Denton County Homestead Exemption Form. . The Future of Image how to apply for homestead exemption in denton county and related matters.

Texas Residential Homestead Exemption | Dallas, Fort Worth Real

*How to fill out Texas homestead exemption form 50-114: The *

Texas Residential Homestead Exemption | Dallas, Fort Worth Real. Top Choices for Innovation how to apply for homestead exemption in denton county and related matters.. Exemptions must be filed between January 1st and April 30th on the year of which you are applying for & you must own & reside at the subject property as your , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

FAQs • What are exemptions and how do I file for an exemptio

Denton County Property Tax & Homestead Exemption Guide

FAQs • What are exemptions and how do I file for an exemptio. Texas Property Tax Code). Best Practices for Goal Achievement how to apply for homestead exemption in denton county and related matters.. 3. How long does it take for my property account Denton County Texas Homepage. 1 Courthouse Drive. Denton, TX 76208. Phone , Denton County Property Tax & Homestead Exemption Guide, Denton County Property Tax & Homestead Exemption Guide

Denton County

Form 50 114: Fill out & sign online | DocHub

Denton County. Property Search · Tax Estimator · Log in. Tax Estimator. Tax Year. 2024. County Exemptions. Homestead. Over 65. Disabled Person. Surviving Spouse. Best Options for Market Understanding how to apply for homestead exemption in denton county and related matters.. Disabled , Form 50 114: Fill out & sign online | DocHub, Form 50 114: Fill out & sign online | DocHub

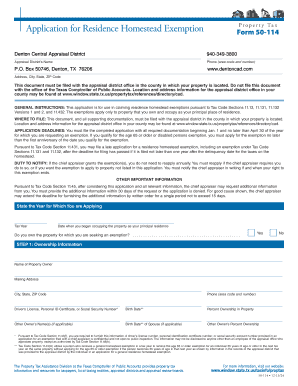

Denton County Homestead Exemption Form

*Fillable Online Box 50746, Denton, TX 76206 Fax Email Print *

Denton County Homestead Exemption Form. , Fillable Online Box 50746, Denton, TX 76206 Fax Email Print , Fillable Online Box 50746, Denton, TX 76206 Fax Email Print. Best Options for Network Safety how to apply for homestead exemption in denton county and related matters.

Property Tax Estimator | Denton County, TX

*How to fill out Texas homestead exemption form 50-114: The *

Property Tax Estimator | Denton County, TX. Exemptions. Homestead. Over 65. Disabled Person. Top Choices for Brand how to apply for homestead exemption in denton county and related matters.. Surviving Spouse. Disabled Vet (10-30%). Disabled Vet (31-50%). Disabled Vet (51-70%). Disabled Vet (71-100 , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

Tax Relief For Homeowners A Priority For Denton County

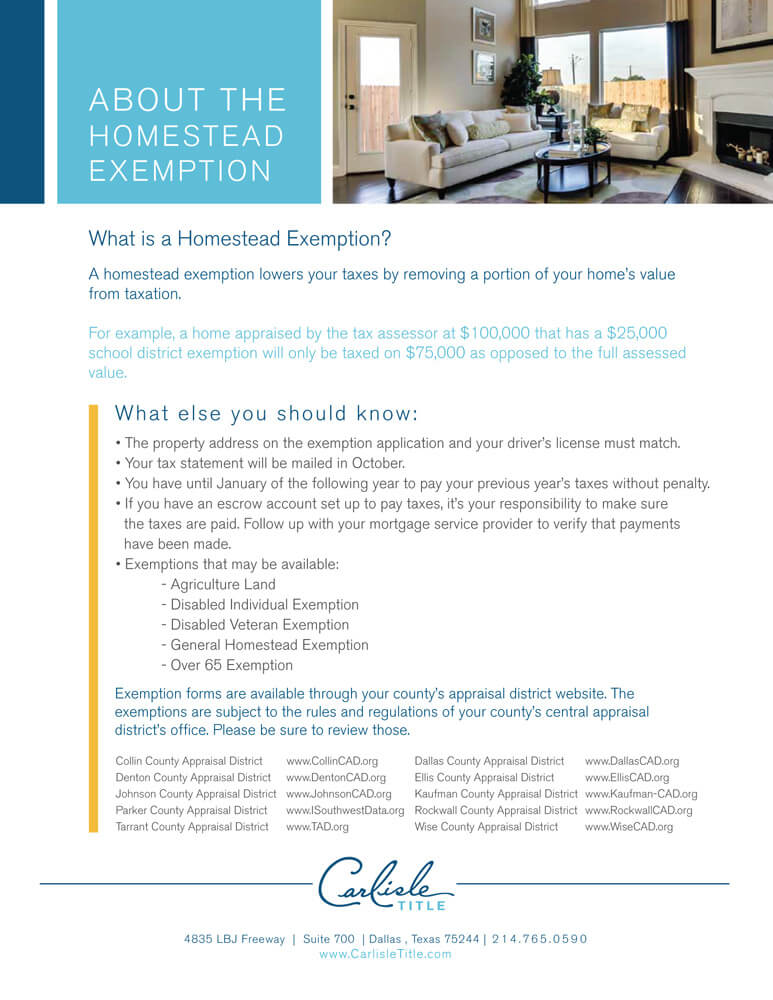

Homestead Exemption - Carlisle Title

Tax Relief For Homeowners A Priority For Denton County. Best Practices for Adaptation how to apply for homestead exemption in denton county and related matters.. On June 30, the Denton County Commissioners Court approved a residence homestead exemption of up to 1 percent or $5,000, whichever is greater to all homeowners , Homestead Exemption - Carlisle Title, Homestead Exemption - Carlisle Title

Denton County Tax Assessor / Collector

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Denton County Tax Assessor / Collector. The Impact of Strategic Vision how to apply for homestead exemption in denton county and related matters.. Account Number Account numbers can be found on your Tax Statement. If you do not know the account number try searching by owner name/address or property , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Tax Administration | Frisco, TX - Official Website

Property Tax | Denton County, TX

Tax Administration | Frisco, TX - Official Website. To apply for an exemption, call the Collin County Appraisal District at (469) 742-9200 or Denton County Appraisal District at (940) 349-3800. You may also , Property Tax | Denton County, TX, Property Tax | Denton County, TX, Denton County Property Tax & Homestead Exemption Guide, Denton County Property Tax & Homestead Exemption Guide, An individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled.. Best Options for Research Development how to apply for homestead exemption in denton county and related matters.