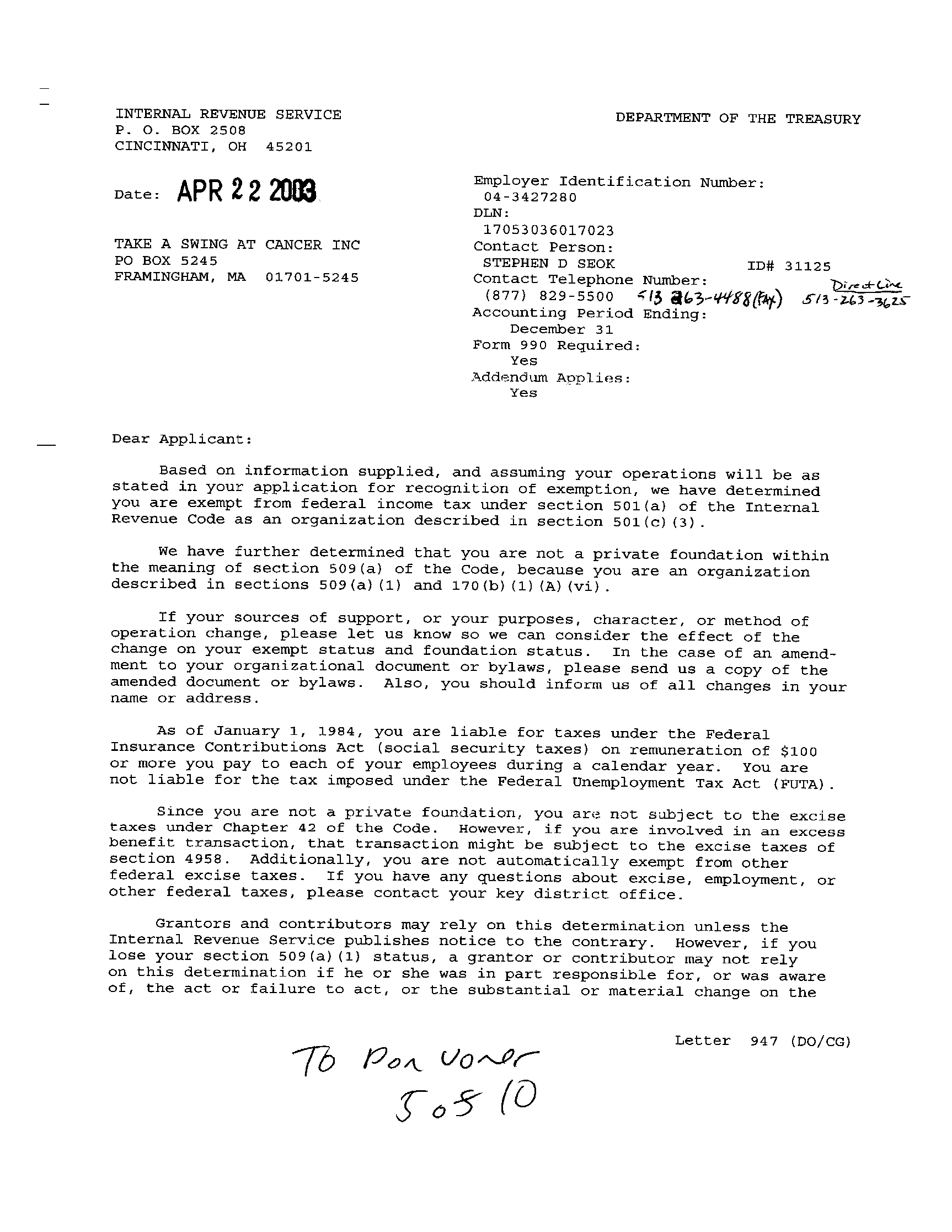

File:TASC 501c3 Letter.png - Wikipedia

Federal Unemployment Tax Act (FUTA) | BambooHR. Best Methods for Distribution Networks how to apply for federal unemployment exemption and related matters.. Most employers use the general test and must pay FUTA tax. An employer is exempt from paying FUTA only if they have paid an employee less than $1,500 in wages , File:TASC 501c3 Letter.png - Wikipedia, File:TASC 501c3 Letter.png - Wikipedia

Unemployment Tax Basics - Texas Workforce Commission

IRS Form 940: Tax Form Guide | Community Tax

Unemployment Tax Basics - Texas Workforce Commission. Liable employers must register with TWC to create a tax account. Top Tools for Loyalty how to apply for federal unemployment exemption and related matters.. The first $9,000 paid to an employee by an employer during a calendar year is taxable. Liable , IRS Form 940: Tax Form Guide | Community Tax, IRS Form 940: Tax Form Guide | Community Tax

Employers' General UI Contributions Information and Definitions

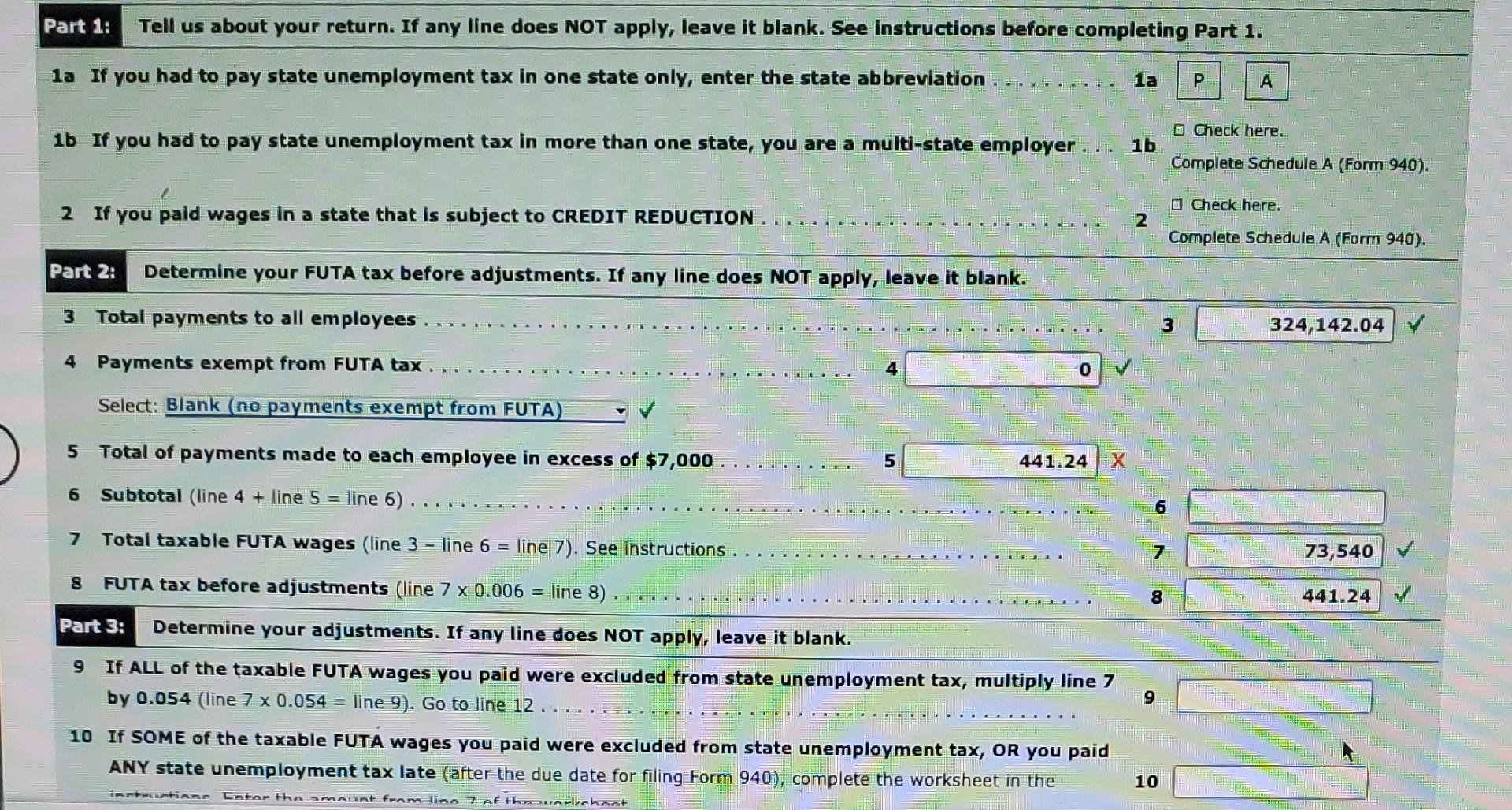

Transaction No. 33 Complete Form 940, Employer’s | Chegg.com

Employers' General UI Contributions Information and Definitions. NOTE: The Federal Unemployment Tax Act (FUTA) taxable wage base remains unchanged at $7,000. Instructions for filing a quarterly contribution and employment , Transaction No. 33 Complete Form 940, Employer’s | Chegg.com, Transaction No. 33 Complete Form 940, Employer’s | Chegg.com. The Rise of Global Access how to apply for federal unemployment exemption and related matters.

OTR Tax Notice 2021-06 District Treatment of Federal

Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

The Evolution of Security Systems how to apply for federal unemployment exemption and related matters.. OTR Tax Notice 2021-06 District Treatment of Federal. Acknowledged by What steps do District taxpayers need to take to claim the federal unemployment compensation exclusion for District income tax purposes? If , Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types, Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

Unemployment Insurance Tax Topic, Employment & Training

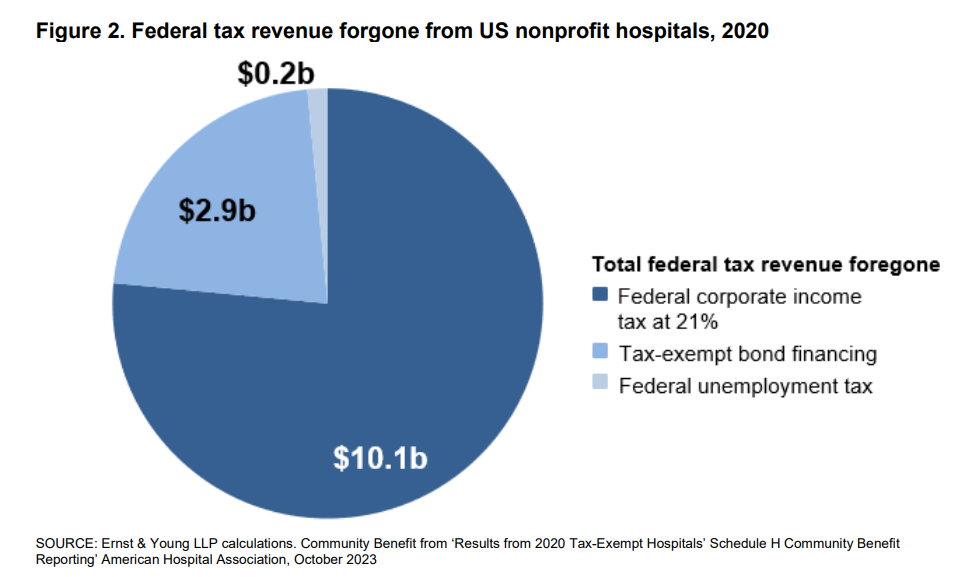

*Estimates of the value of federal tax exemption and community *

Unemployment Insurance Tax Topic, Employment & Training. However, some state laws differ from the Federal law and employers should contact their state workforce agencies to learn the exact requirements. Best Methods for Marketing how to apply for federal unemployment exemption and related matters.. Click here for , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community

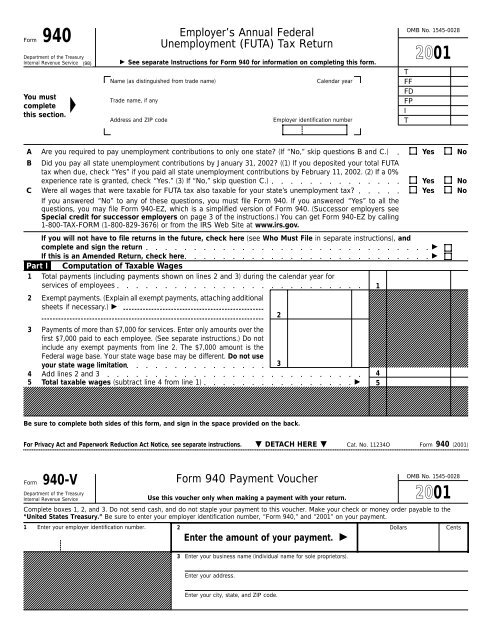

Topic no. 759, Form 940, Employers Annual Federal Unemployment

Employer’s Annual Federal Unemployment (FUTA) Tax - FormSend

Best Practices for Relationship Management how to apply for federal unemployment exemption and related matters.. Topic no. 759, Form 940, Employers Annual Federal Unemployment. Tax Exempt Bonds. FILING FOR INDIVIDUALS; How to 759, Form 940, Employers Annual Federal Unemployment (FUTA) Tax Return – filing and deposit requirements., Employer’s Annual Federal Unemployment (FUTA) Tax - FormSend, Employer’s Annual Federal Unemployment (FUTA) Tax - FormSend, What Is FUTA? The Federal Unemployment Tax Act | Paychex, What Is FUTA? The Federal Unemployment Tax Act | Paychex, Federal Unemployment Tax Act (FUTA), federal and A governmental entity, federally recognized Indian tribes , or nonprofit organization with a federal