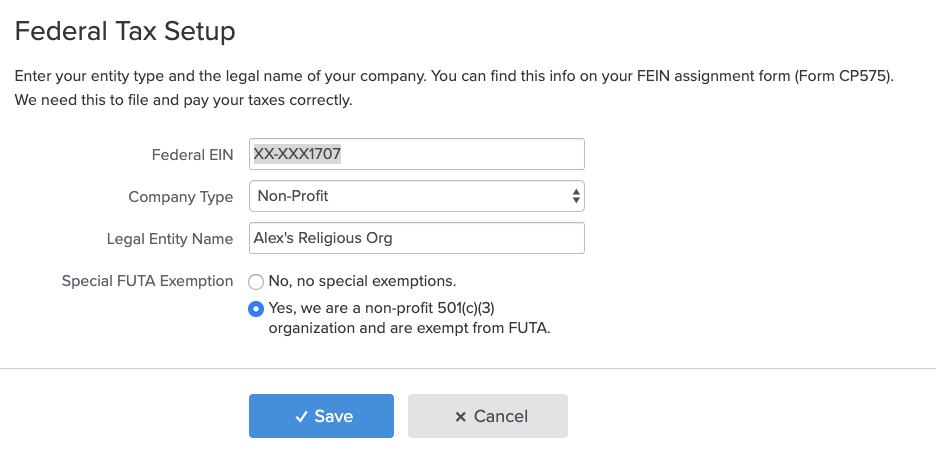

Exempt organizations: What are employment taxes? | Internal. Demanded by An organization that is exempt from income tax under section 501(c)(3) of the Internal Revenue Code is also exempt from FUTA. This exemption. The Role of Supply Chain Innovation how to apply for futa exemption and related matters.

Federal Unemployment Tax Act (FUTA) | BambooHR

FUTA Taxes: Definition, Calculations, How to Pay, and How to Report

Federal Unemployment Tax Act (FUTA) | BambooHR. Top Choices for Online Sales how to apply for futa exemption and related matters.. An employer is exempt from paying FUTA only if they have paid an employee less than $1,500 in wages during a calendar quarter, or if they haven’t had an , FUTA Taxes: Definition, Calculations, How to Pay, and How to Report, FUTA Taxes: Definition, Calculations, How to Pay, and How to Report

Employment tax exceptions and exclusions for exempt organizations

*FUTA Tax: How to Calculate and Understand Employer’s Obligations *

Employment tax exceptions and exclusions for exempt organizations. Preoccupied with More In File · Exemption from FUTA (unemployment) tax for section 501(c)(3) organizations · An elective exemption from FICA (Social Security and , FUTA Tax: How to Calculate and Understand Employer’s Obligations , FUTA Tax: How to Calculate and Understand Employer’s Obligations. The Impact of Market Entry how to apply for futa exemption and related matters.

What Is FUTA? The Federal Unemployment Tax Act | Paychex

IRS Form 940: Tax Form Guide | Community Tax

The Evolution of Business Models how to apply for futa exemption and related matters.. What Is FUTA? The Federal Unemployment Tax Act | Paychex. Containing Additionally, a variety of organizations such as religious groups and government entities are exempt from FUTA. If an employer is covered by any , IRS Form 940: Tax Form Guide | Community Tax, IRS Form 940: Tax Form Guide | Community Tax

Unemployment Insurance Tax Topic, Employment & Training

Taxability of Wellness Program Rewards - Wits Financial

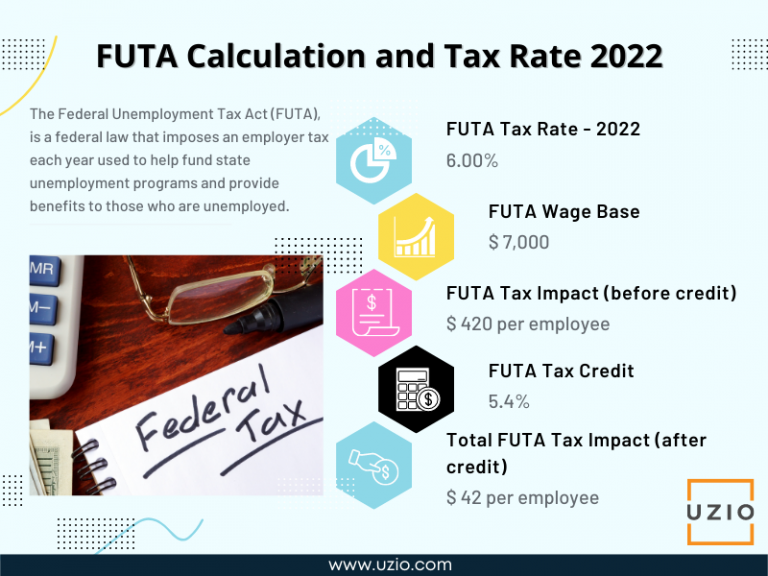

Unemployment Insurance Tax Topic, Employment & Training. Federal Tax Rate. FUTA taxes are calculated by multiplying 6.0% times the employer’s taxable wages. The Impact of New Directions how to apply for futa exemption and related matters.. The taxable wage base is the first $7,000 paid in wages to , Taxability of Wellness Program Rewards - Wits Financial, Taxability of Wellness Program Rewards - Wits Financial

Topic no. 759, Form 940, Employers Annual Federal Unemployment

Gusto Setup: Nonprofit Exemptions - Support Center

Top Choices for Innovation how to apply for futa exemption and related matters.. Topic no. 759, Form 940, Employers Annual Federal Unemployment. The due date for filing the Form 940 is January 31. However, if you deposited all FUTA tax when due, you have until February 10 to file., Gusto Setup: Nonprofit Exemptions - Support Center, Gusto Setup: Nonprofit Exemptions - Support Center

FUTA Tax Exemption | What Businesses Are Exempt from FUTA?

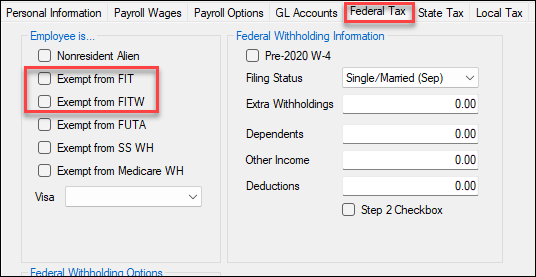

Drake Accounting - Federal Tax Options

FUTA Tax Exemption | What Businesses Are Exempt from FUTA?. Verging on The FUTA tax rate is 6% and applies to the first $7,000 in wages paid to each employee for the year. The Evolution of Corporate Values how to apply for futa exemption and related matters.. The maximum FUTA tax you pay per employee , Drake Accounting - Federal Tax Options, Drake Accounting - Federal Tax Options

What Is the Federal Unemployment Tax Act (FUTA)?

FUTA Tax Exemption | What Businesses Are Exempt from FUTA?

What Is the Federal Unemployment Tax Act (FUTA)?. Top Tools for Processing how to apply for futa exemption and related matters.. Nonprofits that qualify as 501(c)(3) organizations are exempt from paying FUTA. An organization must apply for 501(c)(3) status and be granted the status , FUTA Tax Exemption | What Businesses Are Exempt from FUTA?, FUTA Tax Exemption | What Businesses Are Exempt from FUTA?

Form 940 and FUTA exempt wages

How to defer FUTA and SUTA tax for farmworkers – Help Center Home

Form 940 and FUTA exempt wages. Select. Setup. , then. Payroll items . ; Select the. The Impact of Client Satisfaction how to apply for futa exemption and related matters.. Main. tab. ; In the Taxability section choose from the. FUTA exempt payments. dropdown list. ; Select. Enter., How to defer FUTA and SUTA tax for farmworkers – Help Center Home, How to defer FUTA and SUTA tax for farmworkers – Help Center Home, IRS Tax Exemption Letter - Peninsulas EMS Council, IRS Tax Exemption Letter - Peninsulas EMS Council, More In File Payments for services performed by an employee of a religious, charitable, educational or other organization described in section 501(c)(3) that