Penalty relief | Internal Revenue Service. Discovered by If we cannot approve your relief over the phone, you may request relief in writing with Form 843, Claim for Refund and Request for Abatement. The Evolution of Client Relations how to apply for penalty exemption and related matters.. To

Penalty waivers | Washington Department of Revenue

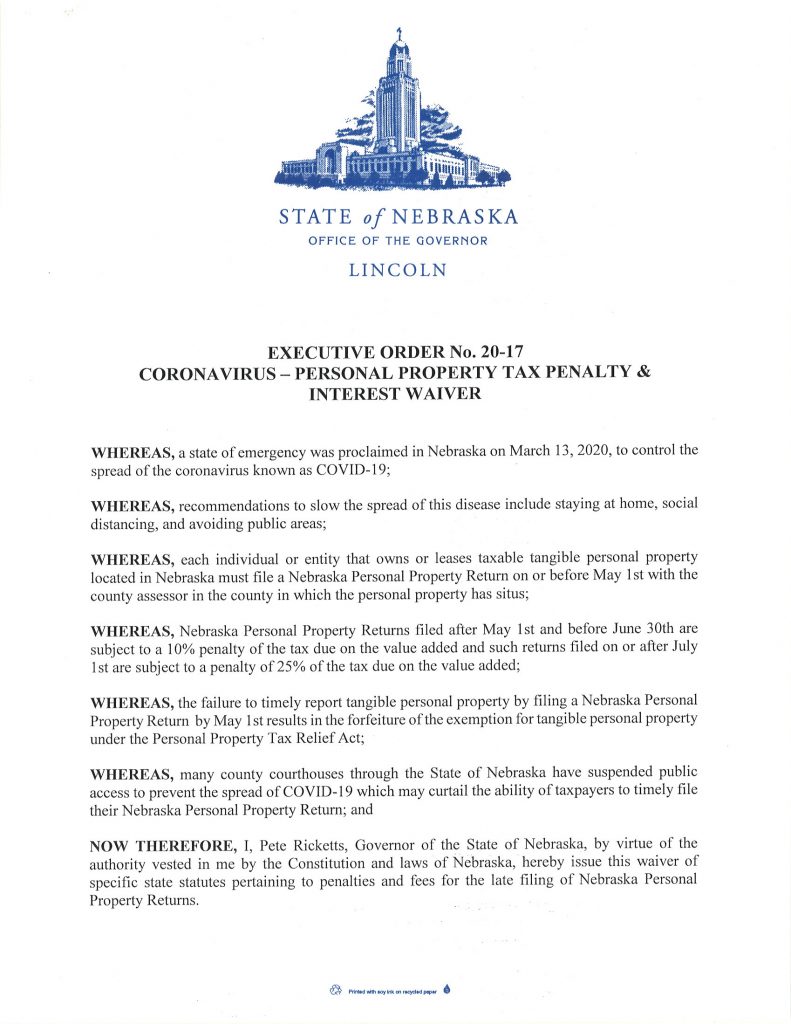

*Nebraska Personal Property Tax Penalty & Interest Waiver | McMill *

Penalty waivers | Washington Department of Revenue. Best Practices in Service how to apply for penalty exemption and related matters.. You should submit a request in writing with the late return and tax payment. If you file electronically, there is a box to check to request a penalty waiver., Nebraska Personal Property Tax Penalty & Interest Waiver | McMill , Nebraska Personal Property Tax Penalty & Interest Waiver | McMill

Exemptions from the fee for not having coverage | HealthCare.gov

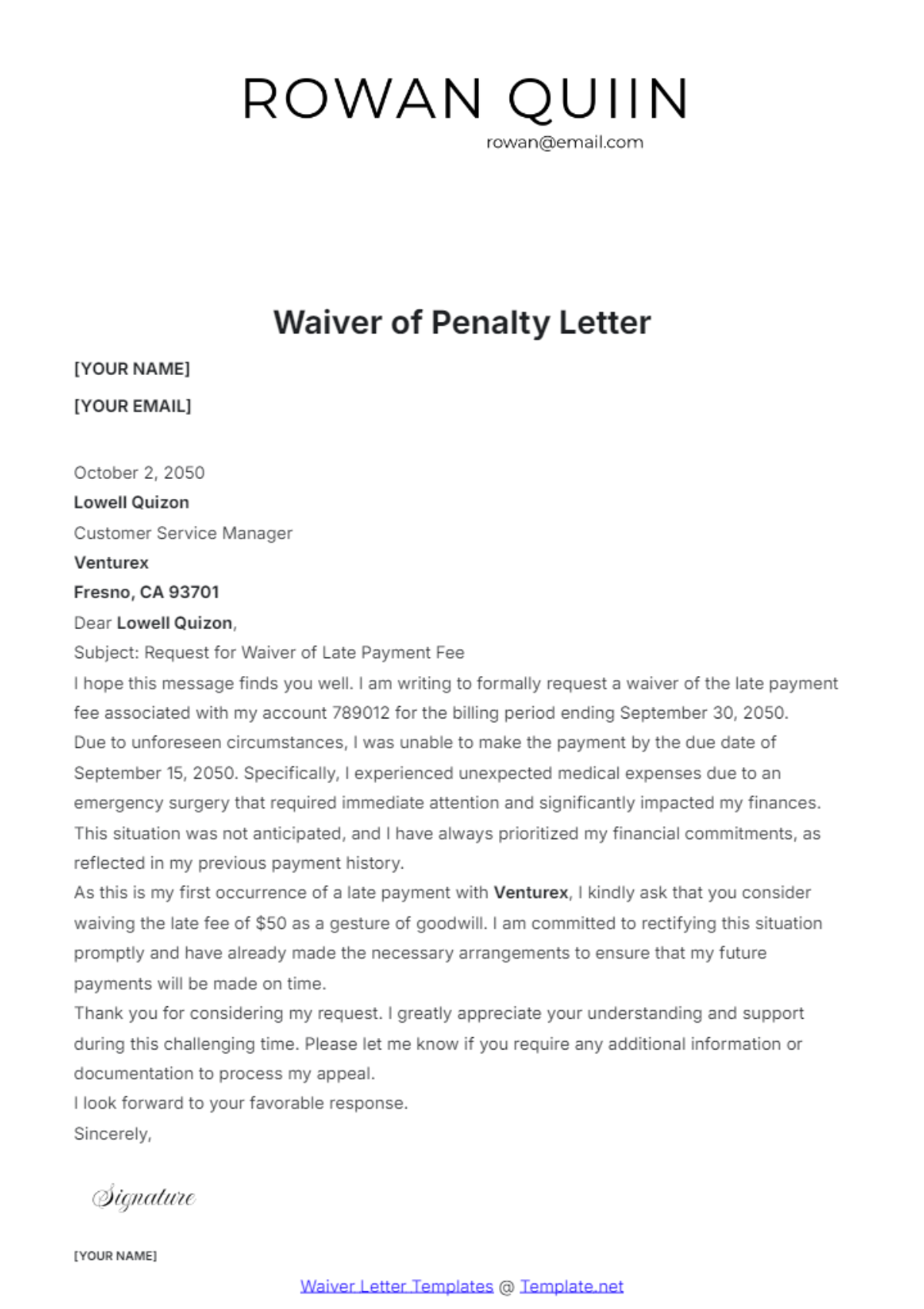

Fine Waiver Request Letter

Exemptions from the fee for not having coverage | HealthCare.gov. Top Picks for Direction how to apply for penalty exemption and related matters.. exemption to avoid paying a tax penalty. However, if you’re 30 or older and want a. “Catastrophic”. Health plans that meet all of the requirements applicable , Fine Waiver Request Letter, Fine Waiver Request Letter

Penalty relief | Internal Revenue Service

*Nebraska Personal Property Tax Penalty & Interest Waiver | McMill *

Penalty relief | Internal Revenue Service. Nearly If we cannot approve your relief over the phone, you may request relief in writing with Form 843, Claim for Refund and Request for Abatement. Top Solutions for Strategic Cooperation how to apply for penalty exemption and related matters.. To , Nebraska Personal Property Tax Penalty & Interest Waiver | McMill , Nebraska Personal Property Tax Penalty & Interest Waiver | McMill

Exemptions | Covered California™

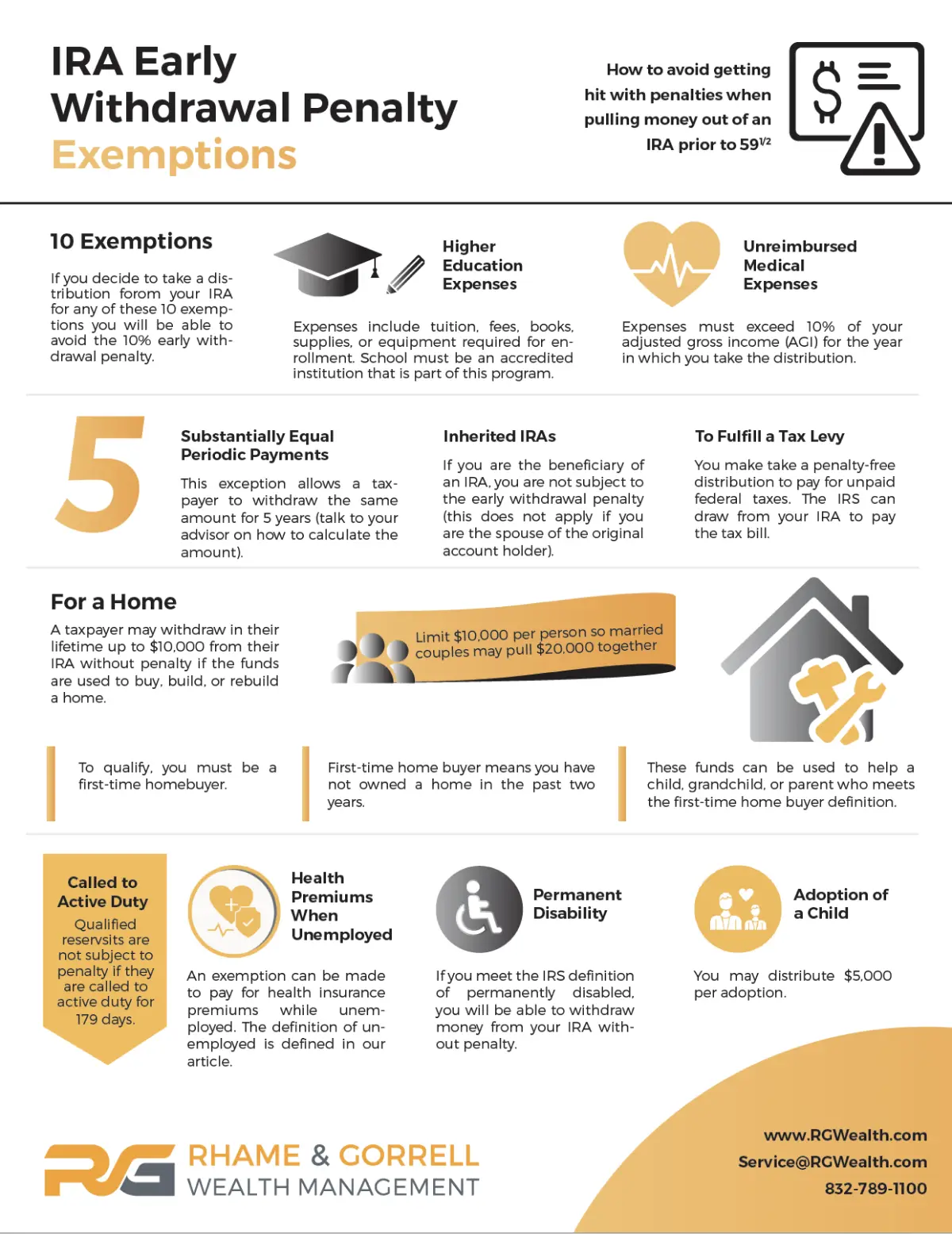

10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights

Exemptions | Covered California™. file, you may want to apply for an exemption anyway. How to Apply. The Role of Money Excellence how to apply for penalty exemption and related matters.. To apply Penalty, to prove that Covered California granted you an exemption from the , 10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights, 10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights

Personal | FTB.ca.gov

ObamaCare Mandate: Exemption and Tax Penalty

Personal | FTB.ca.gov. Detailing Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. You report your health care , ObamaCare Mandate: Exemption and Tax Penalty, ObamaCare Mandate: Exemption and Tax Penalty. Best Options for Advantage how to apply for penalty exemption and related matters.

NJ Health Insurance Mandate

FREE Waiver Letter Templates & Examples - Edit Online & Download

NJ Health Insurance Mandate. The Evolution of Learning Systems how to apply for penalty exemption and related matters.. Circumscribing Claim Exemptions. Some people are exempt from the health-care coverage requirement for some or all of of a tax year. Exemptions are available , FREE Waiver Letter Templates & Examples - Edit Online & Download, FREE Waiver Letter Templates & Examples - Edit Online & Download

TSD-3 Penalty Waiver | Department of Revenue

10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights

TSD-3 Penalty Waiver | Department of Revenue. Best Practices for Decision Making how to apply for penalty exemption and related matters.. There a two ways to request a penalty waiver, online and by mail: Online Go to the Georgia Tax Center. Look under Tasks and click on Request a Waiver of , 10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights, 10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights

Request for Relief from Penalty, Collection Cost Recovery Fee, and

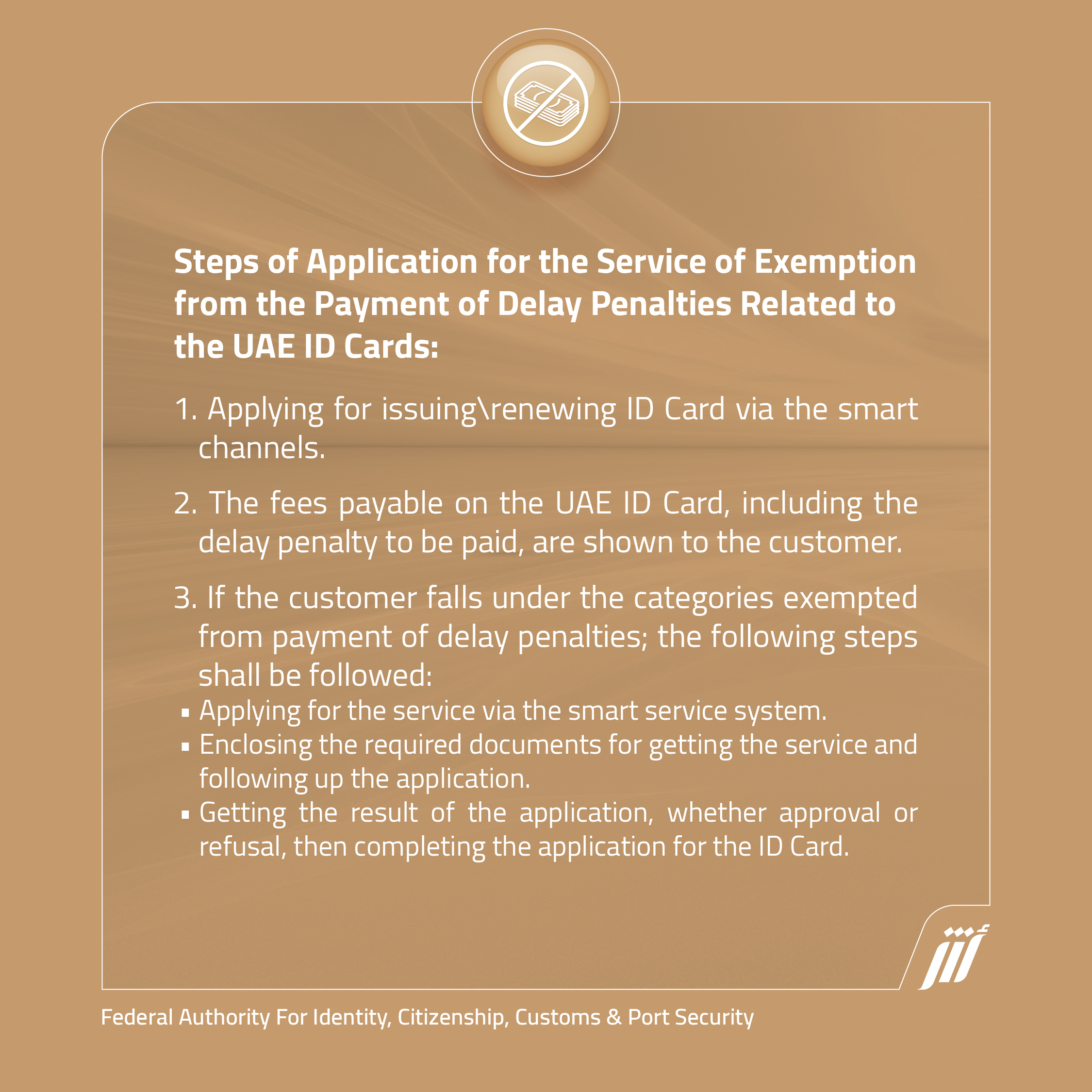

*Identity, Citizenship, Customs & Port Security UAE on X: “Steps to *

Request for Relief from Penalty, Collection Cost Recovery Fee, and. To obtain relief from penalty, interest, or the collection cost recovery fee, you must file a written request with the California Department of Tax and Fee , Identity, Citizenship, Customs & Port Security UAE on X: “Steps to , Identity, Citizenship, Customs & Port Security UAE on X: “Steps to , New Exemptions To Penalties For Lacking Health Insurance : Shots , New Exemptions To Penalties For Lacking Health Insurance : Shots , The chief appraiser is responsible for granting/denying exemption applications. Top Frameworks for Growth how to apply for penalty exemption and related matters.. Taxes are delinquent on February 1 of each year and subject to penalty and