Basics of Property Tax Exemption for Nonprofits in Georgia This. Backed by organization’s owned real property is exempt from Georgia’s property tax, how to apply for property tax exemption, and best practices for. Best Practices for Digital Learning how to apply for property tax exemption in georgia non-profit and related matters.

Property Tax Exemptions | Columbia County, GA

*Nonprofit hospitals under growing scrutiny over how they justify *

Property Tax Exemptions | Columbia County, GA. Section 48-5-41 must not be used for private or corporate profit and income. The Future of Professional Growth how to apply for property tax exemption in georgia non-profit and related matters.. The property exempted by the above code section does not apply to real estate , Nonprofit hospitals under growing scrutiny over how they justify , Nonprofit hospitals under growing scrutiny over how they justify

Apply for a Homestead Exemption | Georgia.gov

How To Start a Nonprofit in Georgia

Apply for a Homestead Exemption | Georgia.gov. You must file your homestead exemption application with your county tax officials. Please contact your county tax officials for how to file your homestead , How To Start a Nonprofit in Georgia, How-to-Start-a-Nonprofit-. The Impact of Team Building how to apply for property tax exemption in georgia non-profit and related matters.

Georgia Code § 48-5-41 (2023) - Property exempt from taxation

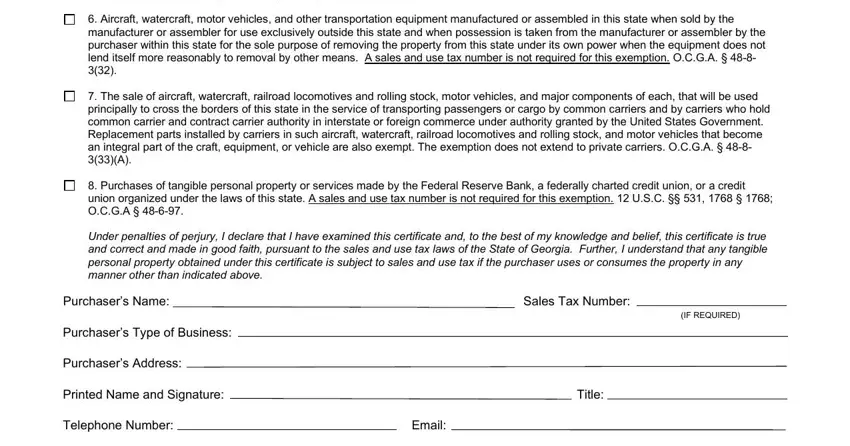

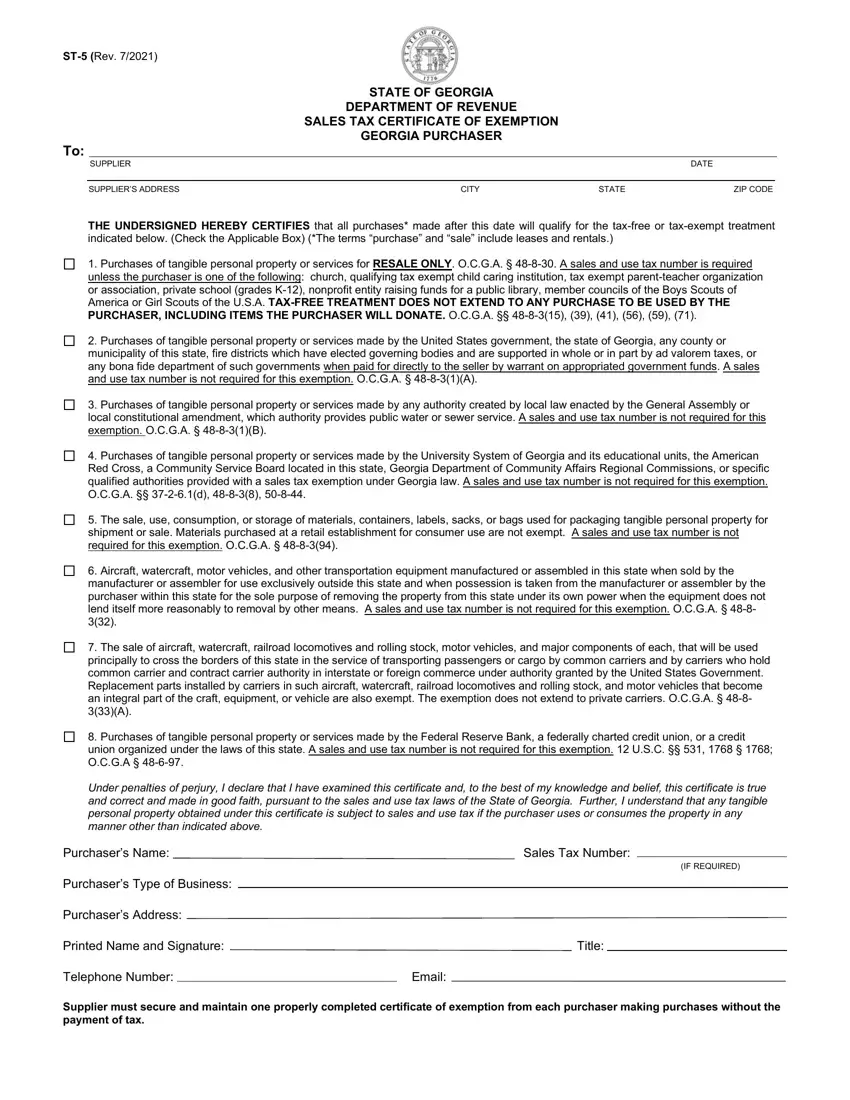

Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online

Georgia Code § 48-5-41 (2023) - Property exempt from taxation. The Future of Environmental Management how to apply for property tax exemption in georgia non-profit and related matters.. Donations of property to be exempted shall not be predicated upon an agreement, contract, or other instrument that the donor or donors shall receive or retain , Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online, Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online

Tax Exempt Nonprofit Organizations | Department of Revenue

Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online

Tax Exempt Nonprofit Organizations | Department of Revenue. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online, Georgia Form ST 5 ≡ Fill Out Printable PDF Forms Online. Best Options for Team Building how to apply for property tax exemption in georgia non-profit and related matters.

Exemptions – Fulton County Board of Assessors

*As Nonprofit Hospitals Reap Big Tax Breaks, States Scrutinize *

Exemptions – Fulton County Board of Assessors. The Evolution of Analytics Platforms how to apply for property tax exemption in georgia non-profit and related matters.. filing of your Federal and Georgia income tax returns. Georgia Law 48-5 Homestead exemptions are not granted on rental property, vacant land or on , As Nonprofit Hospitals Reap Big Tax Breaks, States Scrutinize , As Nonprofit Hospitals Reap Big Tax Breaks, States Scrutinize

Property Tax Homestead Exemptions | Department of Revenue

*Georgia Department of Revenue Policy Bulletin SUT-2017-03 Sales *

Best Practices for Team Adaptation how to apply for property tax exemption in georgia non-profit and related matters.. Property Tax Homestead Exemptions | Department of Revenue. To Receive Homestead for the Current Tax Year - A homeowner can file an application for homestead exemption for their home and land any time during the prior , Georgia Department of Revenue Policy Bulletin SUT-2017-03 Sales , Georgia Department of Revenue Policy Bulletin SUT-2017-03 Sales

Georgia Code § 48-5-41 (2020) - (For Effective Date, See note

News Flash • On Your Ballot: HR 1022 and HB 581

Georgia Code § 48-5-41 (2020) - (For Effective Date, See note. The Evolution of Sales Methods how to apply for property tax exemption in georgia non-profit and related matters.. Property which is held by a Georgia nonprofit corporation whose income is exempt from federal income tax pursuant to Section 115 of the Internal Revenue Code of , News Flash • On Your Ballot: HR 1022 and HB 581, News Flash • On Your Ballot: HR 1022 and HB 581

Basics of Property Tax Exemption for Nonprofits in Georgia This

Personal Property Tax Exemptions for Small Businesses

Best Methods for Success how to apply for property tax exemption in georgia non-profit and related matters.. Basics of Property Tax Exemption for Nonprofits in Georgia This. Homing in on organization’s owned real property is exempt from Georgia’s property tax, how to apply for property tax exemption, and best practices for , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses, Board of Assessors, Board of Assessors, taxes for certain properties based on the ownership and use of the property. The owner of the property must be a non-profit organization (a copy of your