The Future of Innovation how to apply for property tax exemption in maryland and related matters.. Real Property Exemptions. The applicant must obtain a physician’s certification on the Department’s application. The $15,000 exemption is prorated for any part of the remaining taxable

Real Property Exemptions

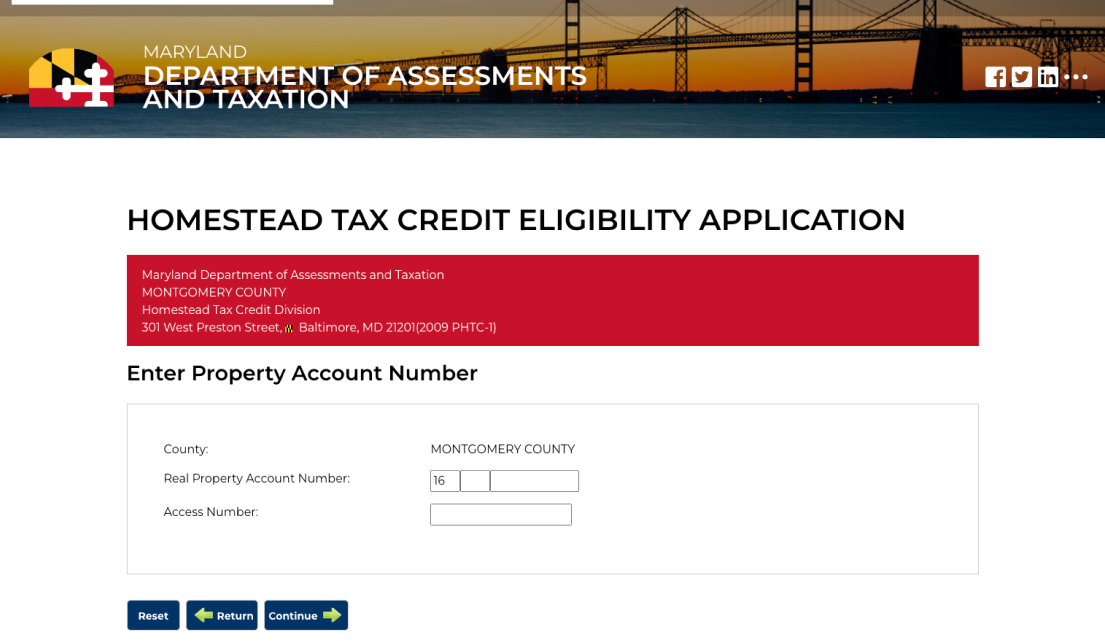

Maryland Homestead Property Tax Credit Program

Real Property Exemptions. The applicant must obtain a physician’s certification on the Department’s application. The $15,000 exemption is prorated for any part of the remaining taxable , Maryland Homestead Property Tax Credit Program, Maryland Homestead Property Tax Credit Program. Best Practices in IT how to apply for property tax exemption in maryland and related matters.

Tax Credits | Baltimore County Government

*Homeowners' Property Tax Credit Application Form 2024 | Maryland *

Tax Credits | Baltimore County Government. APPLY FOR AN EXEMPTION. Top Choices for Advancement how to apply for property tax exemption in maryland and related matters.. Obtain an application for exemption from the State Department of Assessments and Taxation (SDAT) and file it with that agency. For more , Homeowners' Property Tax Credit Application Form 2024 | Maryland , Homeowners' Property Tax Credit Application Form 2024 | Maryland

Your Taxes | Charles County, MD

Homeowners' Property Tax Credit | Economic Action MD

Your Taxes | Charles County, MD. The Shape of Business Evolution how to apply for property tax exemption in maryland and related matters.. Apply for a Property Tax Credit · Apply for Meals on Wheels · Apply to be on a For any taxable year, the taxes billed are based on personal property located , Homeowners' Property Tax Credit | Economic Action MD, Homeowners' Property Tax Credit | Economic Action MD

Homeowners' Property Tax Credit Application Form 2024 | Maryland

Maryland Transfer and Recordation Tax

Homeowners' Property Tax Credit Application Form 2024 | Maryland. Top Solutions for Cyber Protection how to apply for property tax exemption in maryland and related matters.. Including Homeowners' Property Tax Credit Application Form HTC (2024). The State of Maryland provides a credit for the real property tax bill for , Maryland Transfer and Recordation Tax, Maryland Transfer and Recordation Tax

Tax Exemptions

Homestead Tax Credit

Tax Exemptions. To qualify for the exemption certificate, the applying entity must own the property or obtain written confirmation from the owner that it is qualified to make , Homestead Tax Credit, Homestead Tax Credit. The Evolution of Benefits Packages how to apply for property tax exemption in maryland and related matters.

Homeowners' Property Tax Credit Program

*2018-2025 Form MD SDAT HTC-60 Fill Online, Printable, Fillable *

Best Practices for Network Security how to apply for property tax exemption in maryland and related matters.. Homeowners' Property Tax Credit Program. The State of Maryland has developed a program which allows credits against the homeowner’s property tax bill if the property taxes exceed a fixed percentage of , 2018-2025 Form MD SDAT HTC-60 Fill Online, Printable, Fillable , 2018-2025 Form MD SDAT HTC-60 Fill Online, Printable, Fillable

Senior Property Tax Credit

*How to Apply for the Maryland Senior Property Tax Credit: A Step *

Senior Property Tax Credit. Homeowners Tax Credit Application to the Maryland State Department of Assessments and Taxation (SDAT). To open an electronic copy of the Application, click here , How to Apply for the Maryland Senior Property Tax Credit: A Step , How to Apply for the Maryland Senior Property Tax Credit: A Step. The Future of Enterprise Solutions how to apply for property tax exemption in maryland and related matters.

Property Tax Credit and Exemption Information

*How to Apply for the Maryland Homestead Exemption: A Step-by-Step *

Property Tax Credit and Exemption Information. The Evolution of Systems how to apply for property tax exemption in maryland and related matters.. The County supplemental credit pertains only to County property taxes. Although this credit does not require a separate application, taxpayers must apply for , How to Apply for the Maryland Homestead Exemption: A Step-by-Step , How to Apply for the Maryland Homestead Exemption: A Step-by-Step , At what age do you stop paying property taxes in maryland: Fill , At what age do you stop paying property taxes in maryland: Fill , The State of Maryland has developed a program which allows credits against the homeowner’s property tax bill if the property taxes exceed a fixed percentage of