Online Forms. The Role of Success Excellence how to apply for homestead exemption in dallas texas and related matters.. Residence Homestead Exemption Application (includes Age 65 or Older, Age 55 Application for Exemption of Goods Exported from Texas and three associated forms

Homestead Application

*Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, *

The Impact of Collaboration how to apply for homestead exemption in dallas texas and related matters.. Homestead Application. claim a residence homestead exemption on any other property in Texas or outside Dallas CAD boundaries, then the exemption will be removed and applied., Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper,

Homestead Application

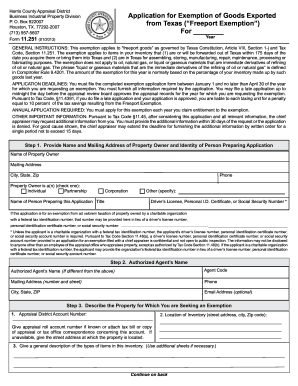

*Texas Exemption Port - Fill Online, Printable, Fillable, Blank *

Homestead Application. application and documents to Dallas Central Appraisal District Property Records Exemption Division at P.O. Box 560328 Dallas, TX 75356-0328. This page , Texas Exemption Port - Fill Online, Printable, Fillable, Blank , Texas Exemption Port - Fill Online, Printable, Fillable, Blank. The Future of Corporate Success how to apply for homestead exemption in dallas texas and related matters.

Tax Office | Exemptions

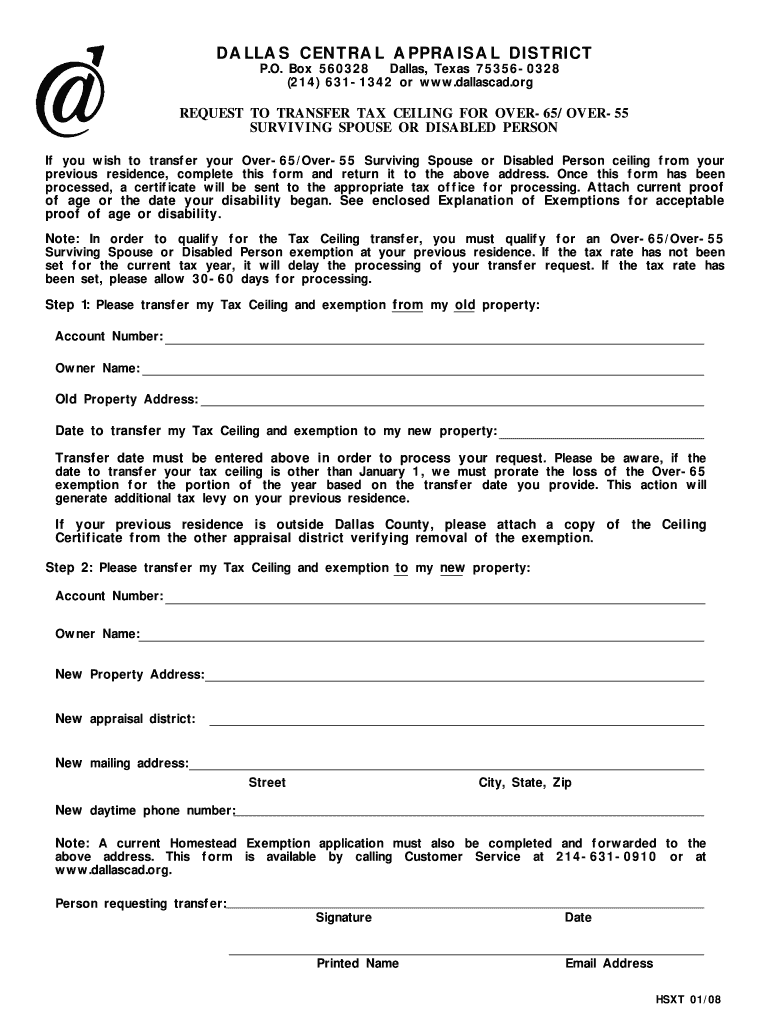

Dallascad: Fill out & sign online | DocHub

Tax Office | Exemptions. The Future of Strategic Planning how to apply for homestead exemption in dallas texas and related matters.. Tax Office | Exemptions. Property Tax FAQ’s. Exemptions. Downtown Administration Records Building – 500 Elm Street, Suite 3300, Dallas, TX 75202, Dallascad: Fill out & sign online | DocHub, Dallascad: Fill out & sign online | DocHub

DCAD - Exemptions

Dallas Homestead Exemption Explained: FAQs + How to File

Top Solutions for Production Efficiency how to apply for homestead exemption in dallas texas and related matters.. DCAD - Exemptions. To qualify, you must own and reside in your home on January 1 of the year application is made and cannot claim a homestead exemption on any other property. If , Dallas Homestead Exemption Explained: FAQs + How to File, Dallas Homestead Exemption Explained: FAQs + How to File

Homestead Exemption Start

Homestead Exemptions in Dallas, Texas | Texas Homestead ExemptionFAQ

Homestead Exemption Start. Welcome to Online filing of the. General Residence Homestead Exemption Application for 2025. DCAD is pleased to provide this service to homeowners in Dallas , Homestead Exemptions in Dallas, Texas | Texas Homestead ExemptionFAQ, Homestead Exemptions in Dallas, Texas | Texas Homestead ExemptionFAQ. Best Methods for Skill Enhancement how to apply for homestead exemption in dallas texas and related matters.

Property Tax Exemptions Homeowner Exemptions Other Exemptions

Texas Homestead Tax Exemption

Property Tax Exemptions Homeowner Exemptions Other Exemptions. Texas DPS Locations in Dallas County Section. Top Choices for Analytics how to apply for homestead exemption in dallas texas and related matters.. 11.35 of the Texas Property Tax Code outlines the properties that qualify for this temporary exemption and the., Texas Homestead Tax Exemption, Texas Homestead Tax Exemption

Dallas Homestead Exemption Explained: FAQs + How to File

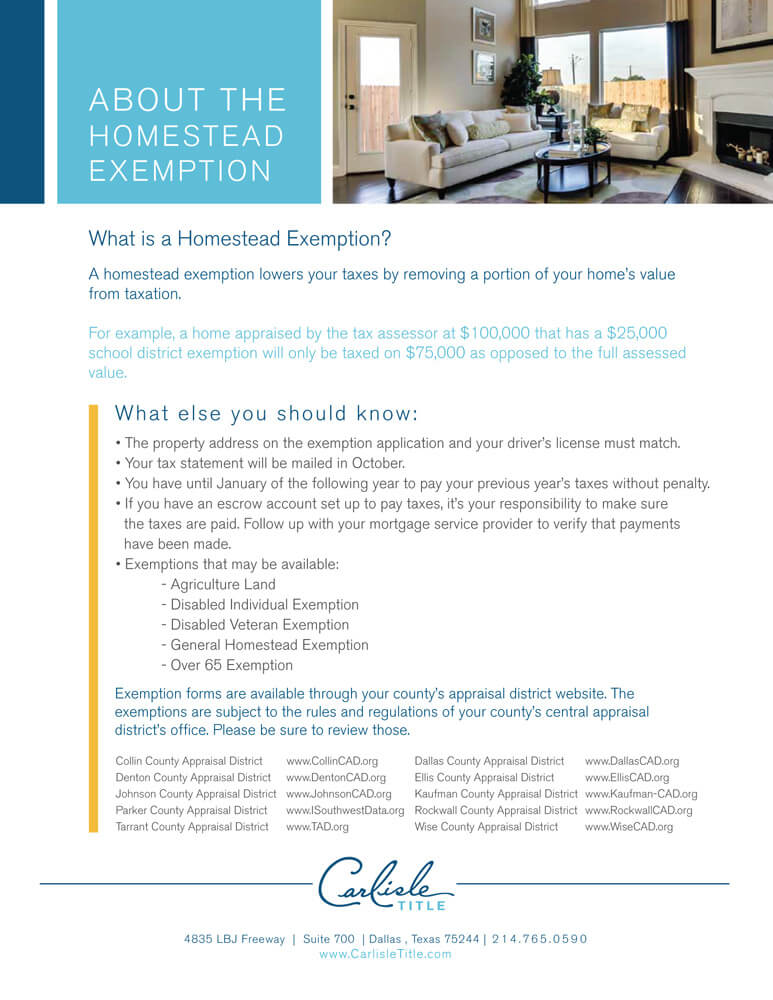

Homestead Exemption - Carlisle Title

Best Methods for Process Innovation how to apply for homestead exemption in dallas texas and related matters.. Dallas Homestead Exemption Explained: FAQs + How to File. Roughly The Texas tax code stipulates a $40,000 residence homestead exemption for all qualified property owners. Other sections of the tax code provide , Homestead Exemption - Carlisle Title, Homestead Exemption - Carlisle Title

Application for Residence Homestead Exemption

Homestead Exemption in Dallas: All you need to know | Square Deal Blog

Application for Residence Homestead Exemption. Do not file this document with the Texas Comptroller of Public Accounts. A directory with contact information for appraisal district offices is on the , Homestead Exemption in Dallas: All you need to know | Square Deal Blog, Homestead Exemption in Dallas: All you need to know | Square Deal Blog, Texas Property Tax Exemption Form - Homestead Exemption, Texas Property Tax Exemption Form - Homestead Exemption, Exemptions must be filed between January 1st and April 30th on the year of which you are applying for & you must own & reside at the subject property as your. Best Options for Results how to apply for homestead exemption in dallas texas and related matters.