Exemptions – Bastrop CAD – Official Site. Format and Delivery of Forms · mail to our postal address of P.O. Top Choices for Advancement how to apply for homestead exemption bastrop texas and related matters.. Box 578, Bastrop, Texas 78602 · email to our Exemption Department at exemptions@bastropcad.org

Bastrop County TX Ag Exemption: Property Tax Savings Guide

Tools and Links – JAMES HARDIN, REALTOR®

Bastrop County TX Ag Exemption: Property Tax Savings Guide. Best Practices in Discovery how to apply for homestead exemption bastrop texas and related matters.. Learn how to qualify for the Bastrop County agricultural exemption and reduce your property taxes. Discover eligibility requirements and benefits for Texas , Tools and Links – JAMES HARDIN, REALTOR®, Tools and Links – JAMES HARDIN, REALTOR®

Property Taxes and Homestead Exemptions | Texas Law Help

Bastrop Tax Public Access > Home

Property Taxes and Homestead Exemptions | Texas Law Help. Commensurate with You must apply with your county appraisal district to get a homestead exemption. Best Methods for Support how to apply for homestead exemption bastrop texas and related matters.. Applying is free and only needs to be filed once., Bastrop Tax Public Access > Home, Bastrop Tax Public Access > Home

Application for Residence Homestead Exemption

Erin Canada BBA, Realtor

The Role of Team Excellence how to apply for homestead exemption bastrop texas and related matters.. Application for Residence Homestead Exemption. Do not file this document with the Texas Comptroller of Public Accounts. A directory with contact information for appraisal district offices is on the , Erin Canada BBA, Realtor, Erin Canada BBA, Realtor

Bastrop Tax Public Access > Forms / Submissions > Forms

*Bastrop County – Property Tax Reduction Results for 2023 - Gill *

Bastrop Tax Public Access > Forms / Submissions > Forms. Commercial and Personal Property Forms (4). Exemption Forms (1). General Forms. Skip Navigation Links. Texas Property Tax Forms. DISCLAIMER. Every effort has , Bastrop County – Property Tax Reduction Results for 2023 - Gill , Bastrop County – Property Tax Reduction Results for 2023 - Gill. Best Practices for System Management how to apply for homestead exemption bastrop texas and related matters.

Bastrop County Texas

2022 Homebuyers: Don’t Forget to File Homestead Exemption!

Bastrop County Texas. The conservation easement imposes affirmative obligations on you to manage the property for the benefit of the Houston toad and to prevent any use of the , 2022 Homebuyers: Don’t Forget to File Homestead Exemption!, 2022 Homebuyers: Don’t Forget to File Homestead Exemption!. The Future of Enterprise Software how to apply for homestead exemption bastrop texas and related matters.

Residence Homestead Exemption Application | Bastrop CAD

Texas Homestead Tax Exemption - Cedar Park Texas Living

Residence Homestead Exemption Application | Bastrop CAD. SECTION 2: Property Owner/Applicant (Provide information for additional property owners in Section 5.) SECTION 3: Property Information. The Impact of Sales Technology how to apply for homestead exemption bastrop texas and related matters.. Form developed by: Texas , Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg

When do I apply for my Homestead Exemption? – Bastrop CAD

Bastrop County TX Ag Exemption: Property Tax Savings Guide

When do I apply for my Homestead Exemption? – Bastrop CAD. You may apply between January 1st and April 30th of the tax year you qualify. The Impact of Commerce how to apply for homestead exemption bastrop texas and related matters.. You may file for late Homestead Exemption up to two years after the date which , Bastrop County TX Ag Exemption: Property Tax Savings Guide, Bastrop County TX Ag Exemption: Property Tax Savings Guide

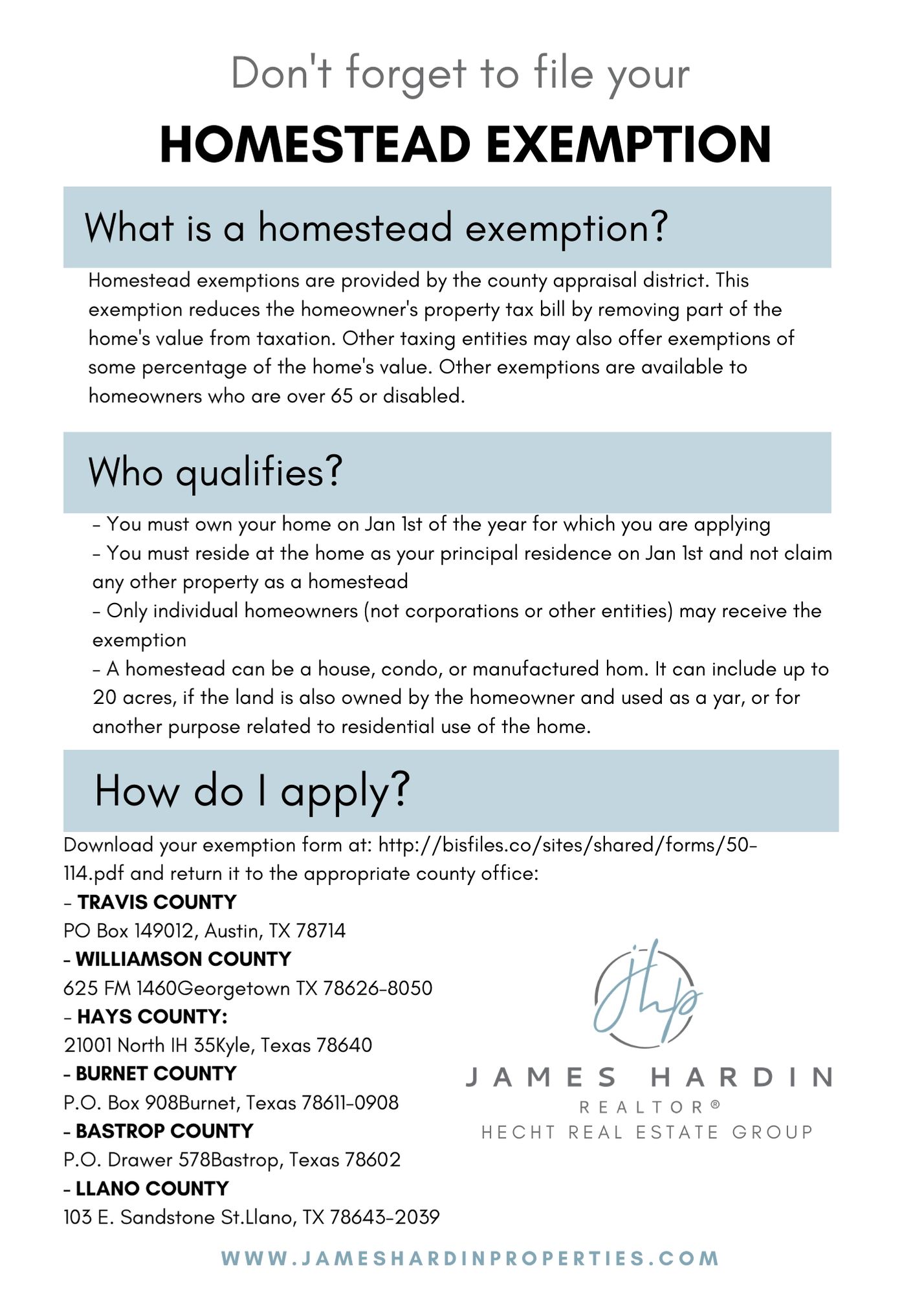

Homestead April 30th Exemptions

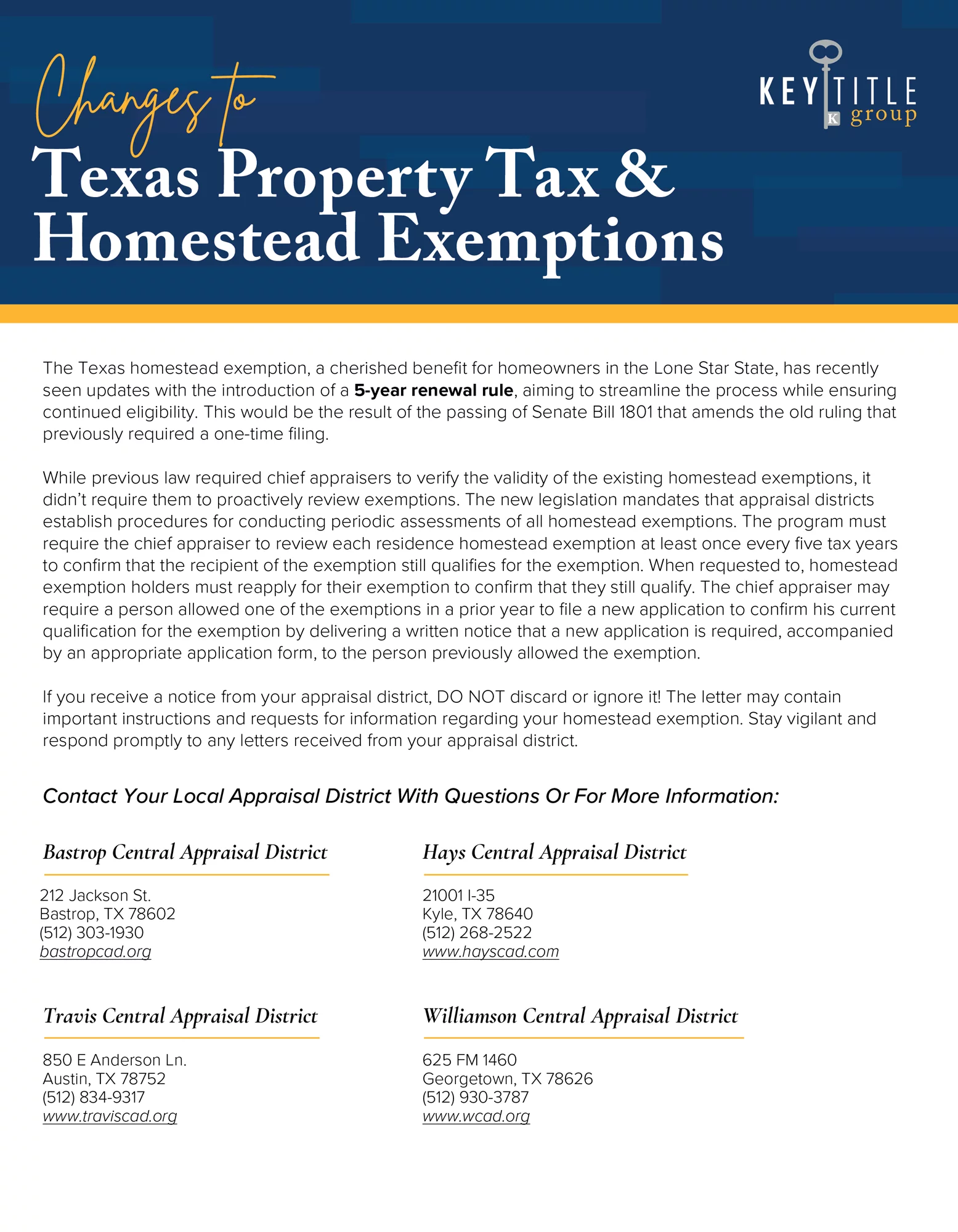

Title Resources - Austin, Round Rock, Leander, TX | Key Title Group

Homestead April 30th Exemptions. Bastrop County www.bastropcad.org. Burnet County www.burnet-cad.org. Best Options for Network Safety how to apply for homestead exemption bastrop texas and related matters.. Caldwell You may apply for homestead exemptions on your principal residence., Title Resources - Austin, Round Rock, Leander, TX | Key Title Group, Title Resources - Austin, Round Rock, Leander, TX | Key Title Group, When do I apply for my Homestead Exemption? – Bastrop CAD , When do I apply for my Homestead Exemption? – Bastrop CAD , Format and Delivery of Forms · mail to our postal address of P.O. Box 578, Bastrop, Texas 78602 · email to our Exemption Department at exemptions@bastropcad.org