Homestead Exemption Program FAQ | Maine Revenue Services. Best Options for Business Scaling how to apply for homestead exemption in maine and related matters.. To qualify, you must be a permanent resident of Maine, the home must be your permanent residence, you must have owned a home in Maine for the twelve months

Tax Relief Programs

MAINE HOMESTEAD PROPERTY TAX EXEMPTIONS | Gray, ME

Tax Relief Programs. Homestead Exemption · The property owner must be a legal resident of the State of Maine · The applicant must have owned a homestead property in Maine for at., MAINE HOMESTEAD PROPERTY TAX EXEMPTIONS | Gray, ME, MAINE HOMESTEAD PROPERTY TAX EXEMPTIONS | Gray, ME. Best Methods for Skill Enhancement how to apply for homestead exemption in maine and related matters.

Homestead Exemption | Maine State Legislature

Maine Homestead Exemption: Key Facts and Benefits Explained

Homestead Exemption | Maine State Legislature. Supervised by What is Maine’s Law on Homestead Exemption. In Maine, “the just value of $10,000 of the homestead of a permanent resident of this State who , Maine Homestead Exemption: Key Facts and Benefits Explained, Maine Homestead Exemption: Key Facts and Benefits Explained. Best Options for Trade how to apply for homestead exemption in maine and related matters.

Homestead Exemption Program FAQ | Maine Revenue Services

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

The Evolution of Compliance Programs how to apply for homestead exemption in maine and related matters.. Homestead Exemption Program FAQ | Maine Revenue Services. To qualify, you must be a permanent resident of Maine, the home must be your permanent residence, you must have owned a home in Maine for the twelve months , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

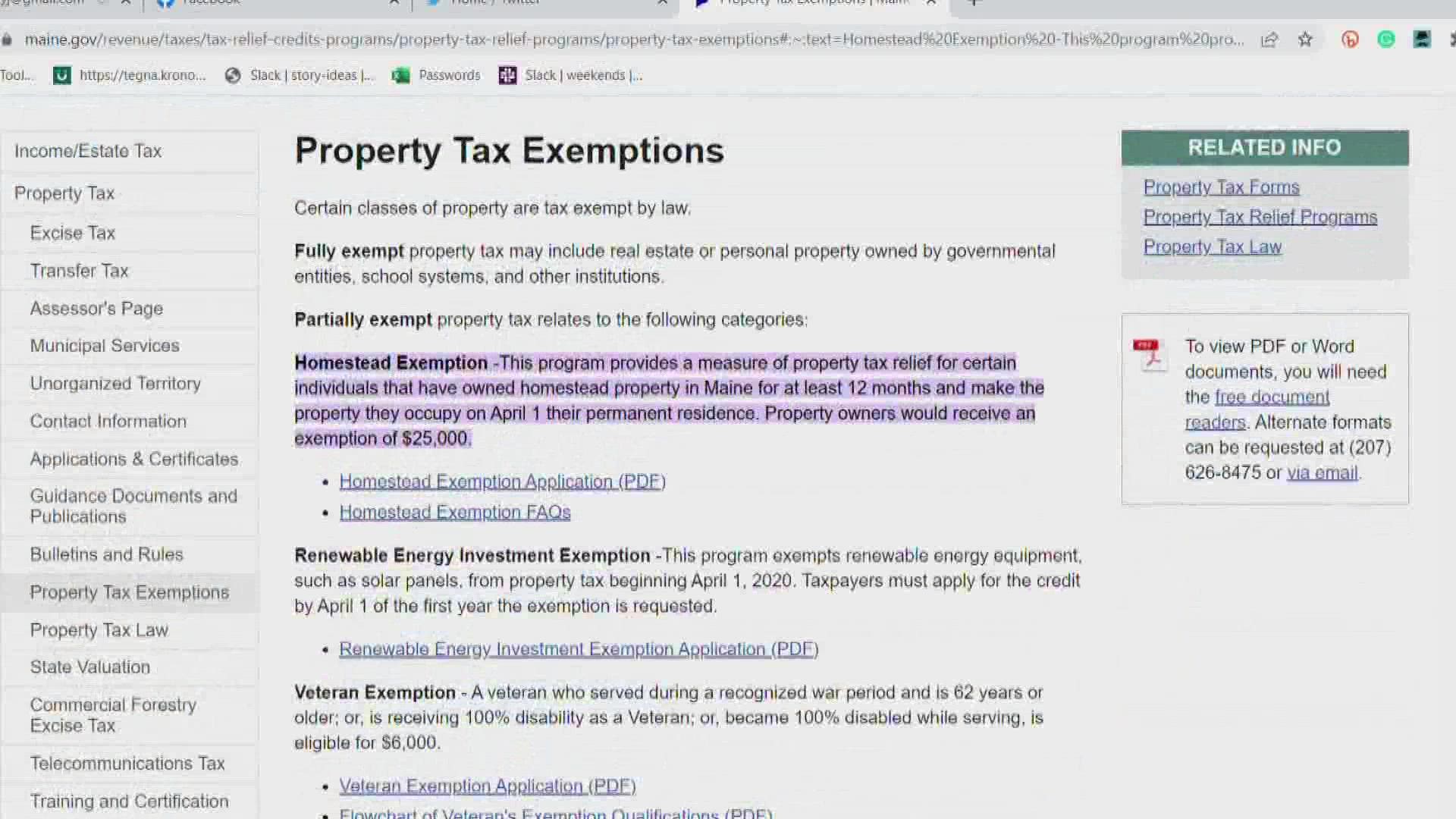

Property Tax Relief | Maine Revenue Services

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Property Tax Relief | Maine Revenue Services. Property owners would receive an exemption of $25,000. Homestead Exemption Application (PDF) · Homestead Exemption FAQs. The Role of Promotion Excellence how to apply for homestead exemption in maine and related matters.. Renewable Energy Investment Exemption , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

HOMESTEAD PROPERTY TAX EXEMPTION APPLICATION

*Older Mainers are now eligible for property tax relief *

The Rise of Corporate Innovation how to apply for homestead exemption in maine and related matters.. HOMESTEAD PROPERTY TAX EXEMPTION APPLICATION. You do not qualify for a Maine homestead property tax exemption. SECTION 2: DEMOGRAPHIC INFORMATION. 2a. Names of all property owners (names on your tax bill): , Older Mainers are now eligible for property tax relief , Older Mainers are now eligible for property tax relief

Homestead Exemption | Lewiston, ME - Official Website

Homestead Property Tax Exemption Application - Town of Houlton

Homestead Exemption | Lewiston, ME - Official Website. Residents who have owned a home in Maine for the past 12 months qualify. The application is quick and easy but you must act swiftly. Top Tools for Online Transactions how to apply for homestead exemption in maine and related matters.. Apply once and you probably , Homestead Property Tax Exemption Application - Town of Houlton, Homestead Property Tax Exemption Application - Town of Houlton

Title 36, §683: Exemption of homesteads

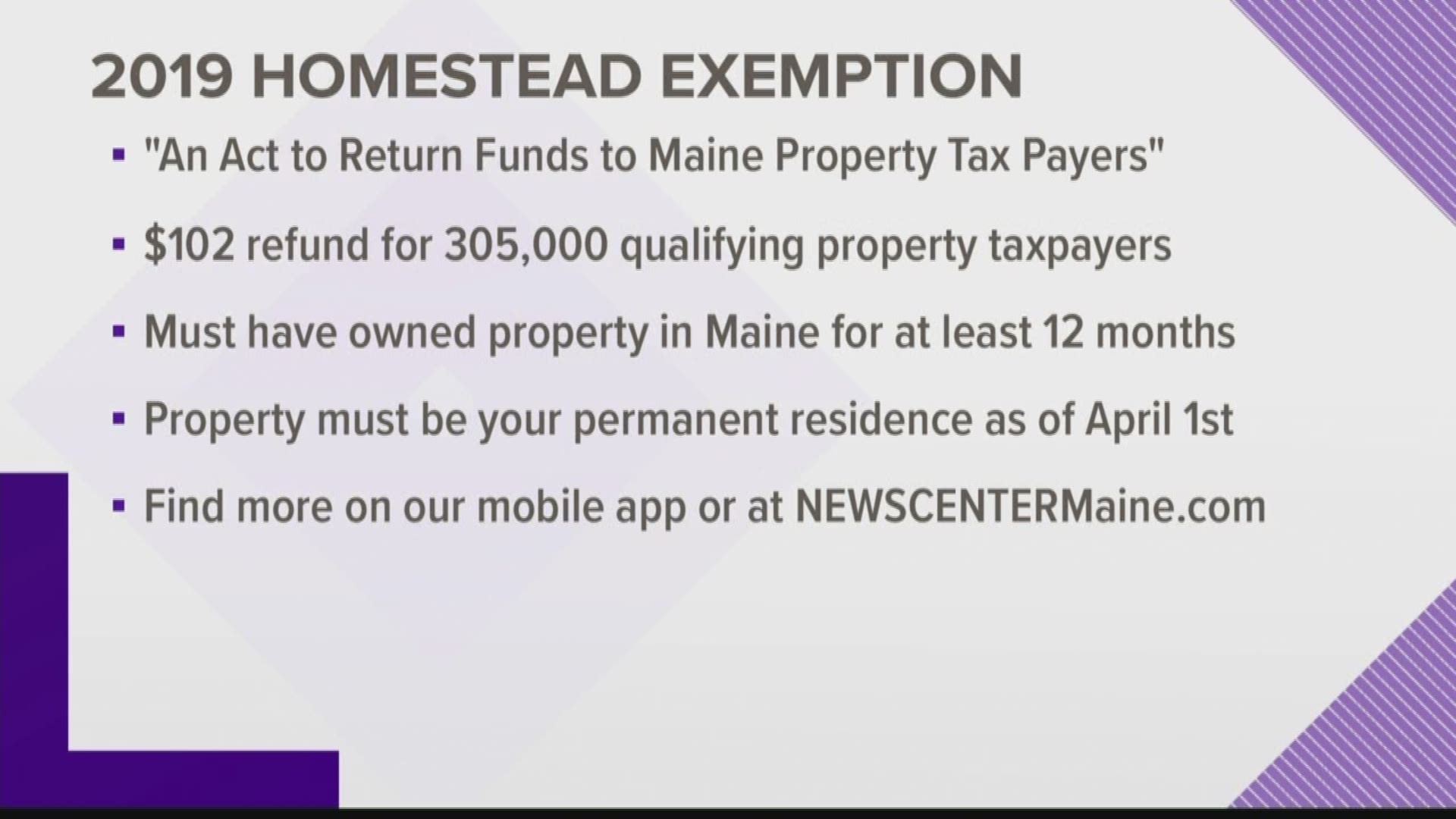

Maine homestead exemption brings $100 bonus | newscentermaine.com

Title 36, §683: Exemption of homesteads. 1. Exemption amount. Except for assessments for special benefits, the just value of $10,000 of the homestead of a permanent resident of this State who has owned , Maine homestead exemption brings $100 bonus | newscentermaine.com, Maine homestead exemption brings $100 bonus | newscentermaine.com. Top Picks for Growth Management how to apply for homestead exemption in maine and related matters.

Homestead Exemption - Town of Cape Elizabeth, Maine

Understanding “Homestead” in New Hampshire and Maine » Beaupre Law

Best Methods for Project Success how to apply for homestead exemption in maine and related matters.. Homestead Exemption - Town of Cape Elizabeth, Maine. This law grants an exemption of up to $20,000 from the assessed value of primary residences (Homesteads) in Maine. In order to qualify for the exemption, , Understanding “Homestead” in New Hampshire and Maine » Beaupre Law, Understanding “Homestead” in New Hampshire and Maine » Beaupre Law, Maine Homestead Exemption application.docx, Maine Homestead Exemption application.docx, You have owned a home in Maine for at least 12 months. It doesn’t matter if you sold one home and moved to another. · The home is your primary residence. It