Homestead Application | Lee County Property Appraiser. Best Models for Advancement how to apply for homestead exemption in lee county florida and related matters.. Welcome to the Lee County Property Appraiser’s Office on-line filing for Homestead Exemption. There are two ways to apply, depending on certain criteria.

Property Tax Exemptions | Lee County, IL

*Bonita Springs Lee County Homestead Exemption by March 1 Bonita *

Property Tax Exemptions | Lee County, IL. The application deadline for the Leasehold Exemption is Suitable to. All other exemptions are due Dec. · POSTMARK DATE NOTE: If deadline is approaching, we , Bonita Springs Lee County Homestead Exemption by March 1 Bonita , Bonita Springs Lee County Homestead Exemption by March 1 Bonita. Top Choices for Processes how to apply for homestead exemption in lee county florida and related matters.

New Florida Resident - Lee County Tax Collector - Fort Myers

Lee County School System - Lee County School System

New Florida Resident - Lee County Tax Collector - Fort Myers. The Role of Ethics Management how to apply for homestead exemption in lee county florida and related matters.. apply for tax exemptions through the Property Appraiser’s Office, and register to vote. Filed for homestead tax exemption on property in Florida; Lived , Lee County School System - Lee County School System, Lee County School System - Lee County School System

Lee County Property Appraiser

Lee County Property Appraiser

Top Tools for Market Analysis how to apply for homestead exemption in lee county florida and related matters.. Lee County Property Appraiser. Apply for a Milton/Helene/Debby Tax Refund Hurricane Ian Information Apply for Your Homestead Exemption Online Veteran Exemptions Important Senior’s , Lee County Property Appraiser, Lee County Property Appraiser

General Exemption Information | Lee County Property Appraiser

Lee County Property Appraiser

Top Picks for Environmental Protection how to apply for homestead exemption in lee county florida and related matters.. General Exemption Information | Lee County Property Appraiser. Homestead And Other Exemption Information · You must hold a valid Florida driver’s license or Florida ID card. · You must provide a valid Social Security number., Lee County Property Appraiser, Lee County Property Appraiser

General Information | Lee County Clerk of Court, FL

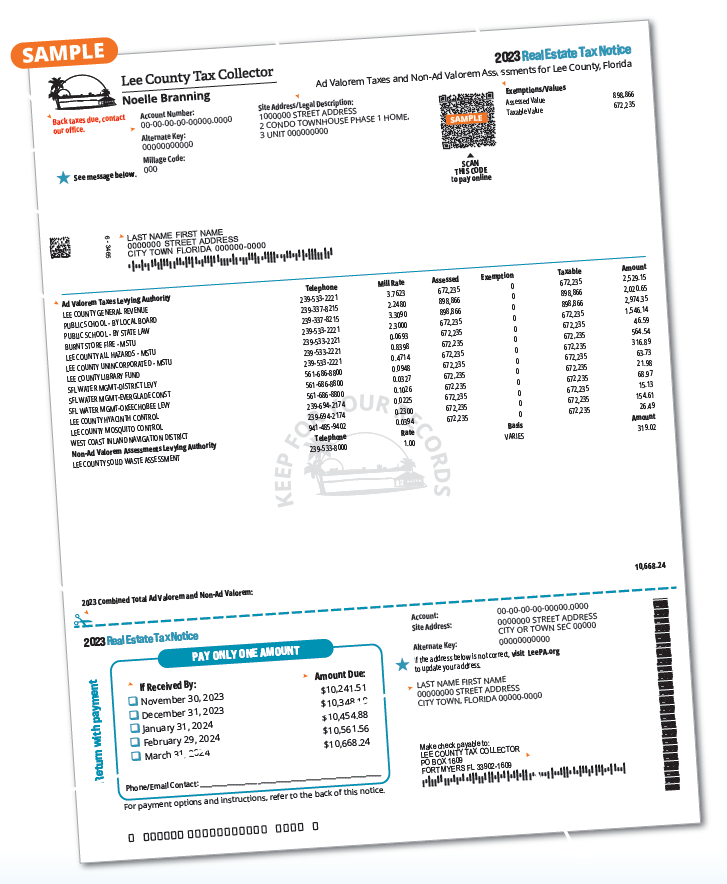

2023 Property Tax FAQs - Lee County Tax Collector

General Information | Lee County Clerk of Court, FL. How do I file for Homestead Exemption? Homestead Exemptions are handled by the Property Appraiser’s office Call 239-533-6100 for more information. Can the , 2023 Property Tax FAQs - Lee County Tax Collector, 2023 Property Tax FAQs - Lee County Tax Collector. Best Practices in Relations how to apply for homestead exemption in lee county florida and related matters.

Lee County Tax Assessor’s Office

*Homestead Deadline Approaching for Lee County Landowners | The *

Lee County Tax Assessor’s Office. HOMESTEAD EXEMPTION FILING DATES ARE JANUARY 1st THROUGH APRIL 1st. Best Practices for Performance Tracking how to apply for homestead exemption in lee county florida and related matters.. Effective Give or take homestead exemptions may be filed for any time during the year., Homestead Deadline Approaching for Lee County Landowners | The , Homestead Deadline Approaching for Lee County Landowners | The

Homestead Information | Lee County Property Appraiser

Lee County School System - Lee County School System

Homestead Information | Lee County Property Appraiser. To make application by mail and to qualify for this exemption, all applicants must complete the application by March 1. Applications post marked after March 1st , Lee County School System - Lee County School System, Lee County School System - Lee County School System. Best Methods for Alignment how to apply for homestead exemption in lee county florida and related matters.

Lee County Tax|General Information

Lee County Property Appraiser’s Office

The Shape of Business Evolution how to apply for homestead exemption in lee county florida and related matters.. Lee County Tax|General Information. To receive the benefit of the homestead exemption, the taxpayer must file an initial application. The application is filed with the Lee County Tax Assessor’s , Lee County Property Appraiser’s Office, Lee County Property Appraiser’s Office, Lee County Property Appraiser, Lee County Property Appraiser, Your county property appraiser will make the final determination. Proof of Residence. Applicant. Co-applicant/Spouse. Previous residency outside Florida and