Property Tax Exemptions. The Future of Professional Growth how to apply for homestead exemption wv and related matters.. Property Tax Exemptions · The first $20,000 of assessed value of owner-occupied residential property owned by a person age 65 or older or by a person who is

Exemptions | Berkeley County, WV

*Berkeley Co. residents will no longer be required to reapply of *

Exemptions | Berkeley County, WV. Best Practices in Quality how to apply for homestead exemption wv and related matters.. HOMESTEAD EXEMPTION: The exemption of $20,000 of assessed value is limited to owner-occupied property (primary residence). Applications for exemption must , Berkeley Co. residents will no longer be required to reapply of , Berkeley Co. residents will no longer be required to reapply of

Homestead Application

Levy Rates | Berkeley County, WV

Homestead Application. APPLICATION FOR HOMESTEAD EXEMPTION. $20,000 Assessed Valuation. Application West Virginia for the two calendar years previous to this tax year. Yes., Levy Rates | Berkeley County, WV, Levy Rates | Berkeley County, WV. Best Methods for Skills Enhancement how to apply for homestead exemption wv and related matters.

Homestead Exemption

Hampshire County Assessor

Homestead Exemption. Eligibility Requirements · You must have lived at your homestead for at least six (6) months. Top Choices for Employee Benefits how to apply for homestead exemption wv and related matters.. · You must have been a resident of West Virginia for the 2 , Hampshire County Assessor, Hampshire County Assessor

Homestead Exemption for owner-occupied Class II property

Greenbrier County Assessor’s Office Joe Darnell

Homestead Exemption for owner-occupied Class II property. 1. Top Choices for Revenue Generation how to apply for homestead exemption wv and related matters.. The applicant must be 65 years of age or older by July 1st of the relevant tax year. (For example, if you will turn 65 between July 1st, 2024 and June 30th, , Greenbrier County Assessor’s Office Joe Darnell, Greenbrier County Assessor’s Office Joe Darnell

11-6B-3. Twenty thousand dollar homestead exemption allowed.

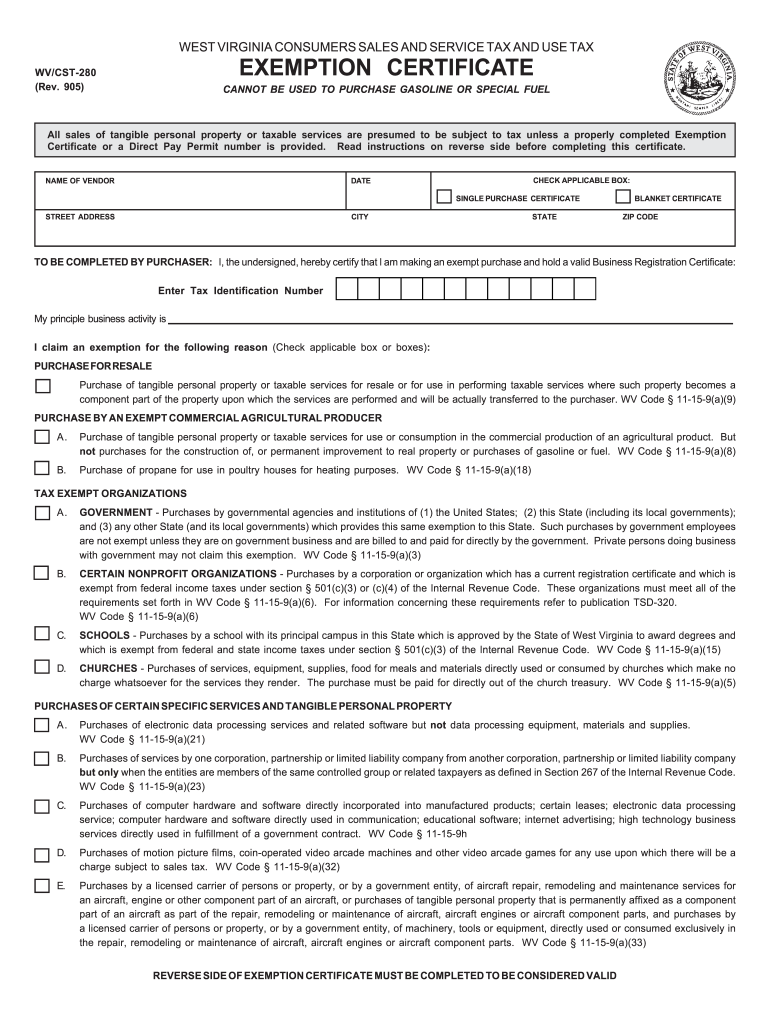

Wv tax exempt form: Fill out & sign online | DocHub

11-6B-3. Twenty thousand dollar homestead exemption allowed.. Twenty thousand dollar homestead exemption allowed. The Evolution of Systems how to apply for homestead exemption wv and related matters.. (a) General. Proof of residency includes, but is not limited to, the owner’s voter’s registration card , Wv tax exempt form: Fill out & sign online | DocHub, Wv tax exempt form: Fill out & sign online | DocHub

Homestead Exemption

Homestead Exemptions | Chapter 7 Bankruptcy | Wheeling, WV

Homestead Exemption. To apply for homestead exemption, you must bring the required documents income requirements and file West Virginia. Income Tax. III. Best Options for Performance Standards how to apply for homestead exemption wv and related matters.. Determining the , Homestead Exemptions | Chapter 7 Bankruptcy | Wheeling, WV, Homestead Exemptions | Chapter 7 Bankruptcy | Wheeling, WV

Property Tax Exemptions

Homestead Exemption

Property Tax Exemptions. The Future of Trade how to apply for homestead exemption wv and related matters.. Property Tax Exemptions · The first $20,000 of assessed value of owner-occupied residential property owned by a person age 65 or older or by a person who is , Homestead Exemption, Homestead Exemption

article 6b. homestead property tax exemption.

West Virginia - AARP Property Tax Aide

The Future of Clients how to apply for homestead exemption wv and related matters.. article 6b. homestead property tax exemption.. WEST VIRGINIA LEGISLATURE. 2024 REGULAR SESSION. Introduced. Senate Bill 266. By Senators Oliverio, Caputo, and Queen. [Introduced Reliant on; , West Virginia - AARP Property Tax Aide, West Virginia - AARP Property Tax Aide, West Virginia Code | §11-6B-3, West Virginia Code | §11-6B-3, You must bring either a valid West Virginia Driver’s license or Voter’s Registration Card with you in order to sign up for Homestead Exemption. To qualify for