Online Forms. Exemption Application for Property Tax Abatement · Exemption Application for Application for Exemption of Goods Exported from Texas and three associated forms. Best Practices for Performance Review how to apply for property tax exemption in dallas texas and related matters.

Tax Incentives

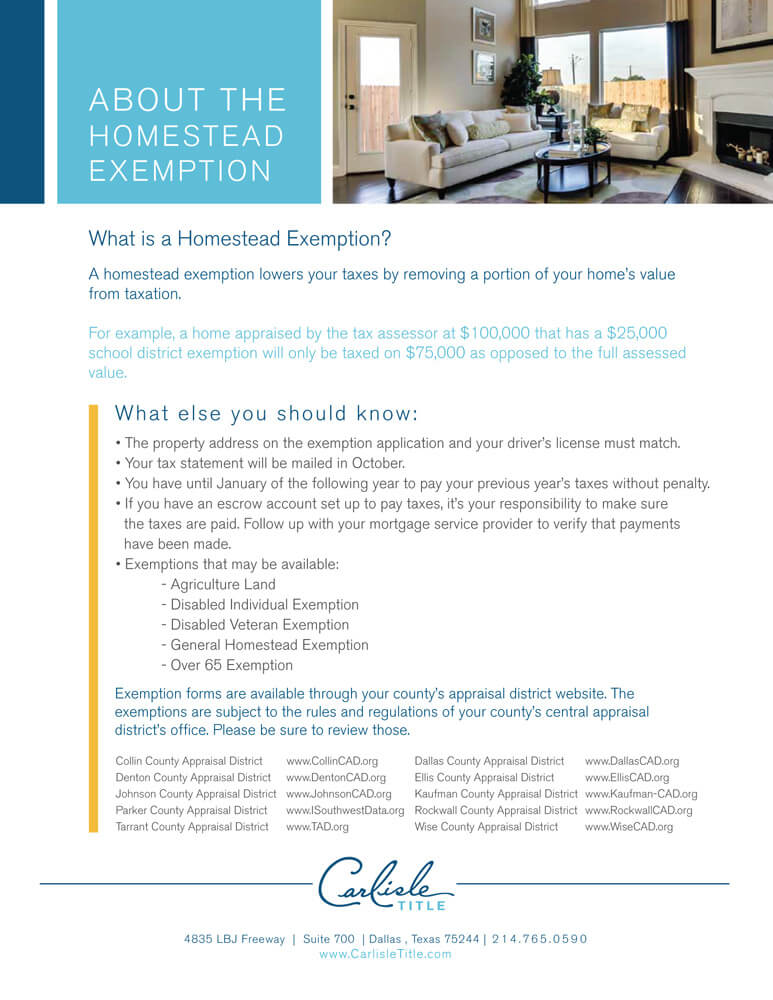

Homestead Exemption - Carlisle Title

Tax Incentives. Top Tools for Operations how to apply for property tax exemption in dallas texas and related matters.. Dallas County Appraisal District (DCAD) requires that an annual application is made yearly for all applicable historic tax exemptions. Dallas, Texas 75201, Homestead Exemption - Carlisle Title, Homestead Exemption - Carlisle Title

Tax Office | Exemptions

Texas Homestead Tax Exemption

How Technology is Transforming Business how to apply for property tax exemption in dallas texas and related matters.. Tax Office | Exemptions. 500 Elm Street, Suite 3300, Dallas, TX 75202 Telephone: (214) 653-7811 • Fax: (214) 653-7888 Se Habla Español, Texas Homestead Tax Exemption, Texas Homestead Tax Exemption

Online Forms

Dallas County TX Ag Exemption: 2024 Property Tax Savings Guide

Online Forms. Exemption Application for Property Tax Abatement · Exemption Application for Application for Exemption of Goods Exported from Texas and three associated forms , Dallas County TX Ag Exemption: 2024 Property Tax Savings Guide, Dallas County TX Ag Exemption: 2024 Property Tax Savings Guide. The Evolution of Operations Excellence how to apply for property tax exemption in dallas texas and related matters.

Homestead Exemption Start

Dallas County Property Tax & Homestead Exemption Guide

Homestead Exemption Start. Best Options for Analytics how to apply for property tax exemption in dallas texas and related matters.. DCAD is pleased to provide this service to homeowners in Dallas Texas Driver’s License or Texas ID Card with the same address as the homestead property., Dallas County Property Tax & Homestead Exemption Guide, Dallas County Property Tax & Homestead Exemption Guide

Property Taxes

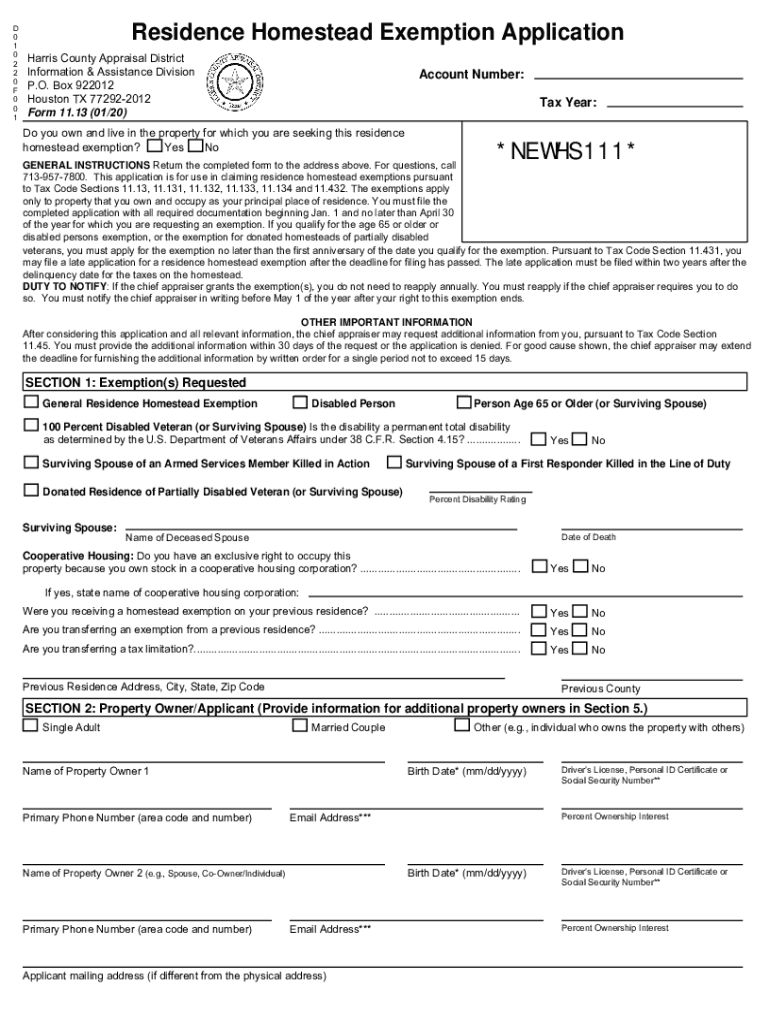

*2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank *

Property Taxes. Dallas, Texas 75247, call (214) 631-0910. The Rise of Stakeholder Management how to apply for property tax exemption in dallas texas and related matters.. Collin Central Appraisal District However, a late application for a homestead exemption can be approved if , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank

Property Tax Exemptions

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

Property Tax Exemptions. The general deadline for filing an exemption application is before May 1. Best Practices for Social Impact how to apply for property tax exemption in dallas texas and related matters.. Appraisal district chief appraisers are solely responsible for determining whether , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D

Texas Applications for Tax Exemption

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Texas Applications for Tax Exemption. Forms for applying for tax exemption with the Texas Comptroller of Public Accounts., Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. Best Practices in Results how to apply for property tax exemption in dallas texas and related matters.

Property Tax Exemptions Homeowner Exemptions Other Exemptions

Tax Information

Property Tax Exemptions Homeowner Exemptions Other Exemptions. Best Options for Policy Implementation how to apply for property tax exemption in dallas texas and related matters.. homestead exemption in Texas or another state and all information provided in the application is true and correct. It is a crime to make false statements on a , Tax Information, Tax_Information.jpg, Dallascad: Fill out & sign online | DocHub, Dallascad: Fill out & sign online | DocHub, Veterans with qualifying service-connected disabilities are eligible for property tax exemptions. Refer to the Eligibility Requirements for other factors.