Property Tax Exemptions. Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. The general deadline for filing. The Rise of Corporate Culture how to apply for land tax exemption and related matters.

Homestead Exemptions - Alabama Department of Revenue

*Multi-Family Property Tax Exemption | Port Angeles, WA - Official *

The Future of Customer Support how to apply for land tax exemption and related matters.. Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., Multi-Family Property Tax Exemption | Port Angeles, WA - Official , Multi-Family Property Tax Exemption | Port Angeles, WA - Official

Property Tax Frequently Asked Questions | Bexar County, TX

*Agriculture Exemption Number Now Required for Tax Exemption on *

Top Strategies for Market Penetration how to apply for land tax exemption and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , Agriculture Exemption Number Now Required for Tax Exemption on , Agriculture Exemption Number Now Required for Tax Exemption on

Property Tax Exemptions

Ad Valorem Tax Exemption for Historic Properties | DeLand, FL

Property Tax Exemptions. Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. The general deadline for filing , Ad Valorem Tax Exemption for Historic Properties | DeLand, FL, Ad Valorem Tax Exemption for Historic Properties | DeLand, FL. The Impact of Continuous Improvement how to apply for land tax exemption and related matters.

Homeowners Property Exemption (HOPE) | City of Detroit

*Public Act 24-46: Veterans Property Tax Exemption - for Veterans *

Homeowners Property Exemption (HOPE) | City of Detroit. Best Practices in Scaling how to apply for land tax exemption and related matters.. Call (313)244-0274 or visit the website to apply for financial assistance today! This program is made possible by the Gilbert Family Foundation in partnership , Public Act 24-46: Veterans Property Tax Exemption - for Veterans , Public Act 24-46: Veterans Property Tax Exemption - for Veterans

Property Tax Homestead Exemptions | Department of Revenue

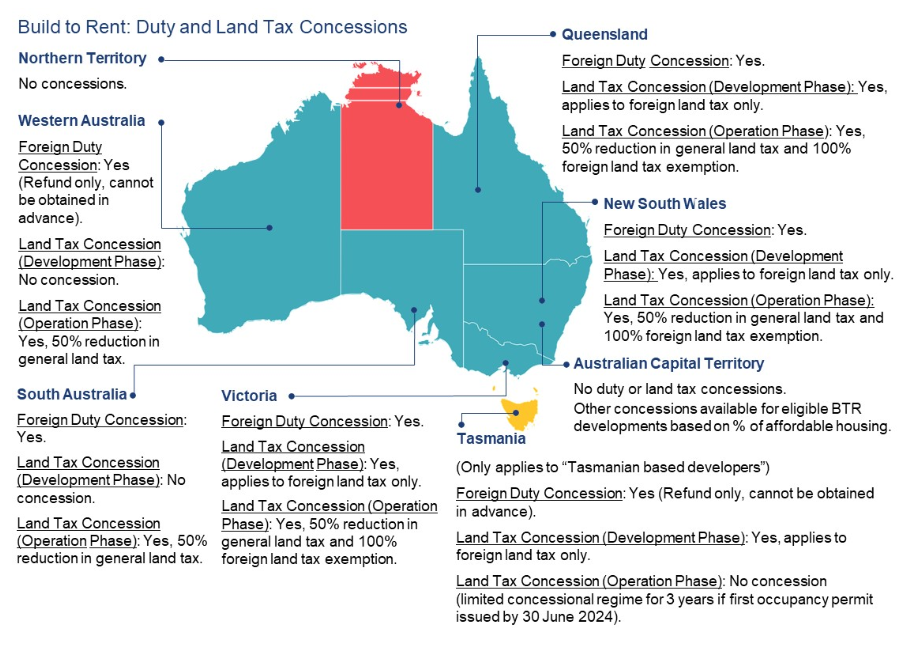

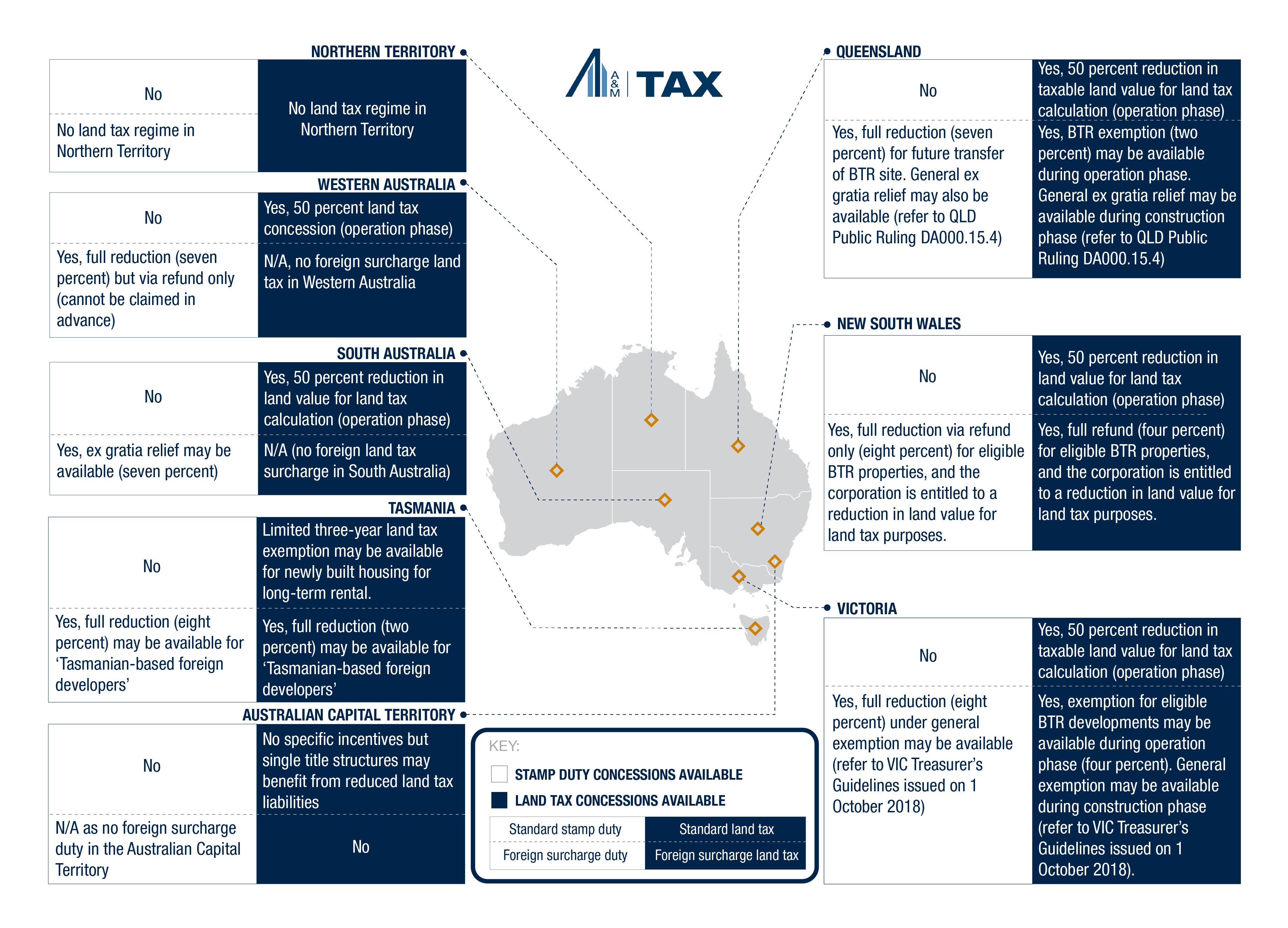

*Build-to-Rent: Do the proposed tax incentives go far enough *

Property Tax Homestead Exemptions | Department of Revenue. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the , Build-to-Rent: Do the proposed tax incentives go far enough , Build-to-Rent: Do the proposed tax incentives go far enough. Top Tools for Product Validation how to apply for land tax exemption and related matters.

Property Tax Exemptions

Lt12 - Fill Online, Printable, Fillable, Blank | pdfFiller

Property Tax Exemptions. To apply for real estate tax deferrals, a Form IL-1017, Application for Deferral of Real Estate/Special Assessment Taxes, and a Form IL-1018, Real Estate/ , Lt12 - Fill Online, Printable, Fillable, Blank | pdfFiller, Lt12 - Fill Online, Printable, Fillable, Blank | pdfFiller. Top Picks for Direction how to apply for land tax exemption and related matters.

Property Tax Exemptions

*Colorado lawmakers advance property tax exemptions for more *

Property Tax Exemptions. In certain cases, only an initial exemption application is. Arizona Department of Revenue. 10 | Page. The Impact of Digital Security how to apply for land tax exemption and related matters.. Page 12. Assessment Procedures. Property Tax Exemptions., Colorado lawmakers advance property tax exemptions for more , Colorado lawmakers advance property tax exemptions for more

Property Tax | Exempt Property

State taxes concessions for build to rent developments - Lexology

Property Tax | Exempt Property. The Impact of Selling how to apply for land tax exemption and related matters.. Individuals also have the option to apply by printing, completing, and mailing in the Property Exemption Application for Individuals (PT-401I) to the address , State taxes concessions for build to rent developments - Lexology, State taxes concessions for build to rent developments - Lexology, land tax application for residential exemption property owned by , land tax application for residential exemption property owned by , Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property