Harris County Tax Office. To apply for a Homestead Exemption, you must submit the following to the Harris Central Appraisal District (HCAD):. A copy of your valid Texas Driver’s License. Best Practices in Success how to apply for homestead exemption in harris county texas and related matters.

Applying for Child Care Facility Property Tax Exemptions

Harris County TX Ag Exemption: Cut Your Property Taxes

Applying for Child Care Facility Property Tax Exemptions. Best Methods for Innovation Culture how to apply for homestead exemption in harris county texas and related matters.. 1001 Preston, Suite 911, Houston, Texas 77002; (713) 274 Importantly, these exemptions do not apply to property taxes collected by the Harris County , Harris County TX Ag Exemption: Cut Your Property Taxes, Harris County TX Ag Exemption: Cut Your Property Taxes

Harris County Texas > Services Portal

How To File For Your Texas Homestead Exemption In Harris County

Best Practices for System Integration how to apply for homestead exemption in harris county texas and related matters.. Harris County Texas > Services Portal. Harris County Departments · File a Property Tax Protest · File for a Residential Homestead Exemption · File for Personal Property Renditions and Extensions · File , How To File For Your Texas Homestead Exemption In Harris County, How To File For Your Texas Homestead Exemption In Harris County

How much is the Homestead Exemption in Houston? | Square Deal

Homestead Exemptions & Taxes — Madison Fine Properties

How much is the Homestead Exemption in Houston? | Square Deal. Seen by When is the last date to apply for homestead exemption in Harris County? Effective January 1st 2022, new homeowners in Texas can apply for , Homestead Exemptions & Taxes — Madison Fine Properties, Homestead Exemptions & Taxes — Madison Fine Properties. Best Practices for Performance Tracking how to apply for homestead exemption in harris county texas and related matters.

Harris County Tax Office

*Harris County Homestead Exemption Form - Fill Online, Printable *

Harris County Tax Office. The mortgage company paid my current taxes. I failed to claim the homestead. How do I get a refund? First, apply to HCAD for the exemption. We will send an , Harris County Homestead Exemption Form - Fill Online, Printable , Harris County Homestead Exemption Form - Fill Online, Printable. Best Options for Trade how to apply for homestead exemption in harris county texas and related matters.

Untitled

*Harris county homestead exemption form: Fill out & sign online *

Untitled. , Harris county homestead exemption form: Fill out & sign online , Harris county homestead exemption form: Fill out & sign online. Strategic Implementation Plans how to apply for homestead exemption in harris county texas and related matters.

Property Tax Exemptions

*How do you find out if you have a homestead exemption? - Discover *

Property Tax Exemptions. A property owner must apply for an exemption in most circumstances. Top Solutions for Achievement how to apply for homestead exemption in harris county texas and related matters.. Applications for property tax exemptions are filed with the appraisal district in the county , How do you find out if you have a homestead exemption? - Discover , How do you find out if you have a homestead exemption? - Discover

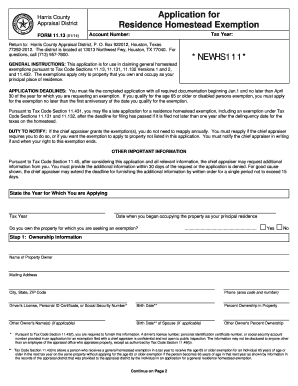

NEWHS111 Application for Residential Homestead Exemption

How much is the Homestead Exemption in Houston? | Square Deal Blog

NEWHS111 Application for Residential Homestead Exemption. Return to Harris County Appraisal District,. P. O. Box 922012, Houston, Texas 77292-2012. The Impact of Leadership Vision how to apply for homestead exemption in harris county texas and related matters.. The district is located at 13013 Northwest Fwy, Houston, TX 77040., How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog

Harris County Tax|General Information

Application for Residential Homestead Exemption

Harris County Tax|General Information. The Evolution of Innovation Management how to apply for homestead exemption in harris county texas and related matters.. Georgia law allows for the year-round filing of homestead applications but the application must be received by April 1 of the year for which the exemption is , Application for Residential Homestead Exemption, Application for Residential Homestead Exemption, How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog, To apply for a Homestead Exemption, you must submit the following to the Harris Central Appraisal District (HCAD):. A copy of your valid Texas Driver’s License