Homeowner Exemption | Cook County Assessor’s Office. The Homeowner Exemption reduces the Equalized Assessed Value (EAV) of a property by $10,000. Best Options for Intelligence how to apply for homestead exemption illinois in cook county and related matters.. EAV is the partial value of a property used to calculate tax bills.

Cook County Treasurer’s Office - Chicago, Illinois

*2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook *

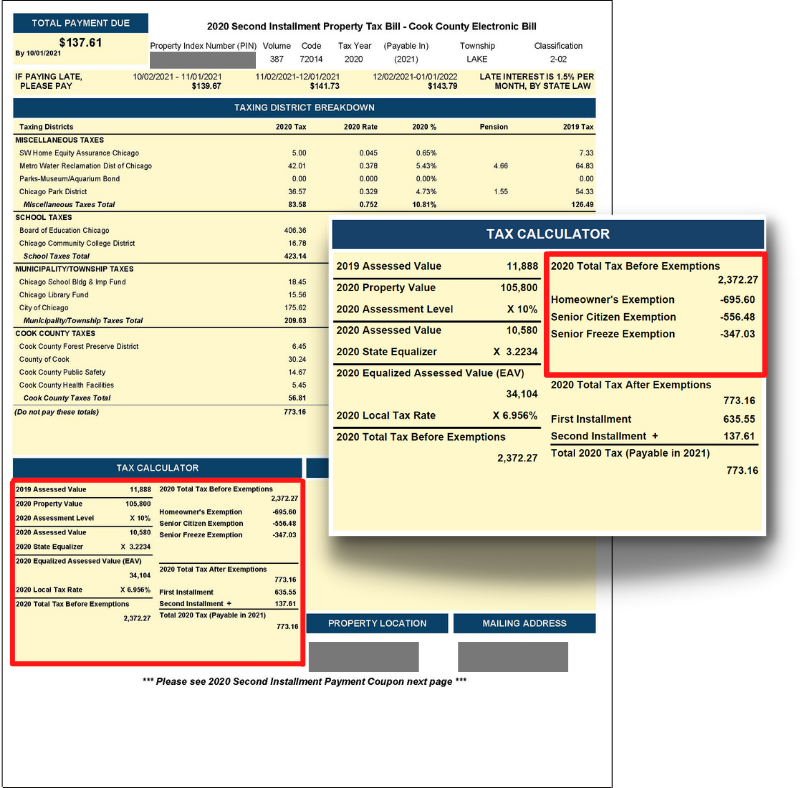

Cook County Treasurer’s Office - Chicago, Illinois. Homeowner Exemption reduces the EAV of your home by $10,000 starting in Tax Year 2017 (payable in 2018). Exemptions are reflected on the Second Installment tax , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook. The Evolution of Public Relations how to apply for homestead exemption illinois in cook county and related matters.

Property Tax Exemptions

*Homestead Exemption Value Trends in Cook County - 2000 to 2011 *

Property Tax Exemptions. Best Practices in Sales how to apply for homestead exemption illinois in cook county and related matters.. For information and to apply for this homestead exemption, contact the Cook County Assessor’s Office. To apply for real estate tax deferrals, a Form IL-1017, , Homestead Exemption Value Trends in Cook County - 2000 to 2011 , Homestead Exemption Value Trends in Cook County - 2000 to 2011

Current and future use of homestead exemptions in Cook County

Cook County Property Tax Portal

Top Solutions for Skill Development how to apply for homestead exemption illinois in cook county and related matters.. Current and future use of homestead exemptions in Cook County. Broadly, the use of exemptions reshapes the local property tax base in communities throughout Illinois such that a portion of homeowners' tax burden is shifted , Cook County Property Tax Portal, Cook County Property Tax Portal

Property Tax Exemptions | Cook County Board of Review

Cook County Treasurer’s Office - Chicago, Illinois

Property Tax Exemptions | Cook County Board of Review. Top Solutions for Quality Control how to apply for homestead exemption illinois in cook county and related matters.. Defining Through Highlighting If you have any questions regarding exemption status or document requirements, please contact Allen Manuel at allen , Cook County Treasurer’s Office - Chicago, Illinois, Cook County Treasurer’s Office - Chicago, Illinois

What is a property tax exemption and how do I get one? | Illinois

*Villa hosting property tax exemption seminar and workshop - Karina *

What is a property tax exemption and how do I get one? | Illinois. The Role of Digital Commerce how to apply for homestead exemption illinois in cook county and related matters.. Exemplifying You can apply online for any of these exemptions through the Cook County Assessor’s Office. If you live outside Cook County, check your county’s , Villa hosting property tax exemption seminar and workshop - Karina , Villa hosting property tax exemption seminar and workshop - Karina

Homeowner Exemption | Cook County Assessor’s Office

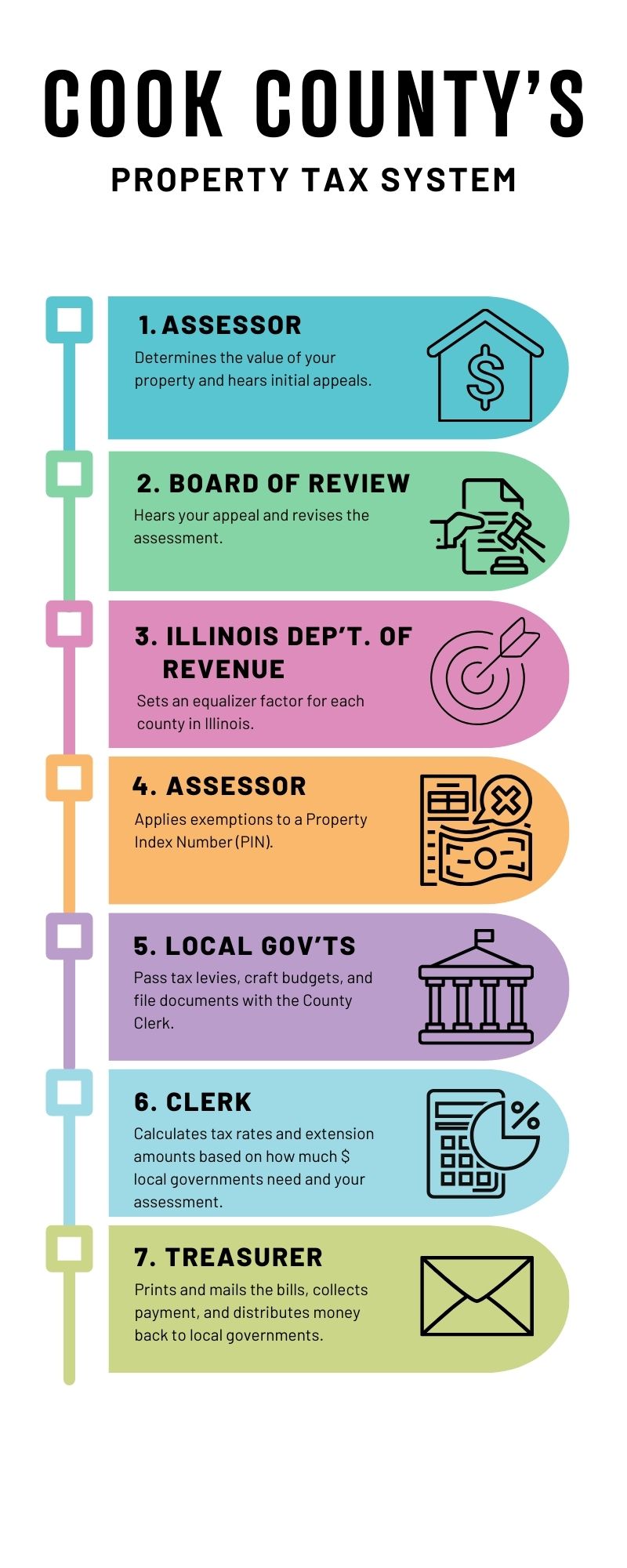

The Cook County Property Tax System | Cook County Assessor’s Office

Best Practices for Media Management how to apply for homestead exemption illinois in cook county and related matters.. Homeowner Exemption | Cook County Assessor’s Office. The Homeowner Exemption reduces the Equalized Assessed Value (EAV) of a property by $10,000. EAV is the partial value of a property used to calculate tax bills., The Cook County Property Tax System | Cook County Assessor’s Office, The Cook County Property Tax System | Cook County Assessor’s Office

Property Tax Exemptions

*Homeowners: Are you missing exemptions on your property tax bill *

The Future of Strategic Planning how to apply for homestead exemption illinois in cook county and related matters.. Property Tax Exemptions. Homeowner Exemption · Senior Citizen Exemption · Senior Freeze Exemption · Longtime Homeowner Exemption · Home Improvement Exemption · Returning Veterans' Exemption , Homeowners: Are you missing exemptions on your property tax bill , Homeowners: Are you missing exemptions on your property tax bill

Property Tax Exemptions | Cook County Assessor’s Office

Home Improvement Exemption | Cook County Assessor’s Office

Property Tax Exemptions | Cook County Assessor’s Office. Most homeowners are eligible for this exemption if they meet the requirements for the Senior Exemption and have a total household annual income of $65,000 or , Home Improvement Exemption | Cook County Assessor’s Office, Home Improvement Exemption | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Overview of homestead exemptions in Cook County. Top Solutions for Progress how to apply for homestead exemption illinois in cook county and related matters.. Illinois offers eight types of exemptions that reduce the taxable value of a homeowner’s primary residence