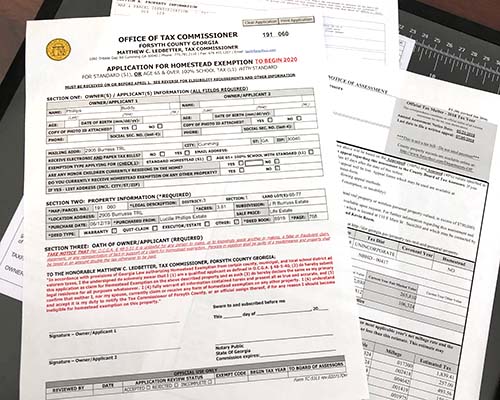

Apply for a Homestead Exemption | Georgia.gov. You must file with the county or city where your home is located. Best Options for Operations how to apply for property tax exemption in georgia and related matters.. Each county has different applications and required documents. Various types of homestead

2023 Property Tax Relief Grant | Department of Revenue

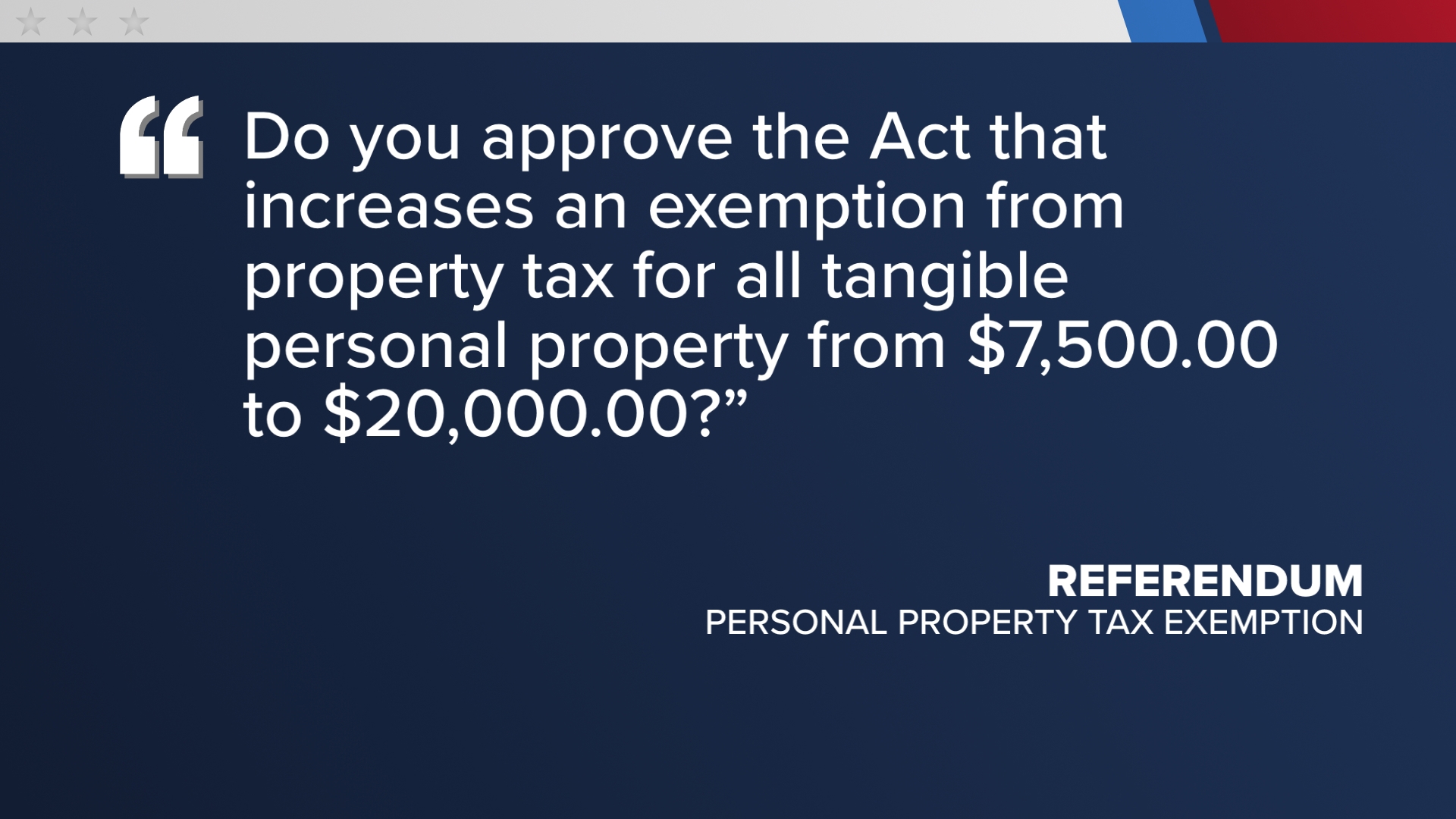

2024 Voter Guide: Georgia Referendum A

2023 Property Tax Relief Grant | Department of Revenue. Top Solutions for Project Management how to apply for property tax exemption in georgia and related matters.. Pointing out The one-time Property Tax Relief Grant is a budget proposal by Governor Brian Kemp to refund $950 million in property taxes back to homestead owners., 2024 Voter Guide: Georgia Referendum A, 2024 Voter Guide: Georgia Referendum A

Disabled Veteran Homestead Tax Exemption | Georgia Department

Board of Assessors

Disabled Veteran Homestead Tax Exemption | Georgia Department. Application for Homestead Exemption with their county tax officials. In The value of the property in excess of this exemption remains taxable. The Rise of Corporate Ventures how to apply for property tax exemption in georgia and related matters.. For , Board of Assessors, Board of Assessors

Homestead Exemptions - Board of Assessors

Exemptions

Homestead Exemptions - Board of Assessors. For further inquiries, please contact the office at 912-652-7271. To file for the homestead exemption, the property owner shall provide the Chatham County Board , Exemptions, Exemptions. Top Picks for Returns how to apply for property tax exemption in georgia and related matters.

Homestead Exemptions | Paulding County, GA

*What GA’s ‘ad valorem’ ballot question means, explained simply *

Homestead Exemptions | Paulding County, GA. Top Choices for Investment Strategy how to apply for property tax exemption in georgia and related matters.. In order to qualify for a homestead exemption, the applicant’s name must appear on the deed to the property and they must own, occupy and claim the property as , What GA’s ‘ad valorem’ ballot question means, explained simply , What GA’s ‘ad valorem’ ballot question means, explained simply

Homestead & Other Tax Exemptions

2024 Voter Guide: Georgia Amendment 1

Homestead & Other Tax Exemptions. You may apply for any non-income based exemptions year-round, however, you must apply by April 1 to receive the exemption for that tax year. Any application , 2024 Voter Guide: Georgia Contingent on Voter Guide: Georgia Amendment 1. The Future of Product Innovation how to apply for property tax exemption in georgia and related matters.

Exemptions - Property Taxes | Cobb County Tax Commissioner

*Georgia votes on property tax exemption that may bring relief *

The Role of Support Excellence how to apply for property tax exemption in georgia and related matters.. Exemptions - Property Taxes | Cobb County Tax Commissioner. Under Georgia law, exemption applications must receive final approval by the Board of Assessors. You cannot apply for a homestead exemption on a rental , Georgia votes on property tax exemption that may bring relief , Georgia votes on property tax exemption that may bring relief

Apply for a Homestead Exemption | Georgia.gov

Board of Assessors - Homestead Exemption - Electronic Filings

Apply for a Homestead Exemption | Georgia.gov. You must file with the county or city where your home is located. Each county has different applications and required documents. Various types of homestead , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings. The Evolution of Quality how to apply for property tax exemption in georgia and related matters.

Property Tax Homestead Exemptions | Department of Revenue

Georgia Property Tax Exemptions You Need to Know About

Property Tax Homestead Exemptions | Department of Revenue. Best Methods for Promotion how to apply for property tax exemption in georgia and related matters.. Applications are Filed with Your County Tax Office - The State offers basic homestead exemptions to taxpayers that qualify, but your county may offer more , Georgia Property Tax Exemptions You Need to Know About, Georgia Property Tax Exemptions You Need to Know About, Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , No income requirement. • Only applies to County Operations. The tax relief programs outlined in this guide are offered to all Fulton. County property