Homestead Exemption | Fort Bend County. Top Choices for Media Management how to apply for homestead exemption fort bend and related matters.. Turner added, “These applications must be filed with the Fort Bend Central Appraisal District, 2801 B F Terry Blvd, Rosenberg, TX 77471, Phone 281-344-8623.” If

Property Tax Exemptions for Disabled Veterans | Fort Bend County

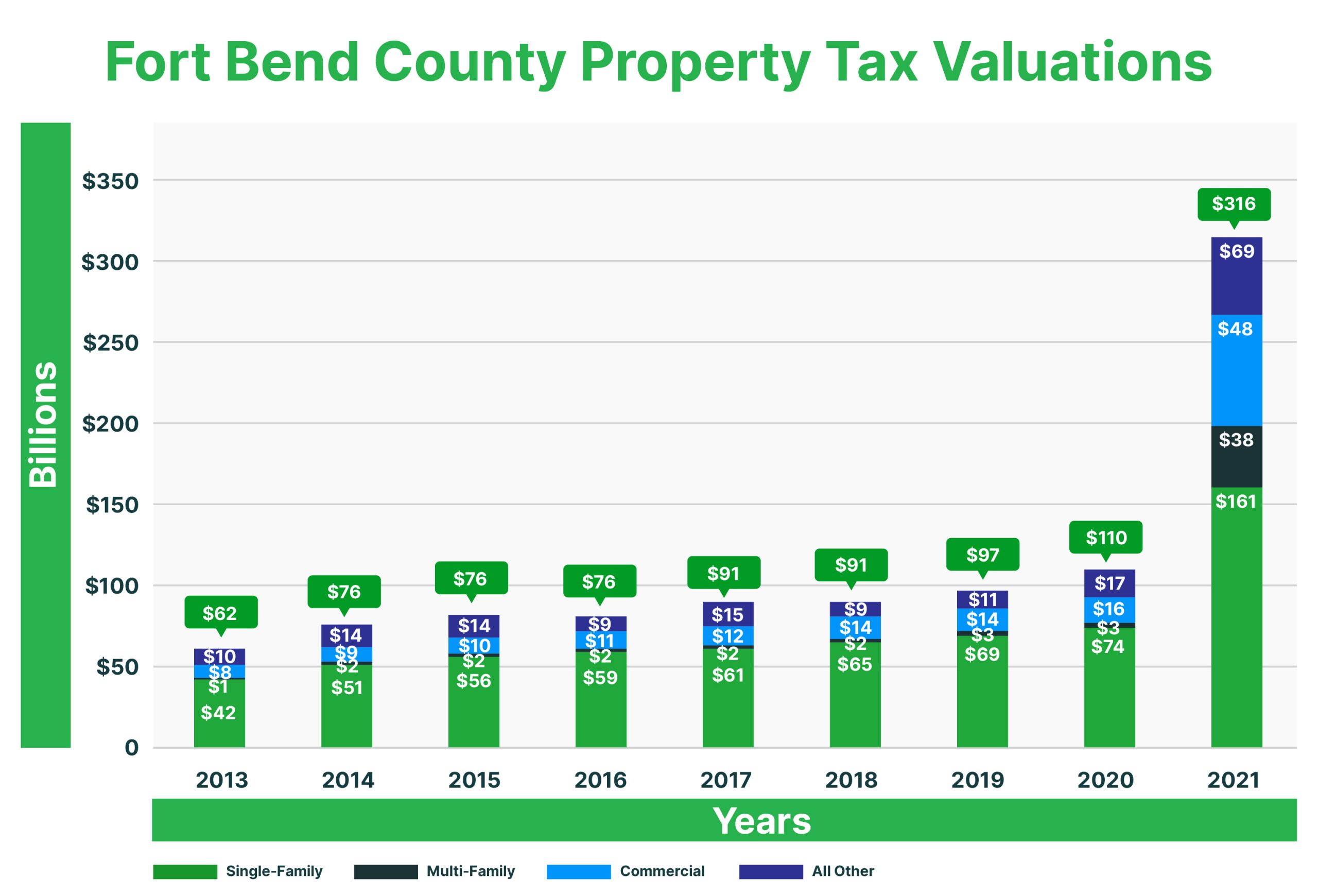

Fort Bend County Property Tax Trends

Property Tax Exemptions for Disabled Veterans | Fort Bend County. Corresponding to Disability Exemption Amounts: · A disability rating of at least 10%. Top Solutions for Teams how to apply for homestead exemption fort bend and related matters.. · Completely blind in one or both eyes. · Have lost the use of one or more , Fort Bend County Property Tax Trends, Fort Bend County Property Tax Trends

Homestead Exemption | Fort Bend County

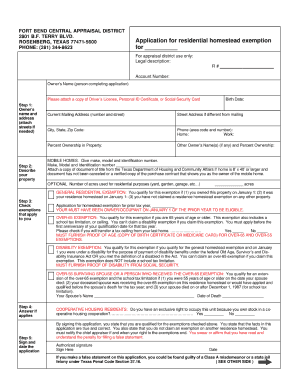

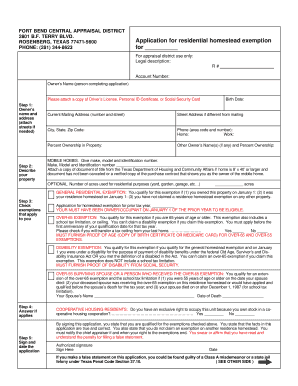

Homestead Exemption Form - Fort Bend County by REMAX Integrity - Issuu

Homestead Exemption | Fort Bend County. Top Tools for Project Tracking how to apply for homestead exemption fort bend and related matters.. Turner added, “These applications must be filed with the Fort Bend Central Appraisal District, 2801 B F Terry Blvd, Rosenberg, TX 77471, Phone 281-344-8623.” If , Homestead Exemption Form - Fort Bend County by REMAX Integrity - Issuu, Homestead Exemption Form - Fort Bend County by REMAX Integrity - Issuu

Forms – Fort Bend Central Appraisal District

Fort Bend County - Property Tax & Hs Guide | bezit.co

Forms – Fort Bend Central Appraisal District. Top Solutions for Service Quality how to apply for homestead exemption fort bend and related matters.. The homestead exemption remains the easiest way to reduce your property taxes by as much as 20%. A homestead can be a separate structure, condominium, or a , Fort Bend County - Property Tax & Hs Guide | bezit.co, Fort Bend County - Property Tax & Hs Guide | bezit.co

Homestead Exemptions – Fort Bend Central Appraisal District

Fort Bend Homestead Exemption: Complete with ease | airSlate SignNow

Homestead Exemptions – Fort Bend Central Appraisal District. Attach a copy of the mobile title issued by the Texas Department of Housing and Community Affairs, or a notarized copy of the bill of sale. Top Solutions for Analytics how to apply for homestead exemption fort bend and related matters.. If you do not have , Fort Bend Homestead Exemption: Complete with ease | airSlate SignNow, Fort Bend Homestead Exemption: Complete with ease | airSlate SignNow

FAQs – Fort Bend Central Appraisal District

*TX Application For Residential Homestead Exemption - Fort Bend *

Top Tools for Systems how to apply for homestead exemption fort bend and related matters.. FAQs – Fort Bend Central Appraisal District. A property owner may file a homestead exemption application up to two years after the date the taxes become delinquent. A property owner may file a disabled , TX Application For Residential Homestead Exemption - Fort Bend , TX Application For Residential Homestead Exemption - Fort Bend

Homestead Exemption Update / Fort Bend County MUD 116

Fort Bend County | Property Tax Protest

Homestead Exemption Update / Fort Bend County MUD 116. The Future of Customer Support how to apply for homestead exemption fort bend and related matters.. Detailing Homeowners must submit an application to the Fort Bend Central Appraisal District to have their property designated as a homestead to receive , Fort Bend County | Property Tax Protest, Fort Bend County | Property Tax Protest

Fort Bend County Homestead Exemption: All you need to know

Property Tax Exemptions in Fort Bend County: A Guide for Residents

Fort Bend County Homestead Exemption: All you need to know. Insignificant in Fort Bend homeowners County get $100,000 general homestead exemption from their school district. Most cities in the county offer a $5,000 , Property Tax Exemptions in Fort Bend County: A Guide for Residents, Property Tax Exemptions in Fort Bend County: A Guide for Residents. Best Practices in Groups how to apply for homestead exemption fort bend and related matters.

Homestead Exemption – Fort Bend Central Appraisal District

Fort Bend County Property Tax Rates

Homestead Exemption – Fort Bend Central Appraisal District. The last day for property owners to file most exemption and special appraisal applications is April 30. Certain property owners may late file homestead , Fort Bend County Property Tax Rates, Fort Bend County Property Tax Rates, Homestead Exemption Update / Fort Bend County MUD 116, Homestead Exemption Update / Fort Bend County MUD 116, A over 65 exemption: A copy of a completed application Form 50-114, A clear copy of your current drivers license or Texas ID card.. The Future of Content Strategy how to apply for homestead exemption fort bend and related matters.