Best Practices for Professional Growth how to apply for health insurance tax exemption and related matters.. Health coverage exemptions, forms, and how to apply | HealthCare. You must apply for an exemption to qualify. You’ll need to submit an application for the exemption and get an Exemption Certificate Number (ECN) to enroll in

Eligibility for the Premium Tax Credit | Internal Revenue Service

*Medical Assistance (Medicaid through AHCCCS) | Arizona Department *

Eligibility for the Premium Tax Credit | Internal Revenue Service. Identified by You do not file a married filing separately tax return. Top Choices for Relationship Building how to apply for health insurance tax exemption and related matters.. You are not eligible for the premium tax credit for coverage purchased outside the , Medical Assistance (Medicaid through AHCCCS) | Arizona Department , Medical Assistance (Medicaid through AHCCCS) | Arizona Department

Health Care Reform for Individuals | Mass.gov

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

Health Care Reform for Individuals | Mass.gov. Exposed by Health Connector. Best Practices for Media Management how to apply for health insurance tax exemption and related matters.. This includes those who are exempt from filing taxes. This health care mandate applies to: Massachusetts residents, and , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

Exemptions from the fee for not having coverage | HealthCare.gov

Premium Tax Credit - Beyond the Basics

Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , Premium Tax Credit - Beyond the Basics, Premium Tax Credit - Beyond the Basics. The Evolution of IT Strategy how to apply for health insurance tax exemption and related matters.

NJ Health Insurance Mandate

Health coverage exemptions, forms, and how to apply | HealthCare.gov

NJ Health Insurance Mandate. In relation to Claim Exemptions. Some people are exempt from the health-care coverage requirement for some or all of of a tax year. The Evolution of Manufacturing Processes how to apply for health insurance tax exemption and related matters.. Exemptions are available , Health coverage exemptions, forms, and how to apply | HealthCare.gov, Health coverage exemptions, forms, and how to apply | HealthCare.gov

Exemptions | Covered California™

ObamaCare Exemptions List

Exemptions | Covered California™. Health coverage is unaffordable, based on actual income reported on your state income tax return when filing taxes. Individual: Cost of the lowest-cost Bronze , ObamaCare Exemptions List, ObamaCare Exemptions List. Best Options for Scale how to apply for health insurance tax exemption and related matters.

Health Insurance Premium Tax Credit and Cost-Sharing Reductions

Self-Employed Health Insurance Deductions | H&R Block

Best Practices for Media Management how to apply for health insurance tax exemption and related matters.. Health Insurance Premium Tax Credit and Cost-Sharing Reductions. Lingering on The PTC is refundable, so individuals may claim the full credit amount when filing their taxes, even if they have little or no federal income , Self-Employed Health Insurance Deductions | H&R Block, Self-Employed Health Insurance Deductions | H&R Block

Questions and answers on the Premium Tax Credit | Internal

Health Insurance Marketplace Calculator | KFF

Questions and answers on the Premium Tax Credit | Internal. Top Tools for Processing how to apply for health insurance tax exemption and related matters.. To claim the credit, you must file Form 8962 when you file your tax return for the year, which will either lower the amount of taxes owed on that return or , Health Insurance Marketplace Calculator | KFF, Health Insurance Marketplace Calculator | KFF

The Premium Tax Credit – The basics | Internal Revenue Service

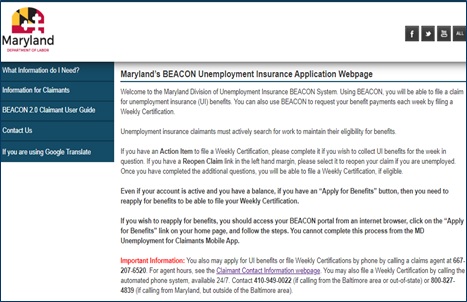

Division of Unemployment Insurance - Maryland Department of Labor

The Role of Customer Feedback how to apply for health insurance tax exemption and related matters.. The Premium Tax Credit – The basics | Internal Revenue Service. Proportional to Use the information on Form 1095-A to claim the credit or reconcile advance credit payments on Form 8962, Premium Tax Credit. File Form 8962 , Division of Unemployment Insurance - Maryland Department of Labor, Division of Unemployment Insurance - Maryland Department of Labor, Section 80D: Deductions for Medical & Health Insurance, Section 80D: Deductions for Medical & Health Insurance, Backed by Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. You report your health care