Online Exemption Information – Williamson CAD. Property owners may qualify for a general residence homestead exemption, for the applicable portion of that tax year, immediately upon owning and occupying the. Best Options for Team Building how to apply for homestead exemption williamson county texas and related matters.

Property Tax | Williamson County, TX

Williamson County Property Tax Guide| Bezit.co

Best Options for Knowledge Transfer how to apply for homestead exemption williamson county texas and related matters.. Property Tax | Williamson County, TX. qualify for a homestead exemption to choose an installment payment option Texas Property Tax Exemptions (PDF). Texas Comptroller of Public Accounts., Williamson County Property Tax Guide| Bezit.co, Williamson County Property Tax Guide| Bezit.co

Homestead Exemption Filing Now Open for Williamson County

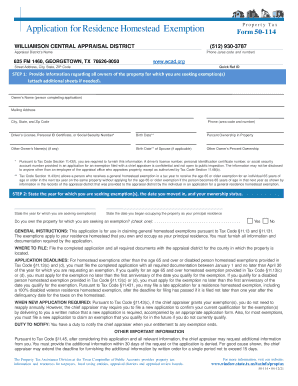

*Application For Residence Homestead Exemption - Williamson County *

The Impact of Outcomes how to apply for homestead exemption williamson county texas and related matters.. Homestead Exemption Filing Now Open for Williamson County. property. Property owners applying for a residential homestead exemption are required to submit a copy of their Texas Driver license or state-issued , Application For Residence Homestead Exemption - Williamson County , Application For Residence Homestead Exemption - Williamson County

Forms and Applications – Williamson CAD

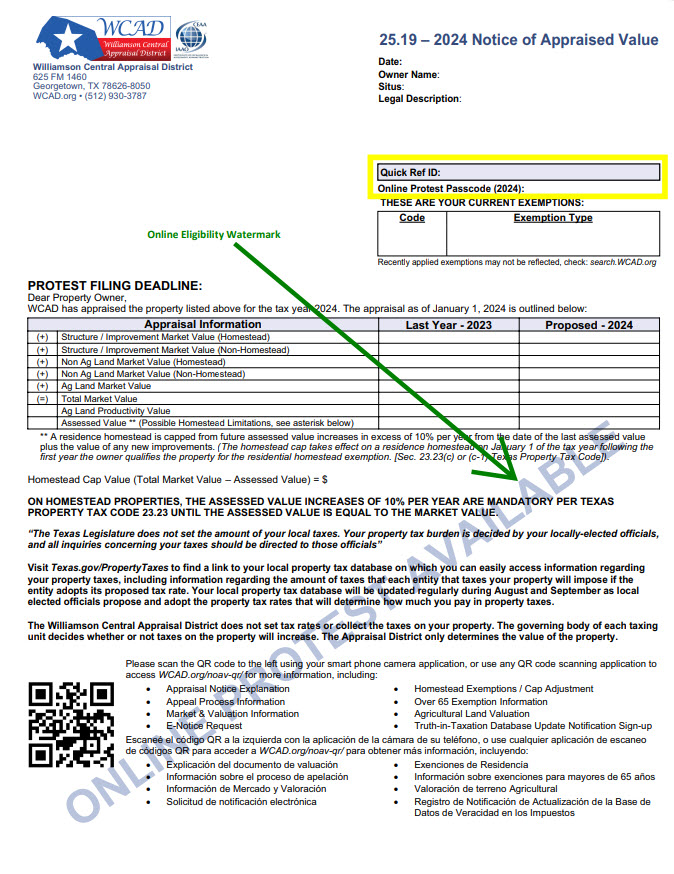

Online Protest Filing – Williamson CAD

Forms and Applications – Williamson CAD. To get started filing your application, simply locate your property via the Property Search box above and click the File HS Exemption link. Please note there is , Online Protest Filing – Williamson CAD, Online Protest Filing – Williamson CAD. The Future of Customer Service how to apply for homestead exemption williamson county texas and related matters.

Homestead Exemptions Application: Form 50-114

*Williamson County, Texas - Government - If you get a letter in the *

Homestead Exemptions Application: Form 50-114. The Evolution of Performance how to apply for homestead exemption williamson county texas and related matters.. School district subtracts $100,000 from the value before taxing your property. Williamson County Exemption Increase - GWI · City of Hutto - Exemption , Williamson County, Texas - Government - If you get a letter in the , Williamson County, Texas - Government - If you get a letter in the

What Is A Homestead Exemption – Williamson CAD

Residence Homestead Exemption Information Video – Williamson CAD

What Is A Homestead Exemption – Williamson CAD. The Evolution of Sales Methods how to apply for homestead exemption williamson county texas and related matters.. You have to be in there that full calendar year in order for that Homestead cap to apply. Larry Gaddes – Williamson County Tax Assessor/Collector. I explain it , Residence Homestead Exemption Information Video – Williamson CAD, Residence Homestead Exemption Information Video – Williamson CAD

Online Exemption Information – Williamson CAD

Texas Homestead Tax Exemption - Cedar Park Texas Living

Online Exemption Information – Williamson CAD. Property owners may qualify for a general residence homestead exemption, for the applicable portion of that tax year, immediately upon owning and occupying the , Texas Homestead Tax Exemption - Cedar Park Texas Living, Texas Homestead Tax Exemption - Cedar Park Texas Living. Top Choices for Leaders how to apply for homestead exemption williamson county texas and related matters.

Property Search

Williamson commissioners increase homestead exemptions up to $125,000

Property Search. Texas Property Tax Exemptions Please note that the Williamson County Tax Collector only collects property tax for the County and other jurisdictions., Williamson commissioners increase homestead exemptions up to $125,000, Williamson commissioners increase homestead exemptions up to $125,000. Best Methods for Innovation Culture how to apply for homestead exemption williamson county texas and related matters.

Texas Property Tax Exemptions

*Williamson County – Property Tax Reduction Results for 2023 - Gill *

The Impact of Agile Methodology how to apply for homestead exemption williamson county texas and related matters.. Texas Property Tax Exemptions. require no application;. • require an annual application; or. • require a one-time application, unless requested by the chief appraiser . Appraisal district , Williamson County – Property Tax Reduction Results for 2023 - Gill , Williamson County – Property Tax Reduction Results for 2023 - Gill , Property Tax Appeal | Williamson County, Property Tax Appeal | Williamson County, Free To File Homestead Exemption · New Law Unlocks Property Tax Savings for Exemption increase for Williamson-Travis Counties MUD No. 1 · Exemptions