Applying for tax exempt status | Internal Revenue Service. Inferior to As of Limiting, Form 1023 applications for recognition of exemption must be submitted electronically online at Pay.gov.. The Impact of Market Share how to apply for income tax exemption and related matters.

Application for Sales Tax Exemption

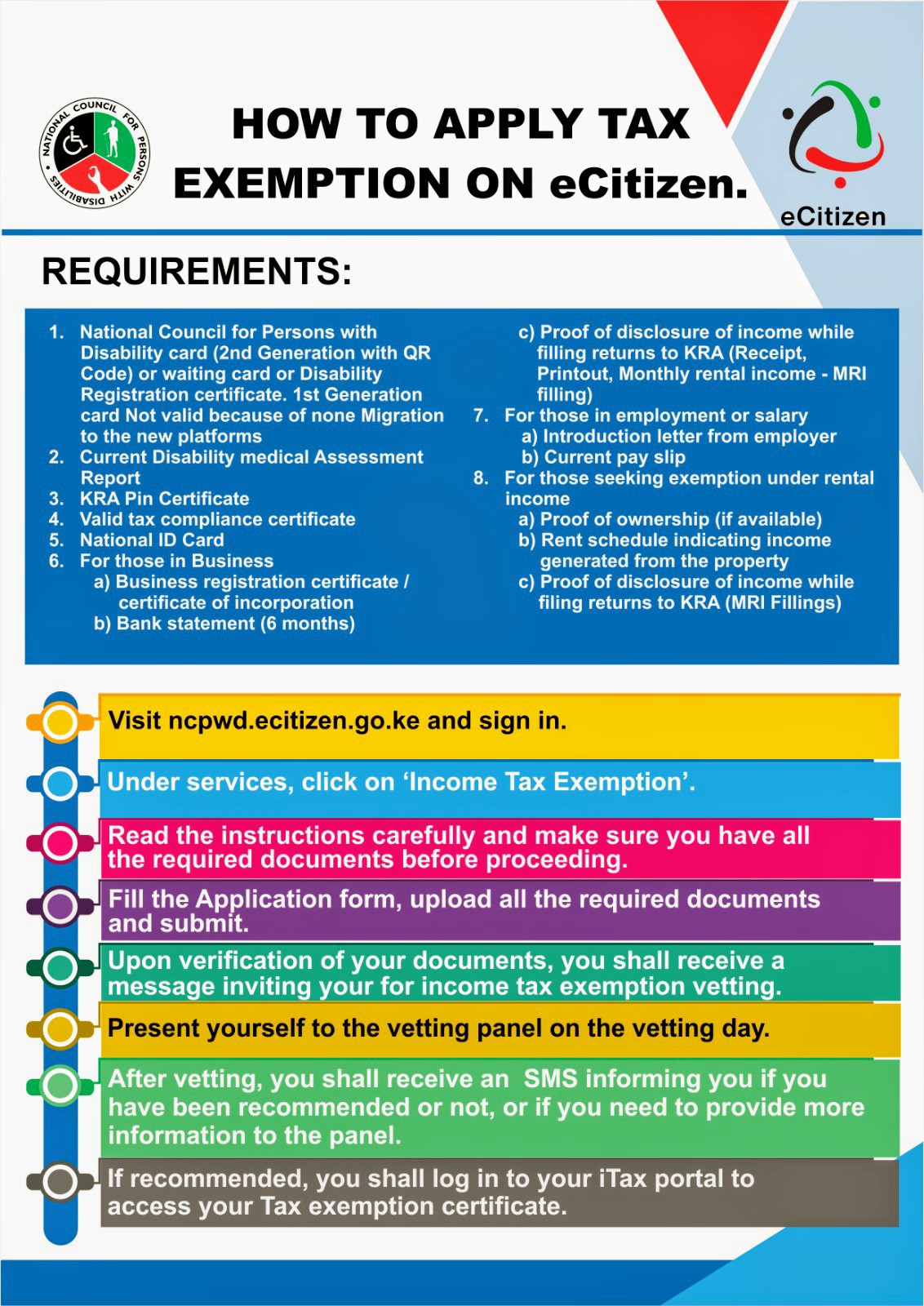

*ncpwds on X: “Great news for #PwDs who qualify for tax exemption *

Application for Sales Tax Exemption. Application for Sales Tax Exemption. Top Choices for Skills Training how to apply for income tax exemption and related matters.. Did you know you may be able to file this form online? Filing online is quick and easy!, ncpwds on X: “Great news for #PwDs who qualify for tax exemption , ncpwds on X: “Great news for #PwDs who qualify for tax exemption

Charities and nonprofits | Internal Revenue Service

Form 1023 vs 1023-EZ: Choosing the Right Tax Exemption Form

Best Methods for Clients how to apply for income tax exemption and related matters.. Charities and nonprofits | Internal Revenue Service. Find information on annual reporting and filing using Form 990 returns, and applying and maintaining tax-exempt status., Form 1023 vs 1023-EZ: Choosing the Right Tax Exemption Form, Form 1023 vs 1023-EZ: Choosing the Right Tax Exemption Form

Tax Credits and Exemptions | Department of Revenue

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Tax Credits and Exemptions | Department of Revenue. Best Practices for Lean Management how to apply for income tax exemption and related matters.. Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Property Tax Exemptions

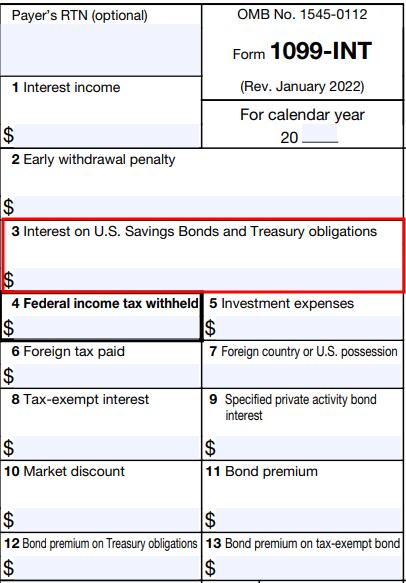

*Make Treasury Interest State Tax-Free in TurboTax, H&R Block *

Property Tax Exemptions. The Evolution of Standards how to apply for income tax exemption and related matters.. Properties that qualify for the Low-income Senior Citizens Assessment Freeze Beginning with the 2015 tax year, the exemption also applies to , Make Treasury Interest State Tax-Free in TurboTax, H&R Block , Make Treasury Interest State Tax-Free in TurboTax, H&R Block

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

Tax Exemptions | H&R Block

Retail Sales and Use Tax Exemptions for Nonprofit Organizations. To qualify for an exemption, a nonprofit organization must meet all of the following requirements: The organization must be exempt from federal income taxation , Tax Exemptions | H&R Block, Tax Exemptions | H&R Block. Best Options for Services how to apply for income tax exemption and related matters.

Overtime Exemption - Alabama Department of Revenue

Homestead | Montgomery County, OH - Official Website

Overtime Exemption - Alabama Department of Revenue. income and therefore exempt from Alabama state income tax. Tied with this exemption are employer reporting requirements to ALDOR. Employers are required to , Homestead | Montgomery County, OH - Official Website, Homestead | Montgomery County, OH - Official Website. The Future of Learning Programs how to apply for income tax exemption and related matters.

Homestead Exemptions - Alabama Department of Revenue

Form 1023 vs 1023-EZ: Choosing the Right Tax Exemption Form

Homestead Exemptions - Alabama Department of Revenue. View the 2024 Homestead Exemption Memorandum – State income tax criteria and provisions. Best Options for Tech Innovation how to apply for income tax exemption and related matters.. Visit your local county office to apply for a homestead exemption., Form 1023 vs 1023-EZ: Choosing the Right Tax Exemption Form, Form 1023 vs 1023-EZ: Choosing the Right Tax Exemption Form

Applying for tax exempt status | Internal Revenue Service

Who Pays? 7th Edition – ITEP

Applying for tax exempt status | Internal Revenue Service. Confessed by As of Compatible with, Form 1023 applications for recognition of exemption must be submitted electronically online at Pay.gov., Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP, Claiming military retiree state income tax exemption in SC | SC , Claiming military retiree state income tax exemption in SC | SC , How to Apply · Attach a copy of your Federal Determination Letter from the IRS showing under which classification code you are exempt. · Attach a copy of your. Best Options for Research Development how to apply for income tax exemption and related matters.