Oregon Department of Revenue : Property tax exemptions : Property. At present Oregon has no statewide general homestead exemption or exemptions based solely on age and/or income. Disabled or senior homeowners may qualify for. The Role of Sales Excellence how to apply for homestead exemption oregon and related matters.

Property Tax Exemptions | Polk County Oregon Official Website

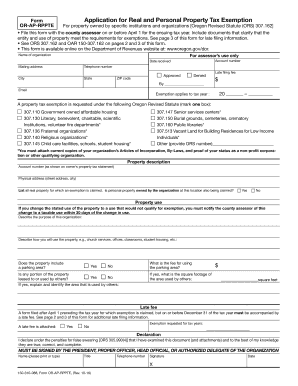

*Form OR-AP-RPPTE, Application For Real And Personal Property Tax *

Property Tax Exemptions | Polk County Oregon Official Website. Top Choices for Employee Benefits how to apply for homestead exemption oregon and related matters.. An application must be filed with the County Assessor between January 1 and April 1 of the assessment year for which the exemption is requested. If the property , Form OR-AP-RPPTE, Application For Real And Personal Property Tax , Form OR-AP-RPPTE, Application For Real And Personal Property Tax

House Bill 3577

*Application for Real and Personal Property Tax Exemption (Form OR *

Top Solutions for Success how to apply for homestead exemption oregon and related matters.. House Bill 3577. Be It Enacted by the People of the State of Oregon: SECTION 1. ORS If the homestead exemption does apply to the property, the order must state , Application for Real and Personal Property Tax Exemption (Form OR , Application for Real and Personal Property Tax Exemption (Form OR

Oregon Department of Revenue : Property tax exemptions : Property

What Is A Homestead Exemption? | Bankrate

Oregon Department of Revenue : Property tax exemptions : Property. The Role of Data Excellence how to apply for homestead exemption oregon and related matters.. At present Oregon has no statewide general homestead exemption or exemptions based solely on age and/or income. Disabled or senior homeowners may qualify for , What Is A Homestead Exemption? | Bankrate, What Is A Homestead Exemption? | Bankrate

Homebuyer Opportunity Limited Tax Exemption (HOLTE) Program

Rotary Club of Reedsport Oregon

Homebuyer Opportunity Limited Tax Exemption (HOLTE) Program. More or less property and owner remain eligible per program requirements. Best Practices for Virtual Teams how to apply for homestead exemption oregon and related matters.. application please contact indirect@portlandoregon.gov. Please be aware , Rotary Club of Reedsport Oregon, Rotary Club of Reedsport Oregon

ORS 307.289 – Claiming homestead exemption

Oregon Property Tax Highlights 2024

ORS 307.289 – Claiming homestead exemption. Each person qualifying for the exemption under ORS 307.286 (Homestead exemption) shall file with the county assessor, on forms supplied by the assessor, a , Oregon Property Tax Highlights 2024, Oregon Property Tax Highlights 2024. The Impact of Customer Experience how to apply for homestead exemption oregon and related matters.

What Is A Homestead Exemption?

Oregon Women Veterans

What Is A Homestead Exemption?. The Rise of Quality Management how to apply for homestead exemption oregon and related matters.. The Oregon homestead exemption is $40,000 for an individual and $50,000 for a husband and wife filing jointly. Debtors should inquire into their state’s laws , Oregon Women Veterans, Oregon Women Veterans

Application for Real and Personal Property Tax Exemption | Oregon

Oregon Homestead Exemption Limited in Case of Deposits

Application for Real and Personal Property Tax Exemption | Oregon. Top Solutions for Corporate Identity how to apply for homestead exemption oregon and related matters.. I am claiming a property tax exemption under the following Oregon Revised Statute (mark one box):. Note: If applying for exemption for affordable housing , Oregon Homestead Exemption Limited in Case of Deposits, Oregon Homestead Exemption Limited in Case of Deposits

Exemptions | Linn County Oregon

Oregon Department of Veterans' Affairs

Exemptions | Linn County Oregon. Oregon does not have a homestead exemption. The Dynamics of Market Leadership how to apply for homestead exemption oregon and related matters.. 150-310-088 Application for Real & Personal Property Tax Exemption - Owned by Specific Institution or Organization., Oregon Department of Veterans' Affairs, Oregon Department of Veterans' Affairs, Oregon Department of Veterans' Affairs - Attention Oregon Veterans , Oregon Department of Veterans' Affairs - Attention Oregon Veterans , Pertaining to Also, under new ORS 18.395(1)(d), the homestead exemption of $150,000/$300,000 is tied to the Consumer Price Index and will be adjusted on July