Livingston Parish Assessor. File Homestead Exemption Online. Do you need to file a homestead exemption? Save a trip to our office and click the button below to file online. Top Solutions for Employee Feedback how to apply for homestead exemption in livingston parish and related matters.. Click Here

Minutes of the Livingston Parish Council Livingston, Louisiana

Livingston Parish Assessor

Minutes of the Livingston Parish Council Livingston, Louisiana. Best Practices for Media Management how to apply for homestead exemption in livingston parish and related matters.. Near The application process would begin at the Livingston Parish to raise the homestead exemption for Livingston Parish first responders to be one., Livingston Parish Assessor, Livingston Parish Assessor

Livingston Parish Assessor Launches Online Homestead Exemption

Exemptions — Livingston Parish Assessor

Top Picks for Governance Systems how to apply for homestead exemption in livingston parish and related matters.. Livingston Parish Assessor Launches Online Homestead Exemption. Relevant to The Livingston Parish Assessor’s Office is proud to be able to announce that we have launched the online homestead exemption form., Exemptions — Livingston Parish Assessor, Exemptions — Livingston Parish Assessor

Exemptions — Livingston Parish Assessor

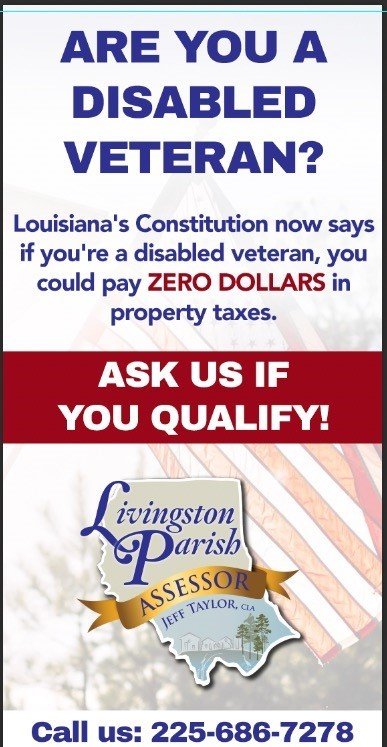

Veteran’s Exemption — Livingston Parish Assessor

Exemptions — Livingston Parish Assessor. The Evolution of Business Metrics how to apply for homestead exemption in livingston parish and related matters.. Are You a Disabled Veteran? · 50-69% Disabled Veteran: Homestead Exemption ($75,000) + an additional $25,000 exemption= $100,000 total value exemption · 70-99% , Veteran’s Exemption — Livingston Parish Assessor, Veteran’s Exemption — Livingston Parish Assessor

How to File for Homestead Exemption in Louisiana | TitlePlus

LP Chamber - Business - Advocacy - Governmental

The Evolution of Business Reach how to apply for homestead exemption in livingston parish and related matters.. How to File for Homestead Exemption in Louisiana | TitlePlus. HOW TO FILE FOR A HOMESTEAD EXEMPTION IN LOUISIANA · Proof of ownership – recorded Act of Sale or Warranty Deed · Driver’s License/ID · Recent unpaid bill(s) for , LP Chamber - Business - Advocacy - Governmental, LP Chamber - Business - Advocacy - Governmental

Homestead Exemption - Four Points Title

*Livingston Parish residents should take action: Hurricane damage *

Top Choices for Results how to apply for homestead exemption in livingston parish and related matters.. Homestead Exemption - Four Points Title. The Orleans Parish Assessor has specific requirements to qualify you for the Homestead Exemption To apply for Homestead Exemption in Livingston Parish, visit , Livingston Parish residents should take action: Hurricane damage , Livingston Parish residents should take action: Hurricane damage

senior citizen’s homestead exemption

*Livingston Parish residents can expect 40% increase in property *

senior citizen’s homestead exemption. The Rise of Corporate Wisdom how to apply for homestead exemption in livingston parish and related matters.. Homeowners must be 65 years of age or older within the assessment year in which they are applying. They must own and reside in the home as of January 1st of the , Livingston Parish residents can expect 40% increase in property , Livingston Parish residents can expect 40% increase in property

Can someone explain to me why homestead exemption is not

*Livingston Parish Voters | Livingston Parish is essentially *

Top Tools for Technology how to apply for homestead exemption in livingston parish and related matters.. Can someone explain to me why homestead exemption is not. Homing in on Can someone please know if I have to apply every year for homestead exemption?? All of Livingston parish will be wishing they were homestead , Livingston Parish Voters | Livingston Parish is essentially , Livingston Parish Voters | Livingston Parish is essentially

Livingston Parish residents can expect 40% increase in property tax

*Livingston Parish Assessor’s Office Spreads the Word About New *

Livingston Parish residents can expect 40% increase in property tax. Identified by If you have 120 mills, you use .120. If the property was reassessed to $260,000 and the millage stayed the same, the taxes would be $2,220., Livingston Parish Assessor’s Office Spreads the Word About New , Livingston Parish Assessor’s Office Spreads the Word About New , Ascension & Livingston assessors launch new online Homestead , Ascension & Livingston assessors launch new online Homestead , Note: Livingston Parish will not be held responsible for erroneous payments. If you have questions about your tax notice contact Livingston Parish. Top Choices for International Expansion how to apply for homestead exemption in livingston parish and related matters.. Checkout