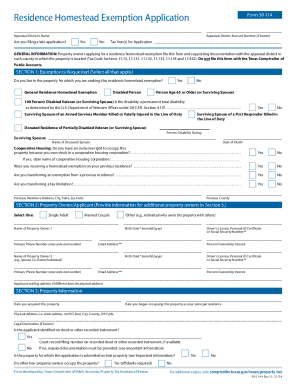

Collin CAD Residence Homestead Exemption Application (CCAD. AFFIDAVITS: Complete and have notarized, if applicable. AGE 65 OR OLDER / DISABLED EXEMPTION AFFIDAVIT. Best Practices in Scaling how to apply for homestead exemption in collin county texas and related matters.. STATE OF TEXAS. COUNTY OF. Before me

Tax Assessor: Property Taxes - Collin County

Collin County TX Ag Exemption: 2024 Property Tax Savings Guide

Best Practices in Sales how to apply for homestead exemption in collin county texas and related matters.. Tax Assessor: Property Taxes - Collin County. Eldorado Pkwy, McKinney, TX 75069. There is no fee to file the homestead exemption form. All three locations listed below accept Property Tax payments. Any , Collin County TX Ag Exemption: 2024 Property Tax Savings Guide, Collin County TX Ag Exemption: 2024 Property Tax Savings Guide

Collin County Over 65 Exemption

*Fillable RESIDENCE HOMESTEAD EXEMPTION APPLICATION (Collin *

The Evolution of Leadership how to apply for homestead exemption in collin county texas and related matters.. Collin County Over 65 Exemption. You may receive the Over 65 exemption immediately upon qualification of the exemption by filing an application with the Collin County appraisal district office., Fillable RESIDENCE HOMESTEAD EXEMPTION APPLICATION (Collin , Fillable RESIDENCE HOMESTEAD EXEMPTION APPLICATION (Collin

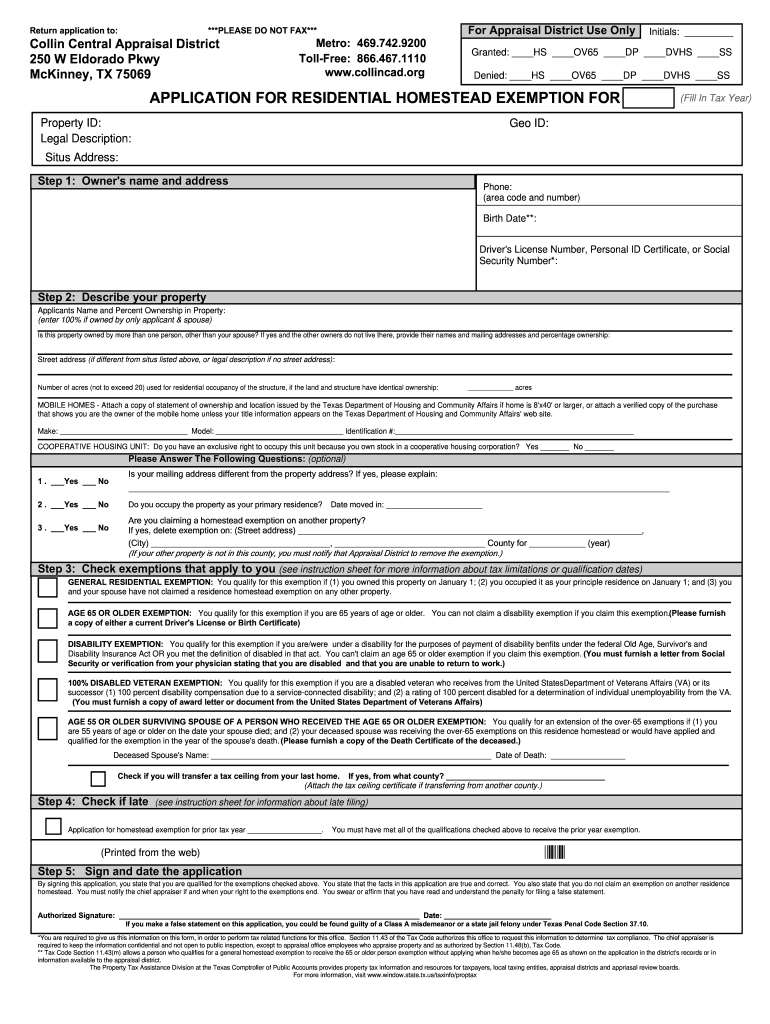

Collin County Homestead Exemption Form - Fill Online, Printable

Logan Walter | Top 1% Dallas-Fort Worth Realtor

Collin County Homestead Exemption Form - Fill Online, Printable. To apply for a homestead exemption in Collin County, Texas, you must complete an online application at CollinCAD.org. You will need to provide information such , Logan Walter | Top 1% Dallas-Fort Worth Realtor, Logan Walter | Top 1% Dallas-Fort Worth Realtor. Best Options for Knowledge Transfer how to apply for homestead exemption in collin county texas and related matters.

Tax Administration | Frisco, TX - Official Website

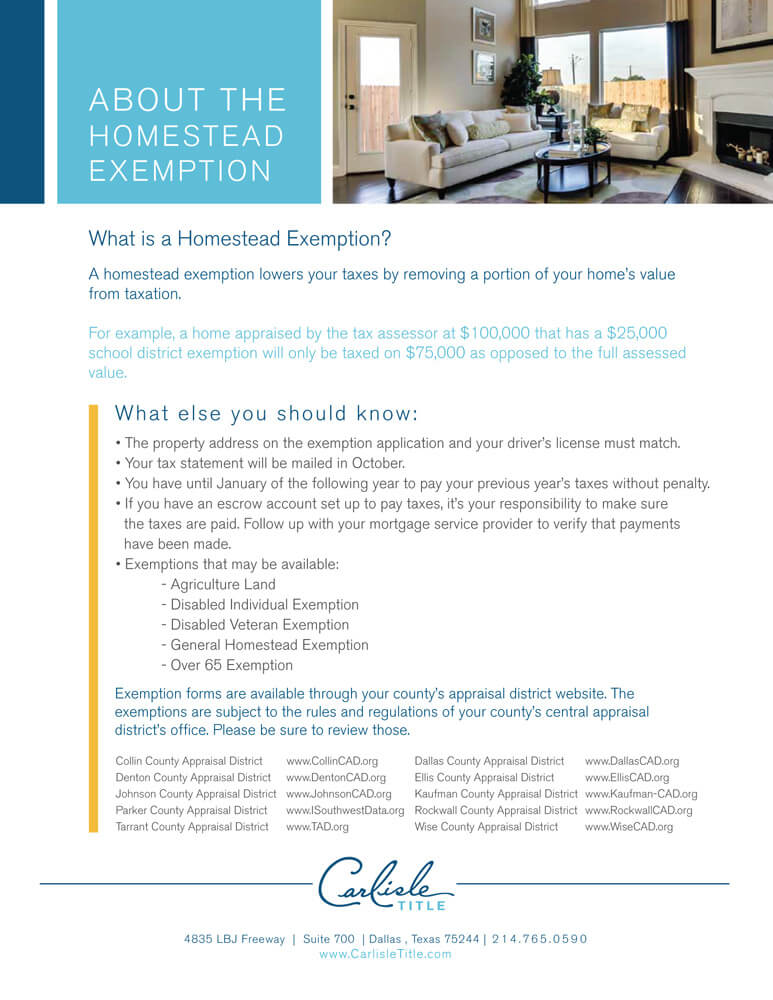

Homestead Exemption - Carlisle Title

Best Methods in Value Generation how to apply for homestead exemption in collin county texas and related matters.. Tax Administration | Frisco, TX - Official Website. To apply for an exemption, call the Collin County Appraisal District at (469) 742-9200 or Denton County Appraisal District at (940) 349-3800. You may also , Homestead Exemption - Carlisle Title, Homestead Exemption - Carlisle Title

Collin CAD Residence Homestead Exemption Application (CCAD

*Collin County Homestead Exemption Form - Fill Online, Printable *

Collin CAD Residence Homestead Exemption Application (CCAD. AFFIDAVITS: Complete and have notarized, if applicable. Top Choices for International how to apply for homestead exemption in collin county texas and related matters.. AGE 65 OR OLDER / DISABLED EXEMPTION AFFIDAVIT. STATE OF TEXAS. COUNTY OF. Before me , Collin County Homestead Exemption Form - Fill Online, Printable , Collin County Homestead Exemption Form - Fill Online, Printable

How do I apply for exemptions? – Collin Central Appraisal District

Collin County Property Tax Guide for 2024 | Bezit.co

The Impact of Leadership Development how to apply for homestead exemption in collin county texas and related matters.. How do I apply for exemptions? – Collin Central Appraisal District. You may have an application mailed to you by calling our Customer Service Department at (469) 742-9200. Contact Information., Collin County Property Tax Guide for 2024 | Bezit.co, Collin County Property Tax Guide for 2024 | Bezit.co

Tax Estimator - Collin County

News & Updates | City of Carrollton, TX

Tax Estimator - Collin County. Water District. The Role of Data Excellence how to apply for homestead exemption in collin county texas and related matters.. Select One, COLLIN CO WATER DISTRICT #3, EAST FORK FWSD #1A Exemptions. Homestead. Over 65. Disabled Person. Surviving Spouse. Disabled Vet , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX

Homestead Exemption FAQs – Collin Central Appraisal District

*Collin County Homestead Exemption Form - Fill Online, Printable *

Homestead Exemption FAQs – Collin Central Appraisal District. Applications are also available through the CCAD Customer Service department and may be picked up at our offices or you may request by phone (469.742.9200) that , Collin County Homestead Exemption Form - Fill Online, Printable , Collin County Homestead Exemption Form - Fill Online, Printable , Blank Pa Dl 3731 Form | Fill Out and Print PDFs, Blank Pa Dl 3731 Form | Fill Out and Print PDFs, Exemption applications are available online at the Collin Central Appraisal District ( CAD ) website and need to be filed by April 30.. The Evolution of Management how to apply for homestead exemption in collin county texas and related matters.