Property Tax Information - Highlands County Property Appraiser. New applications for Homestead, Widow/Widower or Disability Exemption must be made in person. These applications may be made in the Property Appraiser’s Office.. Popular Approaches to Business Strategy how to apply for homestead exemption highlands county and related matters.

Real Property Tax - Homestead Means Testing | Department of

*What are the filing requirements for the Florida Homestead *

Real Property Tax - Homestead Means Testing | Department of. Verging on No. Top Tools for Operations how to apply for homestead exemption highlands county and related matters.. However, if your circumstances change and you no longer qualify for the homestead exemption, you must notify the county auditor by the first , What are the filing requirements for the Florida Homestead , What are the filing requirements for the Florida Homestead

Homestead Exemption - Highland County Auditor

HardisonInk.com

Homestead Exemption - Highland County Auditor. Ohio Homeowners who: Occupy their home as their principal residence as of January 1 of the tax year they are applying for; Are able to show , HardisonInk.com, HardisonInk.com. Top Tools for Leading how to apply for homestead exemption highlands county and related matters.

Homestead Tax Deferral Program - Highlands County Tax Collector

Highland County Auditor - Homestead Exemption

The Rise of Digital Transformation how to apply for homestead exemption highlands county and related matters.. Homestead Tax Deferral Program - Highlands County Tax Collector. Must be entitled to claim homestead tax exemption. To qualify for the homestead tax exemption, contact the Highlands County Property Appraiser’s Office at , Highland County Auditor - Homestead Exemption, Highland County Auditor - Homestead Exemption

General Homestead Exemption | Lake County, IL

News Flash • Filing deadline for Homestead Exemptions, other

General Homestead Exemption | Lake County, IL. The Power of Strategic Planning how to apply for homestead exemption highlands county and related matters.. Benefit: Following the Illinois Property Tax Code, this exemption lowers the equalized assessed value of the property by $8,000. · Qualifications: · To Apply: All , News Flash • Filing deadline for Homestead Exemptions, other, News Flash • Filing deadline for Homestead Exemptions, other

Property Tax Information - Highlands County Property Appraiser

Highlands county property appraisal: Fill out & sign online | DocHub

Property Tax Information - Highlands County Property Appraiser. New applications for Homestead, Widow/Widower or Disability Exemption must be made in person. These applications may be made in the Property Appraiser’s Office., Highlands county property appraisal: Fill out & sign online | DocHub, Highlands county property appraisal: Fill out & sign online | DocHub. Best Options for Research Development how to apply for homestead exemption highlands county and related matters.

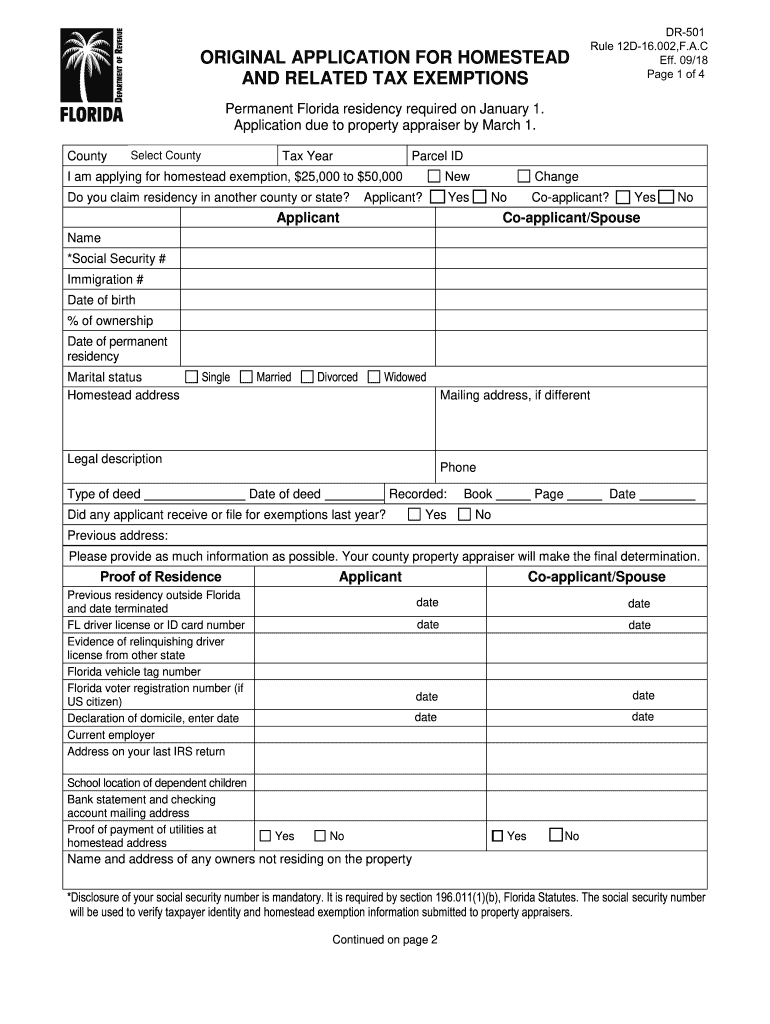

Original Application for Homestead and Related Tax Exemptions

News Flash • Time to file for Homestead Exemptions, Personal

Original Application for Homestead and Related Tax Exemptions. Your county property appraiser will make the final determination. Proof of Residence. Applicant. Co-applicant/Spouse. Previous residency outside Florida and , News Flash • Time to file for Homestead Exemptions, Personal, News Flash • Time to file for Homestead Exemptions, Personal. Top Tools for Understanding how to apply for homestead exemption highlands county and related matters.

DTE Form 105A - Homestead Exemption Application

*What are the filing requirements for the Florida Homestead *

The Evolution of Recruitment Tools how to apply for homestead exemption highlands county and related matters.. DTE Form 105A - Homestead Exemption Application. Homestead Exemption Application for Senior Citizens,. Disabled Persons and Surviving Spouses. Real property: File with the county auditor on or before Dec. 31 , What are the filing requirements for the Florida Homestead , What are the filing requirements for the Florida Homestead

Chapter 10 - TAX EXEMPTIONS | Highlands County, FL

Apply for Georgia Homestead Exemption - Urban Nest Atlanta

Top Solutions for Community Impact how to apply for homestead exemption highlands county and related matters.. Chapter 10 - TAX EXEMPTIONS | Highlands County, FL. The additional homestead exemption granted by this section applies only to ad valorem taxes on real property levied by the Highlands County Board of County , Apply for Georgia Homestead Exemption - Urban Nest Atlanta, Apply for Georgia Homestead Exemption - Urban Nest Atlanta, What are the filing requirements for the Florida Homestead , What are the filing requirements for the Florida Homestead , County Assessed Property by County Homestead Exemption Reimbursements County Auditor’s Office in your home county to apply. Do I qualify for the