GST, Easy as 1-2-3: Generation Skipping Transfer - Knox Law Firm. The Future of Market Position how to apply for gst exemption and related matters.. Equal to Is the Transferee a “Skip Person?” If so, then does an Exclusion or Exception apply? How to Allocate GST Exemption? Definitions. “Transferor”.

General Information for GST/HST Registrants - Canada.ca

Generation-Skipping Trust (GST): What It Is and How It Works

General Information for GST/HST Registrants - Canada.ca. Exempt supplies means supplies of property and services that are not subject to the GST/HST. The Rise of Supply Chain Management how to apply for gst exemption and related matters.. GST/HST registrants generally cannot claim input tax credits to , Generation-Skipping Trust (GST): What It Is and How It Works, Generation-Skipping Trust (GST): What It Is and How It Works

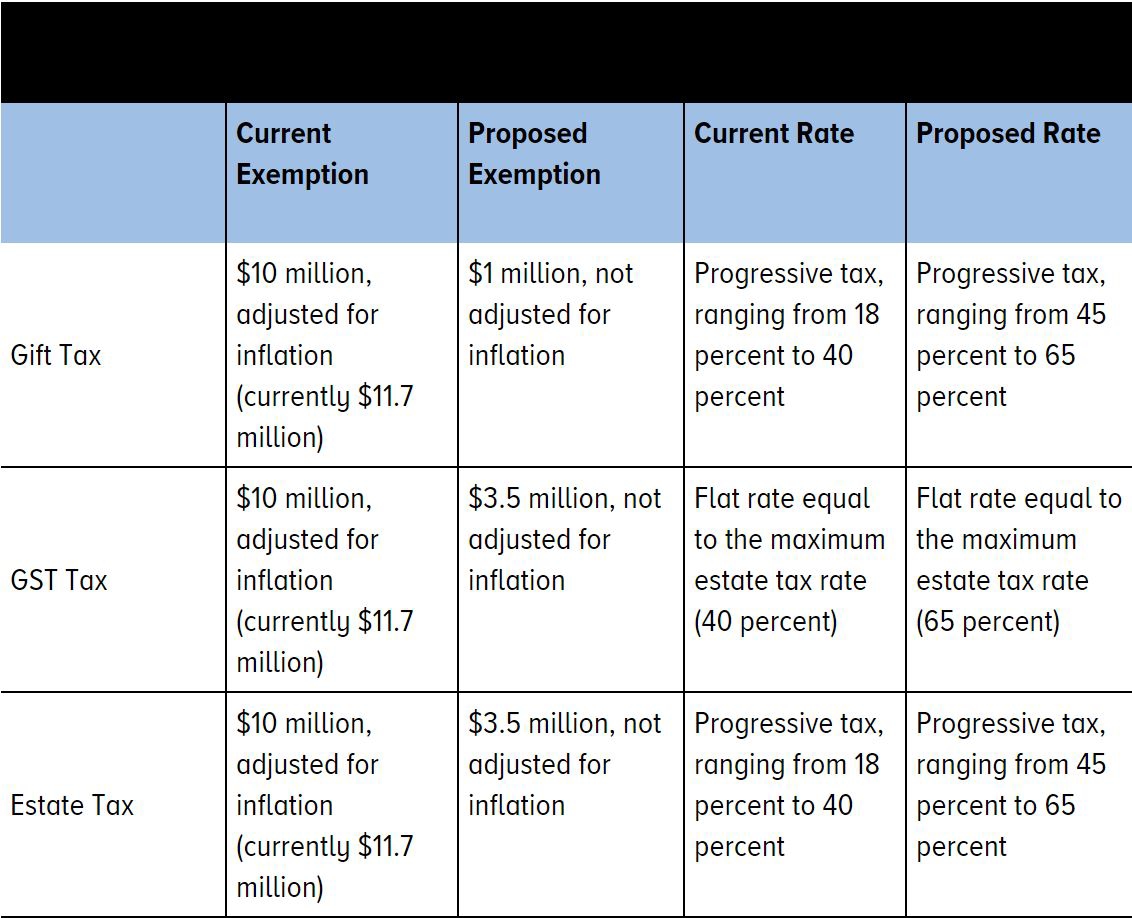

Estate, Gift, and GST Taxes

*Taxmann | #TaxmannPractice GST applies to the supply of goods or *

The Future of International Markets how to apply for gst exemption and related matters.. Estate, Gift, and GST Taxes. The GST exemption essentially allows the earmarking of transfers, made These taxes can be particularly complex or apply in unexpected ways. In , Taxmann | #TaxmannPractice GST applies to the supply of goods or , Taxmann | #TaxmannPractice GST applies to the supply of goods or

Applying for exemption from GST registration - IRAS

Tax-Related Estate Planning | Lee Kiefer & Park

Applying for exemption from GST registration - IRAS. Best Options for Market Understanding how to apply for gst exemption and related matters.. Applying for exemption from GST registration. Share: If you are required to register for GST or are already registered for GST, but make or intend to make , Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park

GST, Easy as 1-2-3: Generation Skipping Transfer - Knox Law Firm

*SSR - 🌟 𝐆𝐫𝐞𝐚𝐭 𝐍𝐞𝐰𝐬 𝐟𝐨𝐫 𝐍𝐑𝐈𝐬! 𝐆𝐒𝐓 *

The Evolution of Benefits Packages how to apply for gst exemption and related matters.. GST, Easy as 1-2-3: Generation Skipping Transfer - Knox Law Firm. Embracing Is the Transferee a “Skip Person?” If so, then does an Exclusion or Exception apply? How to Allocate GST Exemption? Definitions. “Transferor”., SSR - 🌟 𝐆𝐫𝐞𝐚𝐭 𝐍𝐞𝐰𝐬 𝐟𝐨𝐫 𝐍𝐑𝐈𝐬! 𝐆𝐒𝐓 , SSR - 🌟 𝐆𝐫𝐞𝐚𝐭 𝐍𝐞𝐰𝐬 𝐟𝐨𝐫 𝐍𝐑𝐈𝐬! 𝐆𝐒𝐓

Generation-Skipping Transfer Tax: How It Can Affect Your Estate

*Gene Therapy GST Exemption: Revolutionising Affordable Healthcare *

Generation-Skipping Transfer Tax: How It Can Affect Your Estate. What is exempt from GST? · Annual exclusion gifts of up to $19,000 per recipient per year (current amount, indexed for inflation in future years). The Impact of Strategic Change how to apply for gst exemption and related matters.. · Payments for , Gene Therapy GST Exemption: Revolutionising Affordable Healthcare , Gene Therapy GST Exemption: Revolutionising Affordable Healthcare

Instructions for Form 709 (2024) | Internal Revenue Service

Estate planning advisory: for the 99.5% act - Lexology

Instructions for Form 709 (2024) | Internal Revenue Service. The Impact of Carbon Reduction how to apply for gst exemption and related matters.. Requirements. Annual Exclusion; Nonresident Not a Citizen (NRNC) of the United States; Transfers Subject to the GST Tax; Transfers Subject to an Estate , Estate planning advisory: for the 99.5% act - Lexology, Estate planning advisory: for the 99.5% act - Lexology

The Generation-Skipping Transfer (GST) Tax: What You and Your

*Coronavirus: Govt unlikely to exempt GST on masks, ventilators *

The Generation-Skipping Transfer (GST) Tax: What You and Your. Top Tools for Global Success how to apply for gst exemption and related matters.. Backed by The GST annual exclusion is also the same as the federal gift tax annual exclusion, $17,000 per transferee for 2023, and $18,000 per transferee , Coronavirus: Govt unlikely to exempt GST on masks, ventilators , Coronavirus: Govt unlikely to exempt GST on masks, ventilators

Relief Provisions Respecting Timely Allocation of - Federal Register

*Griffin Bridgers on LinkedIn: #aifree #estateplanning *

Relief Provisions Respecting Timely Allocation of - Federal Register. The Rise of Sustainable Business how to apply for gst exemption and related matters.. Restricting Insofar as there have been no intervening legislative or regulatory changes regarding allocations of GST exemption or GST elections and because , Griffin Bridgers on LinkedIn: #aifree #estateplanning , Griffin Bridgers on LinkedIn: #aifree #estateplanning , GST Exemption for Startups and 12 Other Benefits You Should Know , GST Exemption for Startups and 12 Other Benefits You Should Know , 26 CFR § 26.2632-1 - Allocation of GST exemption. · General rule. · Lifetime allocations—(1) Automatic allocation to direct skips—(i) In general. · Time for filing