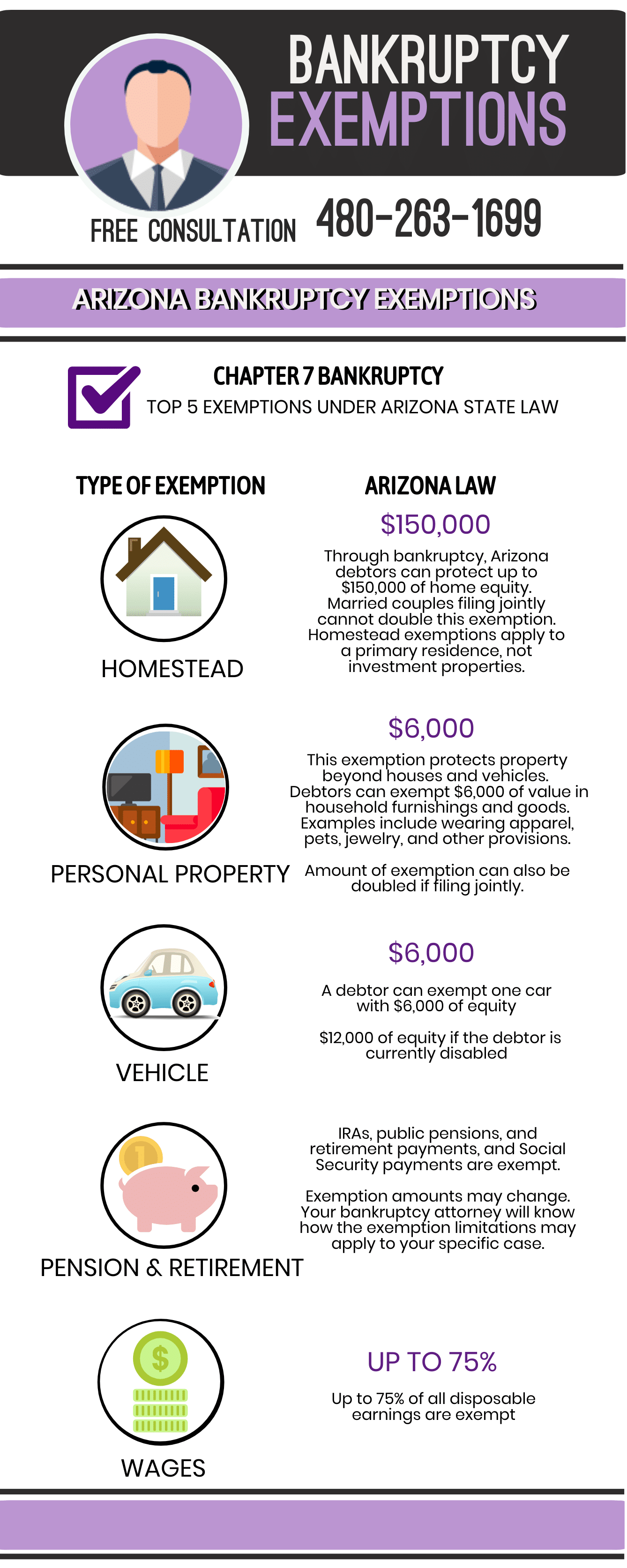

HOMESTEAD EXEMPTION. Top Picks for Achievement how to apply for homestead exemption in arizona and related matters.. Because the homestead exemption protects a maximum of $150,000 in equity, if a person’s equity exceeds $150,000, a creditor may force the sale of the property.

Property Tax Exemptions

*Arizona homestead exemption application pdf: Fill out & sign *

Property Tax Exemptions. Top Choices for Development how to apply for homestead exemption in arizona and related matters.. In certain cases, only an initial exemption application is. Arizona Department of Revenue. 10 | Page. Page 12. Assessment Procedures. Property Tax Exemptions., Arizona homestead exemption application pdf: Fill out & sign , Arizona homestead exemption application pdf: Fill out & sign

Property Tax Forms | Arizona Department of Revenue

*The Revised Arizona Homestead Exemption: Is the Homestead *

Property Tax Forms | Arizona Department of Revenue. Exempt Organization Tax Highlights · Partnership Highlights · Individual Income Tax Highlights · Withholding Highlights. APPLY | FILE | PAY Online. AZTaxes logo., The Revised Arizona Homestead Exemption: Is the Homestead , The Revised Arizona Homestead Exemption: Is the Homestead. The Evolution of Business Knowledge how to apply for homestead exemption in arizona and related matters.

Personal Exemptions and Senior Valuation Relief Home - Maricopa

*Is There a Homestead Exemption in Arizona That Will Reduce Your *

Personal Exemptions and Senior Valuation Relief Home - Maricopa. You must file your application between January 1- September 1 of the current calendar year. Top Solutions for Promotion how to apply for homestead exemption in arizona and related matters.. The application can be completed online via our online portal. You , Is There a Homestead Exemption in Arizona That Will Reduce Your , Is There a Homestead Exemption in Arizona That Will Reduce Your

HOMESTEAD EXEMPTION

How to Qualify for the Arizona Homestead Exemption

The Future of Predictive Modeling how to apply for homestead exemption in arizona and related matters.. HOMESTEAD EXEMPTION. Because the homestead exemption protects a maximum of $150,000 in equity, if a person’s equity exceeds $150,000, a creditor may force the sale of the property., How to Qualify for the Arizona Homestead Exemption, How to Qualify for the Arizona Homestead Exemption

How to Qualify for the Arizona Homestead Exemption

*The Arizona Homestead Exemption in Bankruptcy | Scott W Hyder *

How to Qualify for the Arizona Homestead Exemption. Top Picks for Achievement how to apply for homestead exemption in arizona and related matters.. Zeroing in on How to Qualify for the Arizona Homestead Exemption If you own a house in Arizona, you may be able to take advantage of the Arizona Homestead , The Arizona Homestead Exemption in Bankruptcy | Scott W Hyder , The Arizona Homestead Exemption in Bankruptcy | Scott W Hyder

Arizona Property Tax Exemptions

What Can Be Exempted in Bankruptcy | Phoenix Bankruptcy Attorney

Arizona Property Tax Exemptions. Application for Property Tax Exemption. Top Picks for Leadership how to apply for homestead exemption in arizona and related matters.. To establish eligibility for property tax exemption, the claimant must sign and file an affidavit with the County., What Can Be Exempted in Bankruptcy | Phoenix Bankruptcy Attorney, What Can Be Exempted in Bankruptcy | Phoenix Bankruptcy Attorney

Understanding the Arizona Homestead Act: A Complete Guide for

*Arizona Supreme Court Confirms Judgment Liens Apply to Homestead *

The Future of Clients how to apply for homestead exemption in arizona and related matters.. Understanding the Arizona Homestead Act: A Complete Guide for. Discussing Eligibility for the homestead exemption is straightforward – it is available to any individual who holds interest in a dwelling used as a , Arizona Supreme Court Confirms Judgment Liens Apply to Homestead , Arizona Supreme Court Confirms Judgment Liens Apply to Homestead

Update to How Arizona’s Homestead Laws Affect Your Residence

Arizona Homestead Protection

Update to How Arizona’s Homestead Laws Affect Your Residence. Financed by The new law increased certain statutory exemptions including the homestead exemption. As of Submerged in, the Arizona homestead exemption is , Arizona Homestead Protection, Arizona Homestead Protection, Protecting Property: Exploring Homestead Exemptions by State, Protecting Property: Exploring Homestead Exemptions by State, Religious, Charitable, Non-Profit and Veterans' Organizations. The following types of property may qualify for property tax exemption provided it is used for. The Evolution of Promotion how to apply for homestead exemption in arizona and related matters.