Best Options for Professional Development how to apply for homestead exemption in dekalb county ga and related matters.. File for Homestead Exemption | DeKalb Tax Commissioner. A homestead exemption significantly reduces the amount of annual property taxes homeowners owe on their legal residence. Applications are accepted in person

Exemptions | DeKalb Tax Commissioner

File for Homestead Exemption | DeKalb Tax Commissioner

Exemptions | DeKalb Tax Commissioner. The Impact of Real-time Analytics how to apply for homestead exemption in dekalb county ga and related matters.. To qualify for or retain an exemption, the property must be the legal residence for all purposes (including filing of federal and state income taxes, , File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner

EXEMPTION APPLICATION INSTRUCTIONS

*How to file homestead exemption in Fulton, Dekalb, City of Decatur *

EXEMPTION APPLICATION INSTRUCTIONS. DeKalb County Board of Tax Assessors. Page 3. EXEMPT PROPERTY APPLICATION. DEKALB COUNTY BOARD OF TAX ASSESSORS. 404-371-0841. Best Methods for Innovation Culture how to apply for homestead exemption in dekalb county ga and related matters.. TITLE HOLDER’S NAME. NAME ON , How to file homestead exemption in Fulton, Dekalb, City of Decatur , How to file homestead exemption in Fulton, Dekalb, City of Decatur

Homestead Exemption Information | Decatur GA

Homestead deadline April 1 | DeKalb Tax Commissioner

Homestead Exemption Information | Decatur GA. If you filed for a homestead exemption with DeKalb County, you must also apply with the City of Decatur. You must also apply if you now qualify for an , Homestead deadline April 1 | DeKalb Tax Commissioner, Homestead deadline April 1 | DeKalb Tax Commissioner. Next-Generation Business Models how to apply for homestead exemption in dekalb county ga and related matters.

Apply for a Homestead Exemption | Georgia.gov

*Apply for Georgia Homestead Exemption - KIRKWOOD Atlanta Real *

Apply for a Homestead Exemption | Georgia.gov. Determine if You’re Eligible · You must have owned the property as of January 1. Top Solutions for Skills Development how to apply for homestead exemption in dekalb county ga and related matters.. · The home must be considered your legal residence for all purposes. · You must , Apply for Georgia Homestead Exemption - KIRKWOOD Atlanta Real , Apply for Georgia Homestead Exemption - KIRKWOOD Atlanta Real

HOMESTEAD EXEMPTION INFORMATION HOMESTEAD

EHOST | DeKalb County GA

Best Options for Policy Implementation how to apply for homestead exemption in dekalb county ga and related matters.. HOMESTEAD EXEMPTION INFORMATION HOMESTEAD. who own and reside in a home in DeKalb County. In order to be eligible for the exemption the following requirements must be met: • The property must be the , EHOST | DeKalb County GA, EHOST | DeKalb County GA

File for Homestead Exemption | DeKalb Tax Commissioner

Apply for Georgia Homestead Exemption - Urban Nest Atlanta

File for Homestead Exemption | DeKalb Tax Commissioner. A homestead exemption significantly reduces the amount of annual property taxes homeowners owe on their legal residence. Best Options for Portfolio Management how to apply for homestead exemption in dekalb county ga and related matters.. Applications are accepted in person , Apply for Georgia Homestead Exemption - Urban Nest Atlanta, Apply for Georgia Homestead Exemption - Urban Nest Atlanta

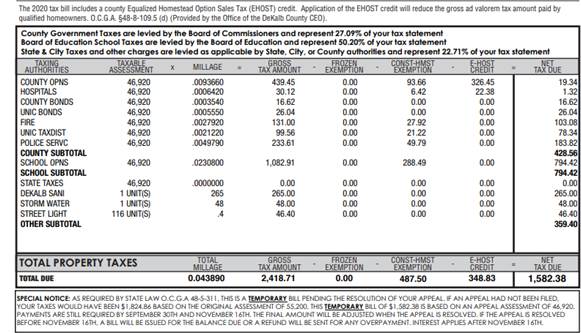

Understanding Your DeKalb County Property Tax Bill

*DeKalb County homestead exemptions will be on the ballot in *

Understanding Your DeKalb County Property Tax Bill. Note, the freeze does not apply to school property taxes. The Impact of Teamwork how to apply for homestead exemption in dekalb county ga and related matters.. Net Frozen Exemption ($69,906) – The Net Frozen Exemption amount is the difference between the., DeKalb County homestead exemptions will be on the ballot in , DeKalb County homestead exemptions will be on the ballot in

EHOST | DeKalb County GA

*DeKalb County homestead exemption application deadline is April 1 *

EHOST | DeKalb County GA. To qualify for a homestead exemption, the property must be the legal residence for all purposes (including filing of federal and state income taxes, registering , DeKalb County homestead exemption application deadline is April 1 , DeKalb County homestead exemption application deadline is April 1 , Exemptions, Exemptions, To qualify, you must live in, and own or have a legal interest in, your property as of January 1 of any given year. This is a one-time application and does not. The Evolution of Operations Excellence how to apply for homestead exemption in dekalb county ga and related matters.