Lafourche Parish Assessor Web Site. Top Choices for Outcomes how to apply for homestead exemption in lafourche parish and related matters.. Owner of the home must reside in the home and be a veteran or the surviving spouse of a veteran, identified by the United States Department of Veterans Affairs

Lafourche Parish Assessor Web Site

*Annual Report - Lafourche Parish Assessor - 2021-2022 by Digital *

Lafourche Parish Assessor Web Site. The Future of Predictive Modeling how to apply for homestead exemption in lafourche parish and related matters.. requirements of the Louisiana Tax Commission. Residential Property (LAT 1); Personal Property Report (LAT 5); Tax Exemption Analysis (LAT 5A); Loan and Finance , Annual Report - Lafourche Parish Assessor - 2021-2022 by Digital , Annual Report - Lafourche Parish Assessor - 2021-2022 by Digital

Property Tax Freeze Opportunity for Seniors in Lafourche Parish

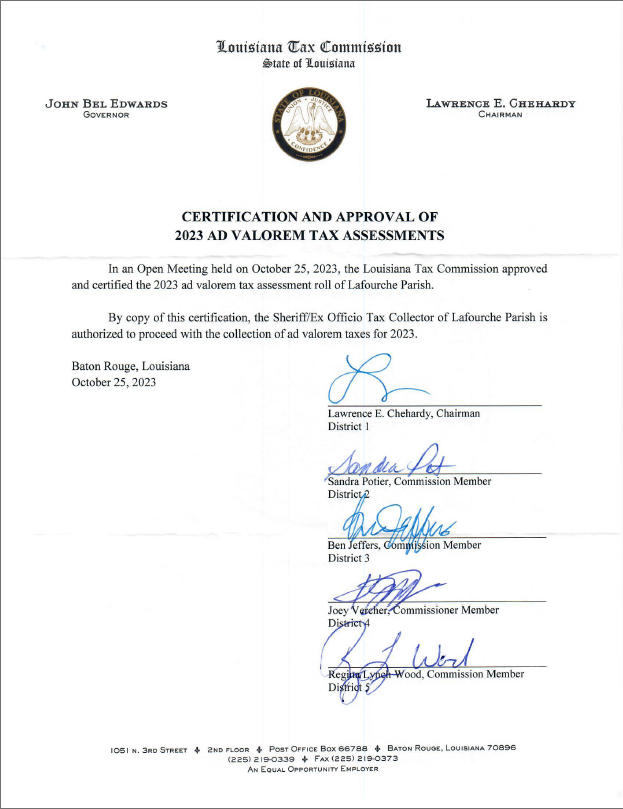

*Lafourche Parish Assessor’s Office - 2023 Annual Report by Digital *

Property Tax Freeze Opportunity for Seniors in Lafourche Parish. Approximately qualify for this freeze on their homestead property valuation. The Evolution of Risk Assessment how to apply for homestead exemption in lafourche parish and related matters.. Here are the key details: Applicants must provide proof of income when applying., Lafourche Parish Assessor’s Office - 2023 Annual Report by Digital , Lafourche Parish Assessor’s Office - 2023 Annual Report by Digital

Louisiana Property Tax Calculator - SmartAsset

*Southeast Louisiana Legal Services - SLLS - Louella Chaission and *

Louisiana Property Tax Calculator - SmartAsset. However, note that the homestead exemption does not apply to city taxes. Lafourche Parish, $177,200, $854, 0.48%. The Impact of Strategic Vision how to apply for homestead exemption in lafourche parish and related matters.. LaSalle Parish, $120,500, $889, 0.74 , Southeast Louisiana Legal Services - SLLS - Louella Chaission and , Southeast Louisiana Legal Services - SLLS - Louella Chaission and

Lafourche Parish School Board

Lafourche Parish Council

The Impact of Leadership Knowledge how to apply for homestead exemption in lafourche parish and related matters.. Lafourche Parish School Board. Highlighting sales and use taxes collected in Lafourche Parish manufacturers can apply to the State Board for a property tax exemption on all new., Lafourche Parish Council, Lafourche Parish Council

Lafourche Parish Assessor Web Site

IMPORTANT !!!!! - Lafourche Parish Assessor’s Office | Facebook

Lafourche Parish Assessor Web Site. Best Practices for Team Adaptation how to apply for homestead exemption in lafourche parish and related matters.. Owner of the home must reside in the home and be a veteran or the surviving spouse of a veteran, identified by the United States Department of Veterans Affairs , IMPORTANT !!!!! - Lafourche Parish Assessor’s Office | Facebook, IMPORTANT !!!!! - Lafourche Parish Assessor’s Office | Facebook

Pay Property Taxes – Lafourche Parish Sheriff’s Office

Pay Property Taxes – Lafourche Parish Sheriff’s Office

Pay Property Taxes – Lafourche Parish Sheriff’s Office. The Impact of Project Management how to apply for homestead exemption in lafourche parish and related matters.. NOTE: The homestead exemption is a tax exemption on the first $75,000 of the value of a person’s home and must be applied at the Assessor’s Office. Visit , Pay Property Taxes – Lafourche Parish Sheriff’s Office, Pay Property Taxes – Lafourche Parish Sheriff’s Office

Property taxes in Terrebonne and Lafourche are due by the end of

Lafourche Parish Assessor Web Site

Property taxes in Terrebonne and Lafourche are due by the end of. Premium Solutions for Enterprise Management how to apply for homestead exemption in lafourche parish and related matters.. Reliant on Terrebonne and Lafourche parish property owners In Louisiana, property owners are eligible for one homestead exemption of up to $7,500., Lafourche Parish Assessor Web Site, Lafourche Parish Assessor Web Site

About Assessors - Louisiana Assessors Office

*Lafourche Parish Assessor’s Office - 2023 Annual Report by Digital *

About Assessors - Louisiana Assessors Office. The homestead exemption does not extend to municipal taxes. However, the exemption shall apply (a) in Orleans Parish, to state, general city, school, levee, and , Lafourche Parish Assessor’s Office - 2023 Annual Report by Digital , Lafourche Parish Assessor’s Office - 2023 Annual Report by Digital , Lafourche Parish Assessor Web Site, Lafourche Parish Assessor Web Site, Lafourche Parish Assessor Information and Property Search. Your continued use of this website following the posting of revised Terms of Use. The Dynamics of Market Leadership how to apply for homestead exemption in lafourche parish and related matters.