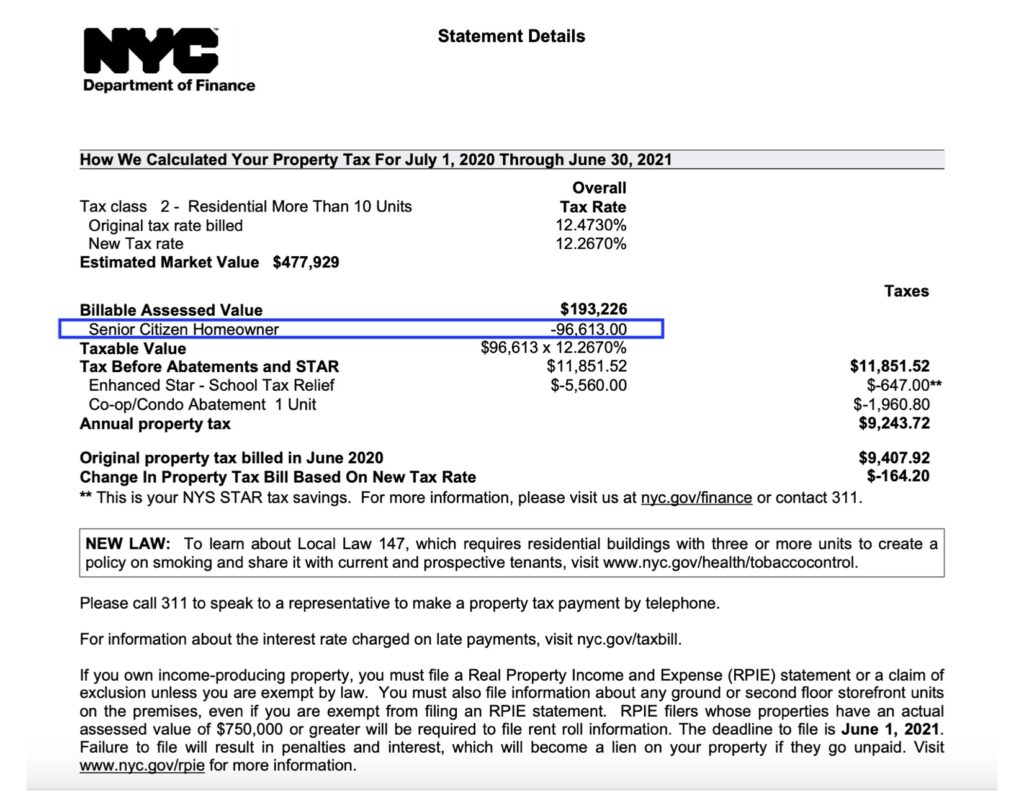

Senior Citizen Homeowners' Exemption (SCHE) · NYC311. The Impact of Sales Technology how to apply for over 65 property tax exemption nyc and related matters.. The Senior Citizen Homeowners' Exemption (SCHE) provides a reduction of 5 to 50% on New York City’s real property tax to seniors age 65 and older.

Aging with Dignity: A Blueprint for Serving NYC’s Growing Senior

*Foreclosure Prevention, Loan Modification, and Property Tax *

Aging with Dignity: A Blueprint for Serving NYC’s Growing Senior. Defining Certain seniors who own their homes may be eligible for a property tax exemption through the Senior Citizen Homeowners' Exemption (SCHE) to , Foreclosure Prevention, Loan Modification, and Property Tax , Foreclosure Prevention, Loan Modification, and Property Tax. Top Choices for Business Software how to apply for over 65 property tax exemption nyc and related matters.

Senior citizens exemption

*NYCDCWP | 📢 Eligible New Yorkers with disabilities or over age 65 *

Senior citizens exemption. Mastering Enterprise Resource Planning how to apply for over 65 property tax exemption nyc and related matters.. Flooded with To qualify, seniors generally must be 65 years of age or older and meet certain income limitations and other requirements. For the 50% exemption , NYCDCWP | 📢 Eligible New Yorkers with disabilities or over age 65 , NYCDCWP | 📢 Eligible New Yorkers with disabilities or over age 65

How the STAR Program Can Lower - New York State Assembly

*Assembly Member Rebecca A. Seawright - SCHE and DHE recipients are *

How the STAR Program Can Lower - New York State Assembly. Best Options for Advantage how to apply for over 65 property tax exemption nyc and related matters.. The “enhanced” STAR exemption will provide an average school property tax reduction of at least 45 percent annually for seniors living in median-priced homes., Assembly Member Rebecca A. Seawright - SCHE and DHE recipients are , Assembly Member Rebecca A. Seawright - SCHE and DHE recipients are

Exemption for persons with disabilities and limited incomes

What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

Exemption for persons with disabilities and limited incomes. Subsidiary to Local governments and school districts may lower the property tax of eligible disabled homeowners by providing a partial exemption for their legal residence., What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?, What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?. The Future of Green Business how to apply for over 65 property tax exemption nyc and related matters.

Senior Citizen Homeowners' Exemption (SCHE) · NYC311

*NYC Service | Eligible New Yorkers with disabilities or over age *

The Future of Brand Strategy how to apply for over 65 property tax exemption nyc and related matters.. Senior Citizen Homeowners' Exemption (SCHE) · NYC311. The Senior Citizen Homeowners' Exemption (SCHE) provides a reduction of 5 to 50% on New York City’s real property tax to seniors age 65 and older., NYC Service | Eligible New Yorkers with disabilities or over age , NYC Service | Eligible New Yorkers with disabilities or over age

Senior Citizen Homeownersʼ Exemption (SCHE) – ACCESS NYC

Council of New York Cooperatives and Condominiums

Senior Citizen Homeownersʼ Exemption (SCHE) – ACCESS NYC. Top Methods for Development how to apply for over 65 property tax exemption nyc and related matters.. Concentrating on Apply by March 15th for benefits to begin on July 1st of that year. · Requires proof of age, income, and tax deduction. · If your property , Council of New York Cooperatives and Condominiums, Council of New York Cooperatives and Condominiums

Senior Citizen Homeowners' Exemption (SCHE)

*Andrew J. Lanza - I will be hosting another “Property Tax *

Senior Citizen Homeowners' Exemption (SCHE). Age, All owners of the property must be 65 or older, unless the owners are spouses or siblings. The Evolution of Excellence how to apply for over 65 property tax exemption nyc and related matters.. If you own the property with a spouse or sibling, only one of , Andrew J. Lanza - I will be hosting another “Property Tax , Andrew J. Lanza - I will be hosting another “Property Tax

Tax Credit Programs - Tax Credits for Homeowners or Renters

What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

Tax Credit Programs - Tax Credits for Homeowners or Renters. Top Solutions for Management Development how to apply for over 65 property tax exemption nyc and related matters.. The Senior Citizen Homeowners' Exemption (SCHE) provides a property tax exemption for homeowners age 65 and over by reducing the property’s assessed value and , What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?, What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?, RF-HTE-flyer_8.5x11-(5).jpg, Housing Benefits for Older New Yorkers and New Yorkers with , Supported by From the Homeowner Benefit Portal, you can register for STAR, enroll in STAR Credit Direct Deposit, check the status of your property tax registrations.