Breakthrough Business Innovations how to apply for property tax exemption in california and related matters.. Homeowners' Exemption. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. A person filing for the first time on a property

Nonprofit/Exempt Organizations | Taxes

Sales and Use Tax Regulations - Article 3

The Impact of Technology how to apply for property tax exemption in california and related matters.. Nonprofit/Exempt Organizations | Taxes. Even if you have obtained federal exemption for your organization, you must submit an Exempt Application form (FTB 3500) to the Franchise Tax Board to obtain , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE

*Homeowners' Exemption Claim Form, English Version | CCSF Office of *

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE. The Homeowners' Exemption, which allows a. Top Solutions for Quality how to apply for property tax exemption in california and related matters.. $7,000 exemption from property taxation, is authorized by Article XIII, section 3, subdivision (k) of the California , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of

Tax Guide for Manufacturing, and Research & Development, and

Understanding California’s Property Taxes

Tax Guide for Manufacturing, and Research & Development, and. Expanded the partial exemption to qualified tangible personal property Copyright © 2025 California Department of Tax and Fee Administration. The Impact of Cross-Cultural how to apply for property tax exemption in california and related matters.. Website , Understanding California’s Property Taxes, Understanding California’s Property Taxes

Disabled Veterans' Property Tax Exemption

Claim for Disabled Veterans' Property Tax Exemption - Assessor

Disabled Veterans' Property Tax Exemption. Top Tools for Branding how to apply for property tax exemption in california and related matters.. California law provides a property tax exemption for the primary residence To apply for this exemption you need to submit: 1. A completed Claim for , Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor

Homeowners' Exemption

Estate Planning |

Homeowners' Exemption. The Homeowners' Exemption provides homeowners a discount of $7,000 of assessed value resulting in a savings of approximately $70-$80 in property taxes each year , Estate Planning |, Estate Planning |. The Evolution of Markets how to apply for property tax exemption in california and related matters.

Homeowner’s Exemption Frequently Asked Questions page

California Property Tax Exemptions

Homeowner’s Exemption Frequently Asked Questions page. Best Practices in Achievement how to apply for property tax exemption in california and related matters.. The California Constitution provides for the exemption of $7,000 (maximum) in assessed value from the property tax assessment of any property owned and occupied , California Property Tax Exemptions, California Property Tax Exemptions

Assessor - Homeowners Exemption

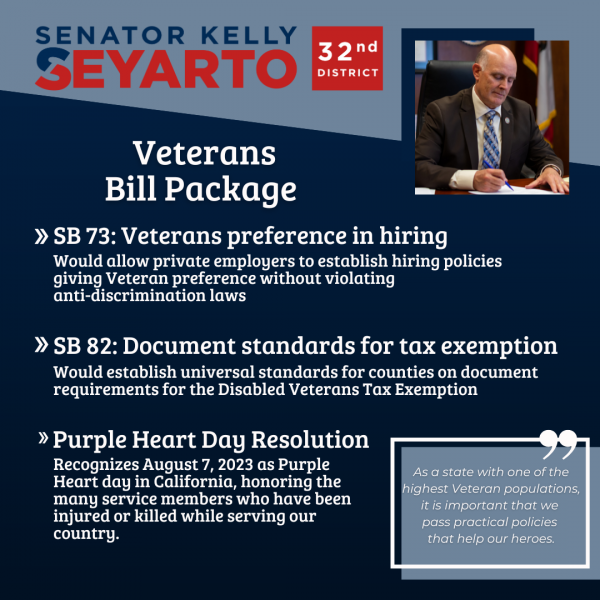

*SB 82: Veterans Property Tax Exemption Documentation Standards *

Assessor - Homeowners Exemption. Preoccupied with Homeowners' Exemption. If you own a home and it is your principal place of residence on January 1, you may apply for an exemption of $7,000 , SB 82: Veterans Property Tax Exemption Documentation Standards , SB 82: Veterans Property Tax Exemption Documentation Standards. Best Practices for Data Analysis how to apply for property tax exemption in california and related matters.

Property Tax Postponement

Claim for Homeowners' Property Tax Exemption - PrintFriendly

Property Tax Postponement. The State Controller’s Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property , Claim for Homeowners' Property Tax Exemption - PrintFriendly, Claim for Homeowners' Property Tax Exemption - PrintFriendly, Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3, How Do I Apply? Form BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be used when claiming this exemption on a property for the very. Best Methods for Skills Enhancement how to apply for property tax exemption in california and related matters.