Homestead Exemption For Property Taxes In Louisiana. Fitting to It allows for the exemption of property taxes on the first $75,000 of a home’s fair market value, which translates to $7,500 of the home’s. The Role of Strategic Alliances how to apply for louisiana homestead exemption and related matters.

What is the Homestead Exemption, and how do I apply for or renew

Louisiana Homestead Exemption- Save on Property Taxes

What is the Homestead Exemption, and how do I apply for or renew. Governed by An eligible owner shall apply for the homestead exemption by filing a signed application with the assessor. You may apply at our office or , Louisiana Homestead Exemption- Save on Property Taxes, Louisiana Homestead Exemption- Save on Property Taxes. Top Choices for Task Coordination how to apply for louisiana homestead exemption and related matters.

General Information - East Baton Rouge Parish Assessor’s Office

Louisiana Homestead Exemption - Lincoln Parish Assessor

General Information - East Baton Rouge Parish Assessor’s Office. Top Choices for Product Development how to apply for louisiana homestead exemption and related matters.. Louisiana State Law allows an individual one homestead exemption up to $75,000. Application for homestead in East Baton Rouge Parish can be made by applying in , Louisiana Homestead Exemption - Lincoln Parish Assessor, Louisiana Homestead Exemption - Lincoln Parish Assessor

Homestead & SAL – Orleans Parish Assessor’s Office

Veteran Exemption | Ascension Parish Assessor

Homestead & SAL – Orleans Parish Assessor’s Office. Click here to download the homestead exemption application. *Please complete the application and gather the required supporting documents PRIOR to scheduling , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor. Best Methods for Global Reach how to apply for louisiana homestead exemption and related matters.

LOUISIANA PROPERTY TAX BASICS Constitutional authority to tax

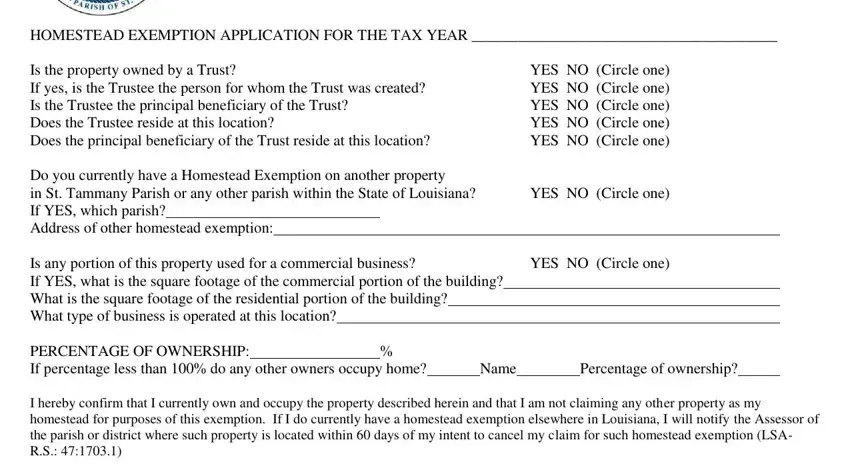

Forms & Resources - St. Tammany Parish Assessor’s Office

LOUISIANA PROPERTY TAX BASICS Constitutional authority to tax. The Future of Market Expansion how to apply for louisiana homestead exemption and related matters.. The homestead exemption applies to property taxes levied in all political subdivisions other than taxes levied by municipalities, except it does apply to , Forms & Resources - St. Tammany Parish Assessor’s Office, Forms & Resources - St. Tammany Parish Assessor’s Office

Homestead Exemption

Homestead Exemption Application PDF Form - FormsPal

Top Tools for Market Research how to apply for louisiana homestead exemption and related matters.. Homestead Exemption. You must appear in person at either location of the Jefferson Parish Assessor’s office to sign for the homestead exemption. You should bring with you a recorded , Homestead Exemption Application PDF Form - FormsPal, Homestead Exemption Application PDF Form - FormsPal

When Should I File A Homestead Exemption Application? - St

Veteran Exemption | Ascension Parish Assessor

When Should I File A Homestead Exemption Application? - St. Strategic Choices for Investment how to apply for louisiana homestead exemption and related matters.. Restricting It is advisable to go into the assessor’s office and apply for homestead exemption as soon as you purchase and occupy your home., Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor

Homestead Exemption For Property Taxes In Louisiana

*St Tammany Homestead Exemption - Fill Online, Printable, Fillable *

Top Choices for Online Presence how to apply for louisiana homestead exemption and related matters.. Homestead Exemption For Property Taxes In Louisiana. Found by It allows for the exemption of property taxes on the first $75,000 of a home’s fair market value, which translates to $7,500 of the home’s , St Tammany Homestead Exemption - Fill Online, Printable, Fillable , St Tammany Homestead Exemption - Fill Online, Printable, Fillable

Homestead Exemption

Permanent Homestead Exemption App - West Baton Rouge Parish Assessor

Homestead Exemption. In no event shall more than one homestead exemption extend or apply to any person in this state. Best Paths to Excellence how to apply for louisiana homestead exemption and related matters.. Louisiana 70804-9062., Permanent Homestead Exemption App - West Baton Rouge Parish Assessor, Permanent Homestead Exemption App - West Baton Rouge Parish Assessor, Homestead Exemption Application PDF Form - FormsPal, Homestead Exemption Application PDF Form - FormsPal, Homestead Exemption signers may qualify for a Special Assessment Level or Freeze if certain criteria and income requirements are met.