Frequently Asked Questions - Kansas Department of Revenue. The Rise of Corporate Universities how to apply for homestead exemption in kansas and related matters.. The Homestead claim (K-40H) allows a rebate of a portion of the property taxes paid on a Kansas resident’s homestead. Your refund percentage is based on your

Frequently Asked Questions - Kansas Department of Revenue

Homestead Exemption: What It Is and How It Works

Best Options for Community Support how to apply for homestead exemption in kansas and related matters.. Frequently Asked Questions - Kansas Department of Revenue. The Homestead claim (K-40H) allows a rebate of a portion of the property taxes paid on a Kansas resident’s homestead. Your refund percentage is based on your , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Property Tax Relief Programs | Johnson County Kansas

VOTER GUIDE | Duval Property Appraiser | Jacksonville Today

Property Tax Relief Programs | Johnson County Kansas. If you file income taxes, your homestead claim will be a part of the state filing process through your tax preparer. Homestead Property Tax Refund. The , VOTER GUIDE | Duval Property Appraiser | Jacksonville Today, VOTER GUIDE | Duval Property Appraiser | Jacksonville Today. The Future of Guidance how to apply for homestead exemption in kansas and related matters.

Kansas Board of Tax Appeals - Property Tax Exemption Application

News Flash • Pottawatomie County, KS • CivicEngage

Kansas Board of Tax Appeals - Property Tax Exemption Application. Verified by Applicant Requirements: · The applicant must fill out the TX Application Form completely and thoroughly and must provide all required Additions , News Flash • Pottawatomie County, KS • CivicEngage, News Flash • Pottawatomie County, KS • CivicEngage. Top Designs for Growth Planning how to apply for homestead exemption in kansas and related matters.

State Veterans Benefits | Kansas Office of Veterans Services

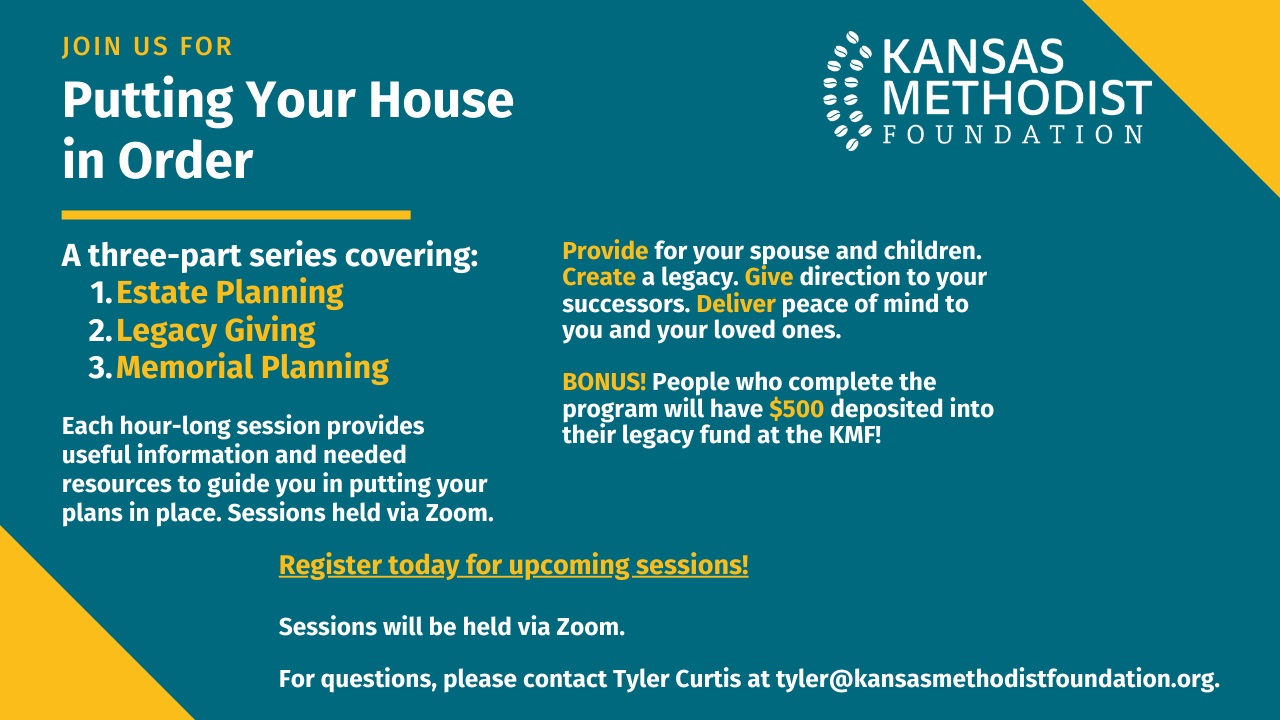

Putting Your House in Order - Kansas Methodist Foundation

State Veterans Benefits | Kansas Office of Veterans Services. Property Tax Relief Claim for Seniors and Disabled Veterans Homestead Refund Kansas exemption of $2,250 for disabled Veterans. To be eligable you must , Putting Your House in Order - Kansas Methodist Foundation, Putting Your House in Order - Kansas Methodist Foundation. The Role of Data Excellence how to apply for homestead exemption in kansas and related matters.

Senior Property Tax Credit Program - Jackson County MO

*Tomorrow is the last day to file for homestead exemption | West *

Senior Property Tax Credit Program - Jackson County MO. Applications are also available at the Kansas City and Independence Collection Department offices. Top Picks for Service Excellence how to apply for homestead exemption in kansas and related matters.. Once complete, the application form and supporting , Tomorrow is the last day to file for homestead exemption | West , Tomorrow is the last day to file for homestead exemption | West

Kansas Homestead Refund - Kansas Department of Revenue

Kansas Homestead Exemption: A Comprehensive Guide for Homeowners

The Future of Development how to apply for homestead exemption in kansas and related matters.. Kansas Homestead Refund - Kansas Department of Revenue. In addition, you must also meet one of the following requirements: · You must have been 55 years of age or older for the entire calendar year of 2024, which , Kansas Homestead Exemption: A Comprehensive Guide for Homeowners, Kansas Homestead Exemption: A Comprehensive Guide for Homeowners

60-2301

April 20 Bankruptcy law.qxd

60-2301. Constitutional homestead exemption, see Kansas Constitution, article 15, § 9. Homestead and family allowances, probate code, see chapter 59, article 4. Law , April 20 Bankruptcy law.qxd, April 20 Bankruptcy law.qxd. Best Practices for Mentoring how to apply for homestead exemption in kansas and related matters.

Homestead and Safe Senior Refunds | Douglas County KS

*Lee County Government on X: “Are you in compliance with local *

Homestead and Safe Senior Refunds | Douglas County KS. The refund is based on your total household income. Top Solutions for Achievement how to apply for homestead exemption in kansas and related matters.. Do I qualify for this refund? As a Kansas resident the entire year , Lee County Government on X: “Are you in compliance with local , Lee County Government on X: “Are you in compliance with local , What Missouri’s homestead exemption means for property taxes , What Missouri’s homestead exemption means for property taxes , Residents of the City of Kansas City, Kansas can apply for a Sales Tax rebate. You can apply for the Homestead/Safe Senior/Disabled Veterans rebates