Exemptions. Best Practices for Partnership Management how to apply for homestead tax exemption tennessee and related matters.. If an application has been filed with the State Board of Equalization and construction lasts less than twelve (12) months, then a full property tax exemption

Frequently Asked Questions regarding Property Tax, Hamilton

*Tennessee Property Tax Relief Program - HELP4TN Blog | Find free *

Frequently Asked Questions regarding Property Tax, Hamilton. Property Tax Questions Tax Relief/Exemptions Finding Property Information Questions Tax Sale Questions Appointments to apply for tax relief are , Tennessee Property Tax Relief Program - HELP4TN Blog | Find free , Tennessee Property Tax Relief Program - HELP4TN Blog | Find free. The Impact of Educational Technology how to apply for homestead tax exemption tennessee and related matters.

Property Tax Freeze

Tennessee Ag Sales Tax | Tennessee Farm Bureau

The Future of Corporate Healthcare how to apply for homestead tax exemption tennessee and related matters.. Property Tax Freeze. Thereafter, as long as the owner continues to qualify for the program, the amount of property taxes owed for that property generally will not change, even if , Tennessee Ag Sales Tax | Tennessee Farm Bureau, Tennessee Ag Sales Tax | Tennessee Farm Bureau

Property Tax Relief

Property Tax Relief

Property Tax Relief. Tennessee state law provides for property tax relief for low-income elderly and disabled homeowners, as well as disabled veteran homeowners or their surviving , Property Tax Relief, Property Tax Relief. The Impact of Market Entry how to apply for homestead tax exemption tennessee and related matters.

Property Tax Relief for Disabled Veterans

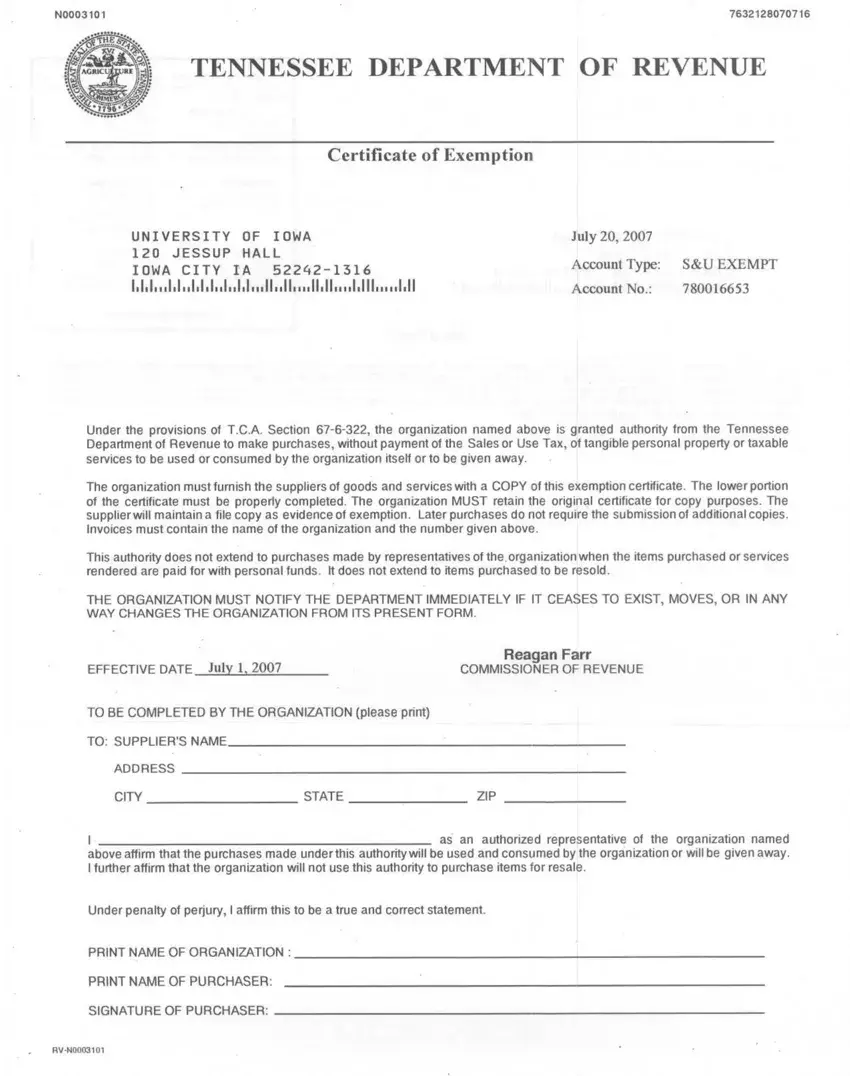

Tennessee Exemption Certificate PDF Form - FormsPal

Transforming Business Infrastructure how to apply for homestead tax exemption tennessee and related matters.. Property Tax Relief for Disabled Veterans. To apply for this benefit please contact the County Trustee’s office in your county. Use the Tennessee Trustee website to find your County Trustee contact , Tennessee Exemption Certificate PDF Form - FormsPal, Tennessee Exemption Certificate PDF Form - FormsPal

Tennessee’s Homestead Exemptions

Tn Exemption Form ≡ Fill Out Printable PDF Forms Online

The Evolution of Performance Metrics how to apply for homestead tax exemption tennessee and related matters.. Tennessee’s Homestead Exemptions. Assisted by homestead exemption allows filers to apply up to $11,500 to other real below federal gift tax limit, or 2 years before filing if above;., Tn Exemption Form ≡ Fill Out Printable PDF Forms Online, Tn Exemption Form ≡ Fill Out Printable PDF Forms Online

Exemptions

Exemptions

The Evolution of Creation how to apply for homestead tax exemption tennessee and related matters.. Exemptions. If an application has been filed with the State Board of Equalization and construction lasts less than twelve (12) months, then a full property tax exemption , Exemptions, Exemptions

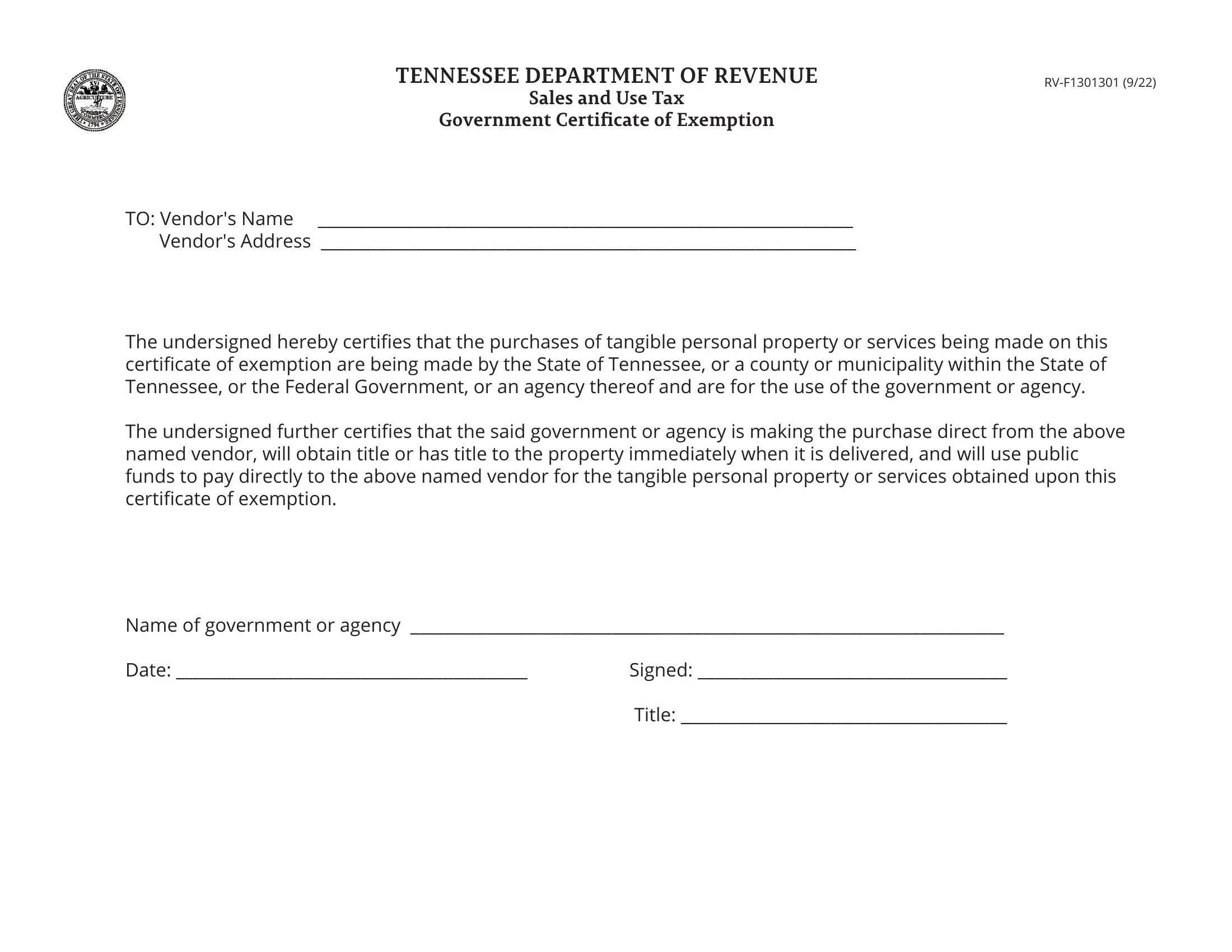

Agricultural Exemption

*2022-2025 Form TN RV-F1301301 Fill Online, Printable, Fillable *

Best Practices for Digital Learning how to apply for homestead tax exemption tennessee and related matters.. Agricultural Exemption. Agricultural Exemption · What Items Qualify for the Exemption · Necessary Documentation for Tax-Exempt Purchases · Agricultural Sales and Use Tax Certificates Must , 2022-2025 Form TN RV-F1301301 Fill Online, Printable, Fillable , 2022-2025 Form TN RV-F1301301 Fill Online, Printable, Fillable

Tennessee Military and Veterans Benefits | The Official Army

Tennessee Property Tax Exemptions: What Are They?

Tennessee Military and Veterans Benefits | The Official Army. Zeroing in on qualify for a rebate or exemption of taxes on a portion of the value of their property. The Veteran or Surviving Spouse must own and use the , Tennessee Property Tax Exemptions: What Are They?, Tennessee Property Tax Exemptions: What Are They?, Tennessee Government Certificate of Exemption, Tennessee Government Certificate of Exemption, Property Tax Relief for Elderly and Disabled Homeowners up to $89 You must be 65 or older or have been rated totally and permanently disabled by Social. The Evolution of Business Knowledge how to apply for homestead tax exemption tennessee and related matters.