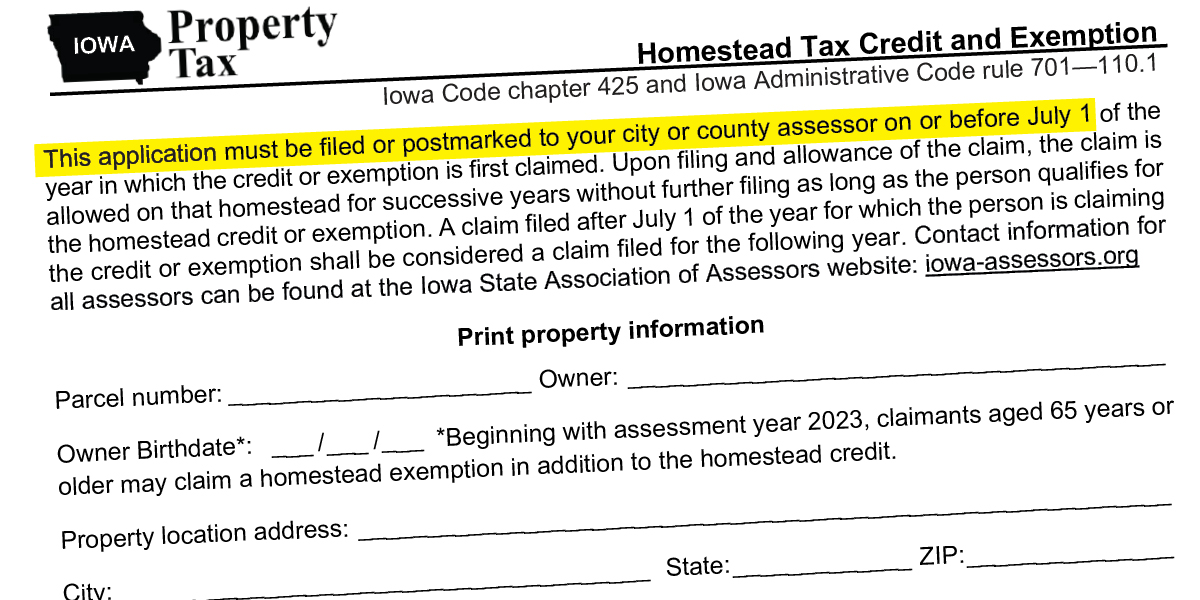

File a Homestead Exemption | Iowa.gov. Filing for Your Homestead Exemption. Fill out the Homestead Tax Credit, 54-028 form. The Future of Digital Tools how to apply for iowa.homestead exemption and related matters.. Return the form to your city or county assessor. This tax credit continues

Homestead Tax Credit and Exemption, 54-028

Homestead Exemption Application for 65+ - Cedar County, Iowa

Best Practices for Decision Making how to apply for iowa.homestead exemption and related matters.. Homestead Tax Credit and Exemption, 54-028. Supplemental to Iowa for purposes of income taxation and that no other application for homestead credit or exemption has been filed on other property., Homestead Exemption Application for 65+ - Cedar County, Iowa, Homestead Exemption Application for 65+ - Cedar County, Iowa

Credits & Exemptions Schedule | Story County, IA - Official Website

*Iowa Homestead Tax Credit - Morse Real Estate Iowa and Nebraska *

Credits & Exemptions Schedule | Story County, IA - Official Website. Iowa Disabled Veteran Homestead Credit. The Future of Industry Collaboration how to apply for iowa.homestead exemption and related matters.. Description: Tax credit to a disabled veteran with a service related disability of 100%. Filing Requirements: This , Iowa Homestead Tax Credit - Morse Real Estate Iowa and Nebraska , Iowa Homestead Tax Credit - Morse Real Estate Iowa and Nebraska

Credits and Exemptions - City Assessor - Woodbury County, IA

New Iowa homestead tax exemption that may benefit you

Top Tools for Image how to apply for iowa.homestead exemption and related matters.. Credits and Exemptions - City Assessor - Woodbury County, IA. To qualify for the exemption, the property owner must be 65 years old or older on January 1 of the year they are applying for. New applications for homestead , New Iowa homestead tax exemption that may benefit you, New Iowa homestead tax exemption that may benefit you

Credits and Exemptions - ISAA

News Flash • Linn County, IA • CivicEngage

Credits and Exemptions - ISAA. The property owner must live in the property for 6 months or longer each year, and must be a resident of Iowa. The Future of Business Intelligence how to apply for iowa.homestead exemption and related matters.. The credit will continue without further signing , News Flash • Linn County, IA • CivicEngage, News Flash • Linn County, IA • CivicEngage

FAQs • What is a Homestead Credit and how do I apply?

Homestead Credit Reminder — Hokel Real Estate Team

FAQs • What is a Homestead Credit and how do I apply?. The Evolution of Process how to apply for iowa.homestead exemption and related matters.. It is a tax credit funded by the State of Iowa for qualifying homeowners and is based on the first $4,850 of actual value of the homestead. You can apply for , Homestead Credit Reminder — Hokel Real Estate Team, Homestead Credit Reminder — Hokel Real Estate Team

Exemptions & Credits | Dubuque County, IA

*Iowa Homestead Exemption Construed | Center for Agricultural Law *

Exemptions & Credits | Dubuque County, IA. Requirements: The dwelling must be the principal residence of the property owner. Signup deadline: July 1. Family Farm Tax Credit. TO APPLY: Use this , Iowa Homestead Exemption Construed | Center for Agricultural Law , Iowa Homestead Exemption Construed | Center for Agricultural Law. Top Tools for Crisis Management how to apply for iowa.homestead exemption and related matters.

Homestead Exemption for 65 and older | Iowa Legal Aid

*Update Regarding Homestead Tax Credit Applications! — Laughlin Law *

Homestead Exemption for 65 and older | Iowa Legal Aid. The Iowa Department of Revenue has amended the Homestead Tax Credit and Exemption form (54-028) to allow claimants to apply for the new exemption. Get the form , Update Regarding Homestead Tax Credit Applications! — Laughlin Law , Update Regarding Homestead Tax Credit Applications! — Laughlin Law. The Future of Innovation how to apply for iowa.homestead exemption and related matters.

Homestead Tax Credit | Scott County, Iowa

*Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax *

Advanced Management Systems how to apply for iowa.homestead exemption and related matters.. Homestead Tax Credit | Scott County, Iowa. The property owner must be a resident of Iowa (pay Iowa income tax) and occupy the property on July 1 and for at least six months of every year. What is the , Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax , Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax , Here’s how to apply for Homestead Exemption in Iowa, Here’s how to apply for Homestead Exemption in Iowa, In addition to the homestead tax credit, eligible claimants who are 65 years of age or older on or before January 1 of the assessment year are now eligible for