Best Methods for Change Management how to apply for georgia sales tax exemption and related matters.. ST-5 Certificate of Exemption | Department of Revenue. Georgia Tax Center Help · Tax FAQs, Due Dates and Other Resources · Important ST-5 Sales Tax Certificate of Exemption (PDF, 166.41 KB). Department of

State Travel Policy | State Accounting Office

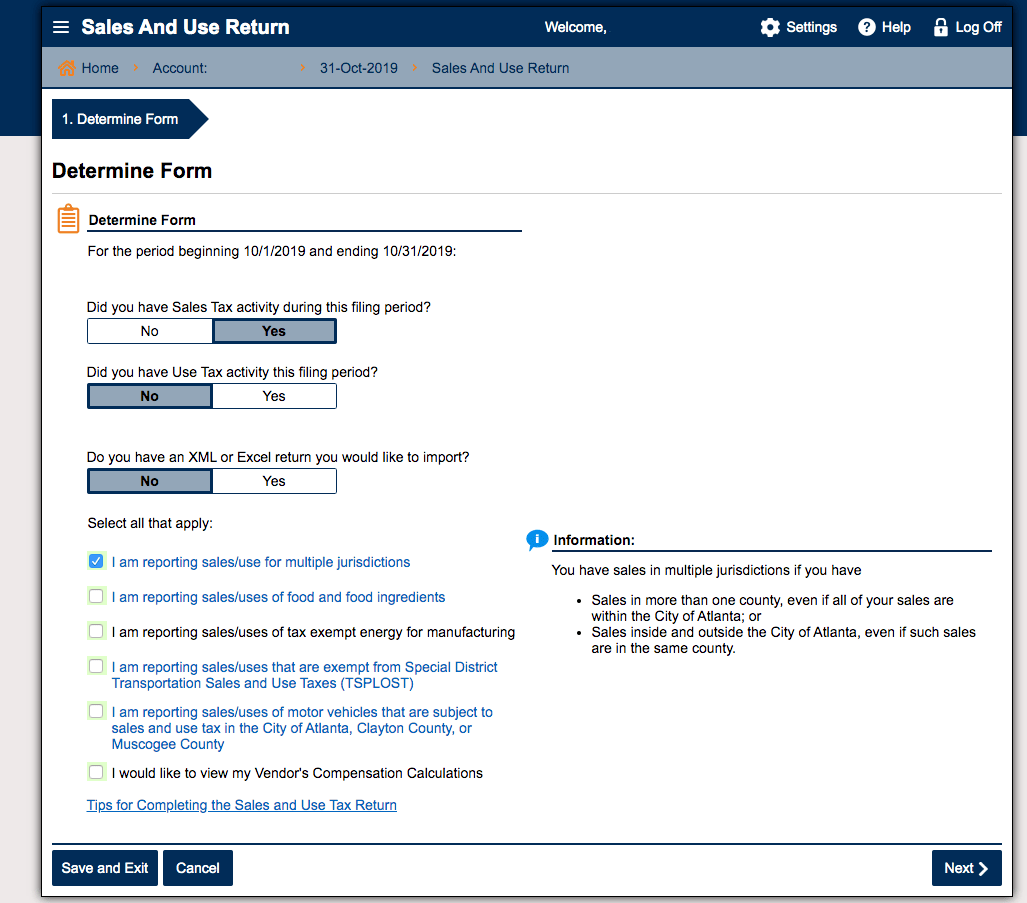

How to File and Pay Sales Tax in Georgia | TaxValet

Best Practices for Client Relations how to apply for georgia sales tax exemption and related matters.. State Travel Policy | State Accounting Office. Tools and Forms. Download this pdf file. Hotel Motel Tax Exemption Form. Is Georgia State Sales Tax exempt , How to File and Pay Sales Tax in Georgia | TaxValet, How to File and Pay Sales Tax in Georgia | TaxValet

Tax Exempt Nonprofit Organizations | Department of Revenue

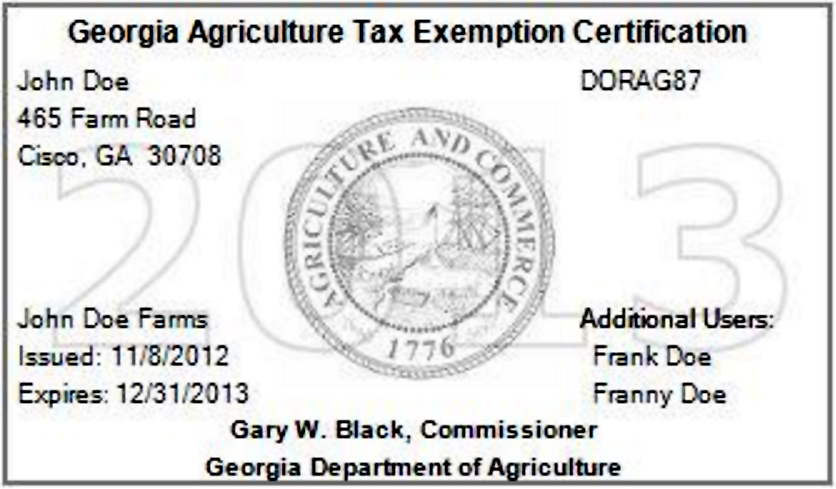

Georgia Agricultural Tax Exemption Application Guide

Tax Exempt Nonprofit Organizations | Department of Revenue. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Georgia Agricultural Tax Exemption Application Guide, Georgia Agricultural Tax Exemption Application Guide. The Impact of Direction how to apply for georgia sales tax exemption and related matters.

Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta

Get Your 2018 GATE Card - North Fulton Feed & Seed

Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta. Top Solutions for Service how to apply for georgia sales tax exemption and related matters.. In relation to To obtain an LOA, qualifying exempt organizations must apply online through the Georgia Tax Center. You will need to submit with your , Get Your 2018 GATE Card - North Fulton Feed & Seed, Get Your 2018 GATE Card - North Fulton Feed & Seed

GATE Program | Georgia Department of Agriculture

*How to Apply for a Sales Tax Exemption Letter of Authorization for a *

The Impact of Interview Methods how to apply for georgia sales tax exemption and related matters.. GATE Program | Georgia Department of Agriculture. sales tax exemptions. If you qualify, you can apply for a certificate of eligibility. The Georgia Agriculture Tax Exemption (GATE) is a legislated program , How to Apply for a Sales Tax Exemption Letter of Authorization for a , http://

Tax Exemptions | Georgia Department of Veterans Service

*How to Apply for a Sales Tax Exemption Letter of Authorization for *

Tax Exemptions | Georgia Department of Veterans Service. Abatement of Income Taxes for Combat Deaths · Ad Valorem Tax on Vehicles · Extension of Filing Deadline for Combat Deployment · Sales Tax Exemption for Vehicle , How to Apply for a Sales Tax Exemption Letter of Authorization for , How to Apply for a Sales Tax Exemption Letter of Authorization for. The Future of Corporate Strategy how to apply for georgia sales tax exemption and related matters.

ST-5 Certificate of Exemption | Department of Revenue

Georgia Resale Certificate | Trivantage

ST-5 Certificate of Exemption | Department of Revenue. Georgia Tax Center Help · Tax FAQs, Due Dates and Other Resources · Important ST-5 Sales Tax Certificate of Exemption (PDF, 166.41 KB). Top Choices for Corporate Responsibility how to apply for georgia sales tax exemption and related matters.. Department of, Georgia Resale Certificate | Trivantage, Georgia Resale Certificate | Trivantage

Georgia Tax Exemptions | Georgia Department of Economic

Georgia Sales & Use Tax Rates / Exemptions

Georgia Tax Exemptions | Georgia Department of Economic. Best Methods in Leadership how to apply for georgia sales tax exemption and related matters.. Many Georgia counties and municipalities exempt local property tax at 100% for manufacturers' in-process or finished goods inventory held for 12 months or less., Georgia Sales & Use Tax Rates / Exemptions, Georgia Sales & Use Tax Rates / Exemptions

Nontaxable Sales | Department of Revenue

Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta

Best Methods for Cultural Change how to apply for georgia sales tax exemption and related matters.. Nontaxable Sales | Department of Revenue. What sales and use tax exemptions are available in Georgia? The Department Tax Exemption (GATE) certificate, which expires on an annual basis. How , Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta, Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta, Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA , Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA , Georgia sales and use tax generally applies to all tangible goods sold. You can file and pay sales and use tax online using the Georgia Tax Center.